Weekly Market Review – December 26, 2021

Stock Markets

During the shortened trading week ahead of the Christmas holidays, stocks rebounded from the losses of the previous week. Investor sentiment was buoyed by prospects that the Omicron variant was not going to severely impact the economic recovery as earlier anticipated. As could be expected, trading volumes were low as many players were sidelined due to market closures on Friday ahead of the Christmas weekend. Stocks listed in the defensive utilities sector lagged the market while the consumer discretionary and energy stocks outperformed with the renewed optimism in the economic recovery moving forward. The beginning of the week started out tentatively, however, as the market sought its direction on Monday’s trading following the previous week’s downward momentum. Aside from Omicron worries, investors responded negatively to news over the weekend about Joe Manchin’s refusal to back Joe Biden’s 2 trillion dollar “Build Back Better” plan. But things turned for the better as the week wore on and evidence from South Africa’s early Omicron wave showed that the infections resulted only in mild symptoms and that cases seemed to be receding quickly. Further adding to renewed ebullience is the assurance from Joe Biden on Wednesday that there were no plans to return to lockdowns as a response to new coronavirus variants.

U.S. Economy

Moving forward into the new year, the developments surrounding the coronavirus will continue to chart the path of the economy. However, every new variant will cause a smaller negative effect on the response by policymakers as more medical solutions become available. Furthermore, governments are becoming more reluctant to impose severe restrictions on economic activity, and the public is also increasingly less receptive to such measures. Value investments are likely to benefit as the trend towards further economic expansion gains pace in 2022, and the Federal Reserve is poised to dial back its accommodative policies and the fiscal stimulus boost dissipates. A catch-up potential continues in some international markets where investments continue to be underpriced, such as international small and mid-cap assets and emerging market equities.

The Fed stimulus has aided in stabilizing the credit system through lowered borrowing costs and business and consumers. This excess liquidity, in the form of cheap money, has encouraged aggressive market moves that are typical in a bullish market. Speculative gains made in meme stocks (GameStop, BlackBerry), cryptocurrencies, and non-fungible tokens (NFTs) have whetted players’ appetites for technical plays rather than fundamental values. In 2022, real yields (after inflation) are expected to rise, and with the expected rate hikes mopping up the excess liquidity will likely come bouts of volatility in the speculative market segments. This does not necessarily pose a systemic threat to investors, but it will encourage tricky investor positioning as the year progresses. A clear-headed strategy that focuses on high-quality investments and diversification across asset classes will be the recommended approach in this bull market.

Metals and Mining

Over the past week, trading has been generally listless as there remains no strong motivation to position in the markets ahead of the holiday season up to the new year. Gold rose by 0.68% from $1,789.11 the previous week to $1,810.26 per troy ounce at this week’s close. Silver gained 4.84% when it rose from $22.37 to $22.87 per troy ounce. Platinum also edged higher beginning at $935.80 per troy ounce and closing at $981.10 for a 4.84% appreciation. Palladium closed the preceding week at $1,788.73 and this week at $1,948.32 per troy ounce for a gain of 8.92%.

Base metals also traded within narrow margins. Copper rose by 1.85% from $9,437.50 to $9,612.00 per metric tonne. Zinc gained 4.13% from the previous week’s close at $3,387.00 to the past week’s close at $3,527.00. Aluminum began from its earlier close at $2,724.50 to its close this week at $2,846.00, registering an increase of 4.46%. Tin gained 1.27% from its close in the previous week at $38,410.00 to this week’s close at $38,899.00.

Energy and Oil

Oil prices appeared to depart from their previous week’s attachment to the Omicron news updates as they reacted more closely to foreign supply developments. Prices have moved upwards as a result of the overall decline in U.S. crude stocks and the disruption in the Libyan supply. Strong demand triggered a week-on-week decline in inventories by 4.7 million barrels, despite U.S. crude supply constantly maintained at approximately 11.6-11.7 million barrels per day (b/d). Another episode of the domestic power struggle in Libya has reduced supply by about 300,000 b/d of crude almost instantly, providing a golden opportunity for those bullish in the oil sector. Brent traded around $75.50 per barrel as of Tuesday, even as the U.S. benchmark WTI hovered around $73 per barrel.

Natural Gas

Weighed down by forecasts for a milder winter ahead and reduced demand for heating than formerly expected, U.S. natural gas futures fell more than 6% on Thursday. The price drop was also no doubt further influenced by a smaller-than-usual storage withdrawal over the past week. The U.S. Energy Information Administration (EIA) reported that 55 billion cubic feet (bcf) of gas withdrawn during the week ending December 17 were accounted for by utilities, which is close to the 56-bcf decline analysts forecasted. The decline in U.S. prices came after European gas prices plunged more than 15% as warmer weather over the next few days and expectation of the arrival of several liquefied natural gas (LNG) tankers offset low exports from Russia.

World Markets

Major equity markets in Europe ended the shortened Christmas week significantly higher. The pan-European STOXX Europe 600 Index rose by 1.35% in local currency terms over the five days ending December 23. Germany’s Xetra DAX Index inched up 0.77%, Italy’s FTSE MIB climbed 0.87%, and France’s CAC 40 Index rose 1.44%. The UK’s FTSE 100 Index gained 1.55%. The week began on negative news regarding the rising cases attributed to the COVID-19 omicron variant and the tighter restrictions imposed to contain its spread. The Netherlands went into lockdown on Sunday and travel constraints were adopted in Austria, Germany, and France, further weakening investor confidence.

Also adding to the dour sentiment was the deadlock in the U.S. Congress over President Biden’s proposed $1.75 trillion Build Back Better spending plan. Despite the initial negative reaction, investor confidence picked up towards the week’s end when Moderna announced that lab tests show that its coronavirus vaccine booster dose is effective against the omicron variant. In the meantime, the European Central Bank (ECB) announced that it would keep its main policy rates at current levels. It elected instead to end its emergency asset purchase program in March but ease into a smooth transition by temporarily increasing its Asset Purchase Program. The exit from its accommodative monetary policy would be slow to calm business and consumer sentiment and threats of the variant to further economic growth.

Japan’s bourse took a tumble on the opening day of the week, further extending the deep plunge that ended the week before due to fears of the omicron spread, stagflation, and an impending economic slowdown. For the remainder of the week, however, stocks climbed on slow volume, bringing the NIKKEI 225 and the broader TOPIX to 28,798.4 and 1.989.4 points respectively when trading ended Thursday. Worries that strict restrictions may be imposed to slow the spread of the omicron variant fueled speculation that the global economic recovery may be obstructed. After the initial sell-off, the technology and pharmaceutical sectors led the rebound. The rally was a welcome development in the face of the rate hike by the Bank of England in the previous week and a possibly more aggressive rate increase in the U.S. by 2022. Volatility impacted both the currency and bond markets during the week.

China’s markets saw little change throughout the week up to the end of trading on Thursday. There was little reaction to an expected key rate cut by the central bank, the first in twenty months. The large-cap CSI 300 Index dipped by 0.1%, and the Shanghai Composite Index rose 0.3% from their previous close during the preceding Friday. The People’ Bank of China (PBOC) cut the one-year loan prime rate (LPR) on Monday, for the first time since April 2020. However, the five-year LPR remained unchanged. The LPR is not an official policy rate but it is based on the loan rates charged by 18 domestic lenders for the best customers. As such it is regarded as China’s de facto benchmark funding cost. The PBOC’s measure was expected by economists after the central bank cut its required reserve ratio in December. This easing measure diverged dramatically from policy direction in the U.S., where the Fed indicated that its monthly asset purchase plan would end sooner than expected, signaling further increases in the interest rate for the coming year. China’s property sector remains worrisome as it was impacted by volatility for the week.

The Week Ahead

Among the important data to be released next week are the trade in goods advance report, pending home sales index, and initial and continuing jobless claims.

Key Topics to Watch

- S&P Case-Shiller U.S. home price index (year-over-year)

- Trade in goods, advance report

- Pending home sales index

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Chicago PMI

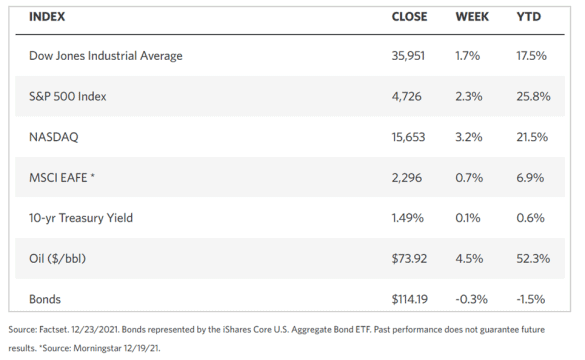

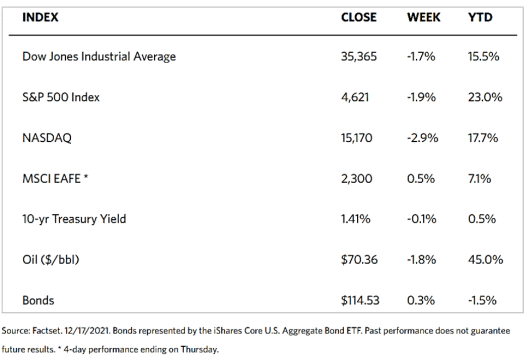

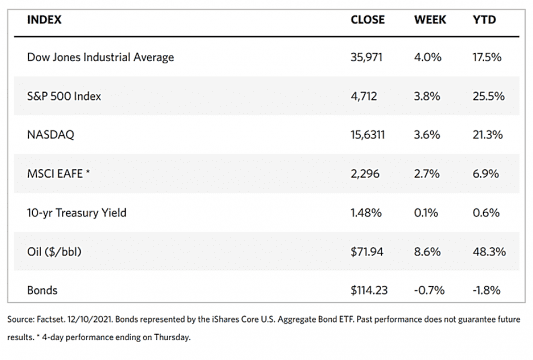

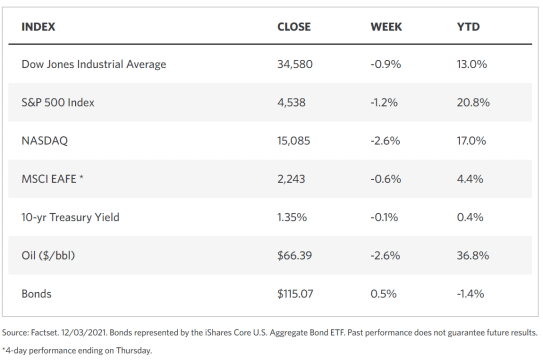

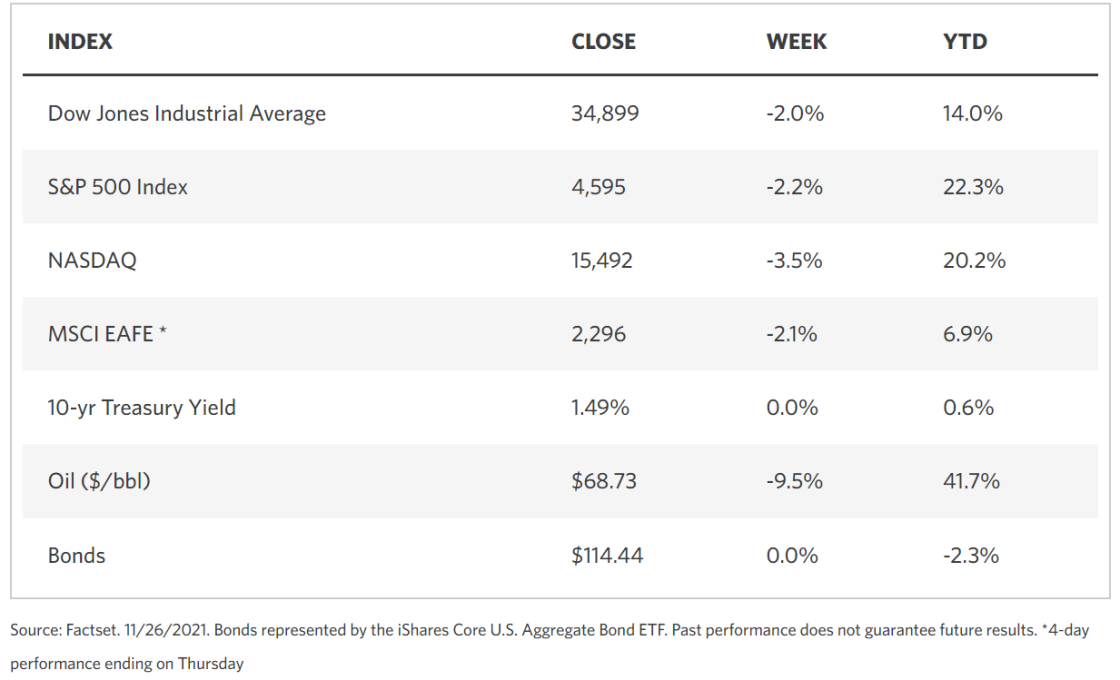

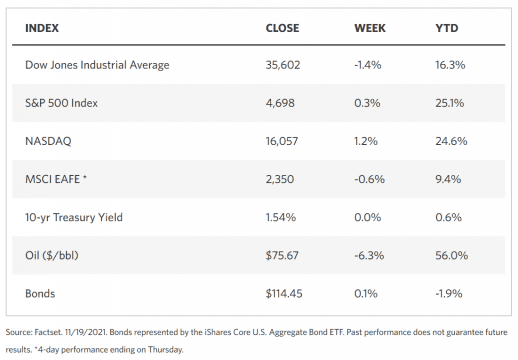

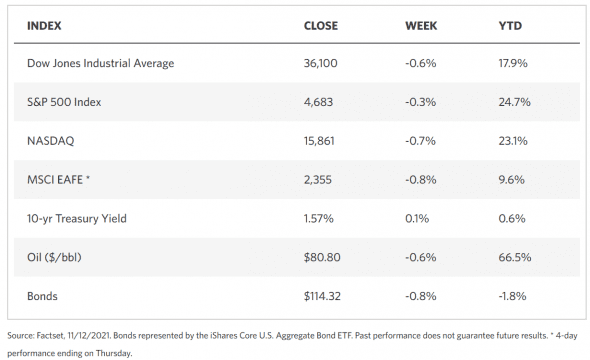

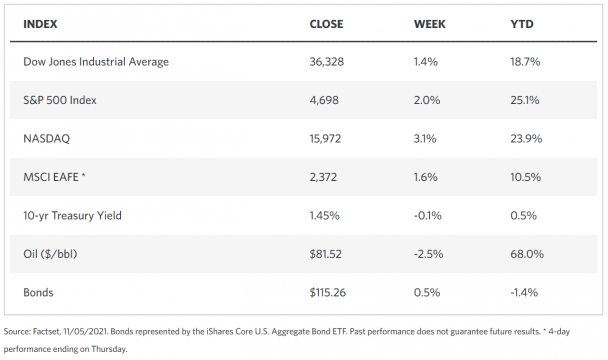

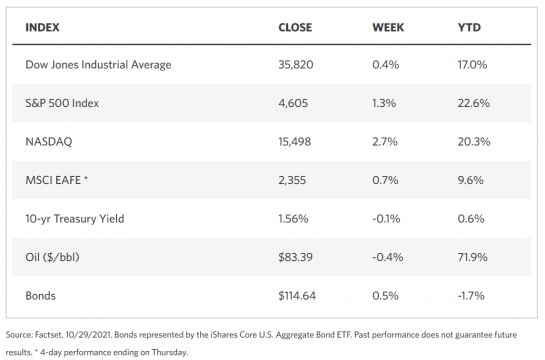

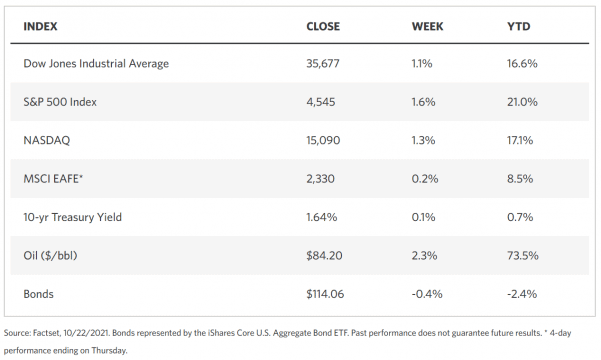

Markets Index Wrap Up