Stock Markets

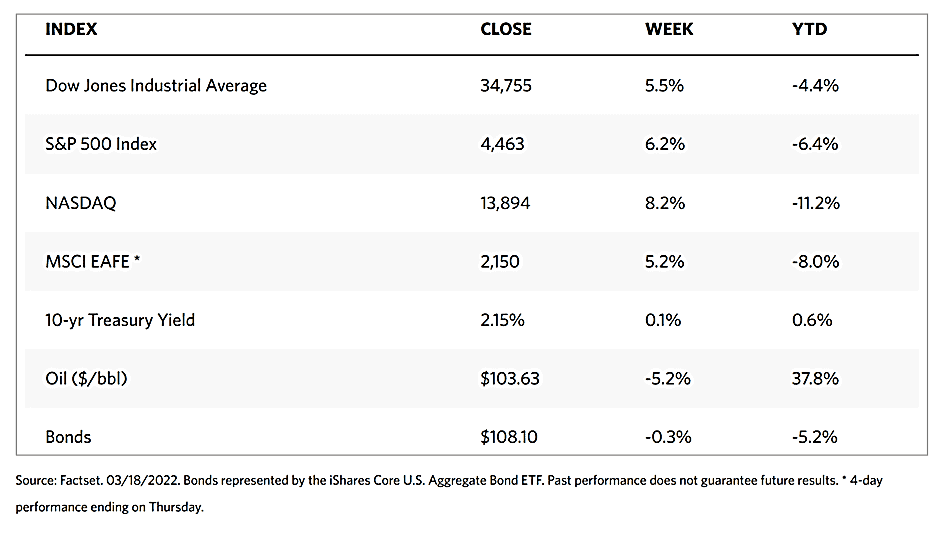

After a two-week losing streak, stocks, at last, surged for the week to recover much of the ground lost over the last month. Multiple factors accounted for the rally, among which are falling oil prices, news that Russia avoided default and instead made good on its sovereign debt, and an optimistic outcome of the monetary policy meeting conducted by the Federal Reserve. Investor sentiment was also lifted during the week, despite continued fighting in Ukraine, due to continued efforts at negotiations aimed at ending the conflict. The tech-heavy Nasdaq Composite exhibited the most robust gains even as positive results were widespread across all the major indexes.

At its March meeting, the Fed raised its short-term lending rate by 25 basis points, in line with the expectations of investors. This moves the fed funds target rate from almost zero to a range of 0.25% to 0.50%. The adjustment was the first interest rate hike taken by the Fed since 2018, signaling a departure from the ultra-accommodative monetary policy instituted by the central bank at the onset of the pandemic. In line with the shift, policymakers updated their economic forecast moving forward. According to the median projection, they expect to raise rates seven times in 2022; they also downgraded their economic growth forecast while revising inflation projections upward. The updated inflation predictions indicate that policymakers expect price pressures to expand beyond the pandemic-related disruptions that triggered the initial price spikes. The Fed intends to shift its monetary policy stance from accommodative to neutral, and from neutral to slightly restrictive before the end of 2023. It suggests that monetary policies will shift sooner and more aggressively to address inflation, an approach that the equity markets look favorably upon, prompting the rally after the Fed meeting.

U.S. Economy

With its initial rate hike in years, the Federal Reserve has embarked on a monetary tightening plan that expects to raise interest rates as high as 2.8%, although this is not on a fixed course. Rate hike expectations will fluctuate in tandem with the trajectory of inflation and economic growth. The present escalation of commodity prices has been exacerbated by the Ukraine crisis. It will act as a tax on the consumer, reducing purchasing power, and in all probability will temper spending in the coming months. Nonetheless, the economy will, from all indications, continue on its above-average growth rate for the remainder of 2022. The year-end GDP as forecasted by Fed officials will likely grow by 2.8%, a lower level than the estimate reached three months ago, but still higher than the 2% at which economic growth averaged over the last decade.

Even with the increase in interest rates, fundamentals suggest that the economic activity will not be dampened, given the low unemployment rate of 3.8% and job openings are exceeding the number of unemployed by the widest margin in two decades. Both indicators suggest a tight labor market and strengthening employment that supports consumer income. Although February’s retail sales were disappointing, January figures were revised upwards and continuing unemployment claims have fallen to their lowest level in 52 years. As a sign that inflation may be reaching its peak, the headline producer price index decelerated during February while the increase in core prices remained unchanged with January’s pace.

Metals and Mining

There is no sign that the war between Russia and Ukraine will be ending any time soon, and the humanitarian crisis continues to build. At this point, however, it appears that gold’s geopolitical safe haven premium is beginning to erode, as analysts conjecture that the conflict will be contained within Ukraine. Despite the waning of gold’s margin, there are still many reasons for investors to invest in gold. If the geopolitical order should shift with energy trade, supply chains will be reconfigured and payment networks become fragmented, raising risks of economic uncertainties. Analysts continue to point to the rising inflation rate as the biggest reason for retaining gold in one’s investment portfolio, suggesting an overweight position in gold in the range of 10% to 15%.

During the past week, the price of gold corrected by 3.36%, from the previous week’s close at $1,988.46 to this week’s close of $1,921.62 per troy ounce. Silver began at the prior close of $25.87 to end this week at $24.96 per troy ounce, or a loss of 3.52%. Platinum followed the same trend, dropping 5.09% from the earlier week’s close at $1,082.08 to Friday’s close at $1,026.97 per troy ounce. Palladium slumped from $2,807.77 to $2,496.71 per troy ounce, a decline of 11.08%. While most precious metals fell, 3-mo base metal prices ended mixed. Copper closed this week at $10,331,00 per metric tonne, down up by 1.45% from the previous week’s close at $10,183.50. Zinc gained 0.29% from the prior close at $3,815.00 to the recent close at $3,826.00 per metric tonne. Aluminum lost 2.93%, from the previous week’s $3,483.00 to last week’s $3,381.00 per metric tonne. Tin began at $44,100.00 and ended at $42,305.00 per metric tonne for a decline of -4.07%.

Energy and Oil

Oil prices were sent back to above $100 per barrel when hopes began to dim about Russia and Ukraine agreeing to end hostilities any time soon. In the meantime, the International Energy Agency (IEA) announced that the developing energy crisis may grow more tumultuous in the coming weeks. The likely scenario is that consumers will have to absorb a three-million barrel-per-day supply shortfall if Russia does not desist from its invasion into Ukraine. If sanctions against Russia continue to remain in place, this will likely force the beleaguered country to cut three million barrels per day of oil production – 1.5 million barrels per day accounted for by shrinking marketing opportunities for crude and another 1 million barrels per day from falling product exports. The IEA suggested that consumers will need to adopt measures to mitigate the crunch by staying at home, avoiding air travel, and possibly even reducing speed limits until the dire situation would have been abated. The present volatility in oil prices is likely to prevail for longer than originally anticipated. Furthermore, at the OPEC+ front, a widening discrepancy between production targets and the actual output from the oil consortium’s members rose to a new high in February as participating states underperformed their quota by 136%, amounting to almost 1 million barrels per day.

Natural Gas

Over the report week, March 9 to March 16, 2022, natural gas spot prices fell at most locations. The Henry Hub spot price climbed from its price on March 9 at $4.56 per million British thermal units (MMBtu) to its close on March 16 at $4.67/MMBtu. At major hubs, the prices moved within a band of $1.26/MMBtu at the end of the report week. The price range moved from a low of $3.88/MMBtu in New York to a high of $5.14/MMBtu at PG&E Citygate in California, as per data from Natural Gas Intelligence. Of the major pricing hubs, the Henry Hub price was the second-highest. By comparison, the international natural gas spot prices declined over the report week, although they remained elevated since the commencement of hostilities between Russia and Ukraine on February 24. The average total natural gas supply in the U.S. fells this week by 0.9% compared with the previous week. The country’s natural gas consumption increased this week across all sectors, while U.S. LNG exports decreased by one vessel this report week compared to the week before.

World Markets

European equities climbed for the second straight week as investors became cautiously optimistic that Russia and Ukraine will enter into productive negotiations that will end the conflict. Sentiments were also boosted by announcements from China that it is ready to adopt measures to support the global economy and financial markets. The pan-European STOXX Europe 600 Index rose 5.43% in local currency terms. Germany’s Xetra DAX Index gained 5.76%, France’s CAC 40 Index rose 5.75%, and Italy’s FTSE MIB Index ascended 5.13% week-on-week. The UK’s FTSE 100 Index moved in the same direction, rising 5.13% week-on-week.

The core eurozone bond yields climbed slightly higher. Hopes for an improved geopolitical situation and the anticipation that the central banks will adopt more aggressive monetary policies to address inflation caused the benchmark German 10-year bund yield to climb higher. The yields slowed after it became evident that ceasefire negotiations will be further stymied. Peripheral eurozone bond prices firmed up support during the week. While the price of the Italian government debt and other sovereign issues were buoyed by news that the European Union (EU) was contemplating fresh joint issuances to fund energy and defense spending. Although the Bank of England raised interest rates, UK gilt yields fell. The markets noted that a more accommodative tone overshadowed policymakers’ comments, causing expectations for more rate hikes to be scaled back.

Japan’s equity markets rose for five successive days. The Nikkei 225 Index ended the week higher by 6.62% from the previous week, while the broader TOPIX Index climbed 6.10%. Sentiment remained positive as the Bank of Japan remained committed to its accommodative stance despite the prevailing global transition to a tighter monetary policy. The government also announced that it was prepared to lift all remaining quasi-states of emergency as daily coronavirus infections trended downwards. Export volumes recovered, experiencing double-digit growth in February after declining slightly in January. Backed by these positive developments, the yield on the 10-year Japanese government bond rose to 0.21% from 0.18% one week earlier. The yen fell slightly against the US dollar, from JPY 117.29 the previous week to JPY 118.90 in the week just ended.

Chinese stocks weakened during the trading week as the broad-cap Shanghai Composite Index declined by 1.8% and the blue-chip CSI 300 Index descended by 0.8%. Despite the soft trading, the sentiment was more positive at the week’s end when policymakers announced their commitment towards greater economic support. Government officials promised to introduce market-friendly policies and to maintain smooth operations in the capital market at a meeting attended by Vice Premier Liu He, the economic czar of President Xi Jinping. In reports broadcast over state media, the top Chinese financial policymaking body vowed to stabilize the capital markets, support overseas stock listings, address risks pertaining to property developers, and complete a crackdown on Big Tech at the soonest possible time. The 10-year government bond yield closed the week at 2.82%, down from 2.836% during the week before. The yuan lost some ground ahead of a meeting between U.S. President Joe Biden and Chinese President Xi Jinping. During the meeting, it is expected that President Biden will issue a warning to Beijing against providing support to Russia. On the positive side, there was some optimism that Beijing may make some concessions on issues surrounding the U.S.-China audit dispute.

The Week Ahead

The PMI index and building permits as well as jobless claims are among the economic data that will be released in the coming week.

Key Topics to Watch

- Atlanta Fed President Raphael Bostic speaks

- Chicago Fed national activity index

- Fed Chair Jerome Powell speaks at NABE conference

- New home sales (SAAR)

- Initial jobless claims

- Continuing jobless claims

- Durable goods orders

- Core capital goods orders

- Current account deficit

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- UMich consumer sentiment index (final)

- 5-year inflation expectations (final)

- Pending home sales index

Markets Index Wrap Up