Stock Markets

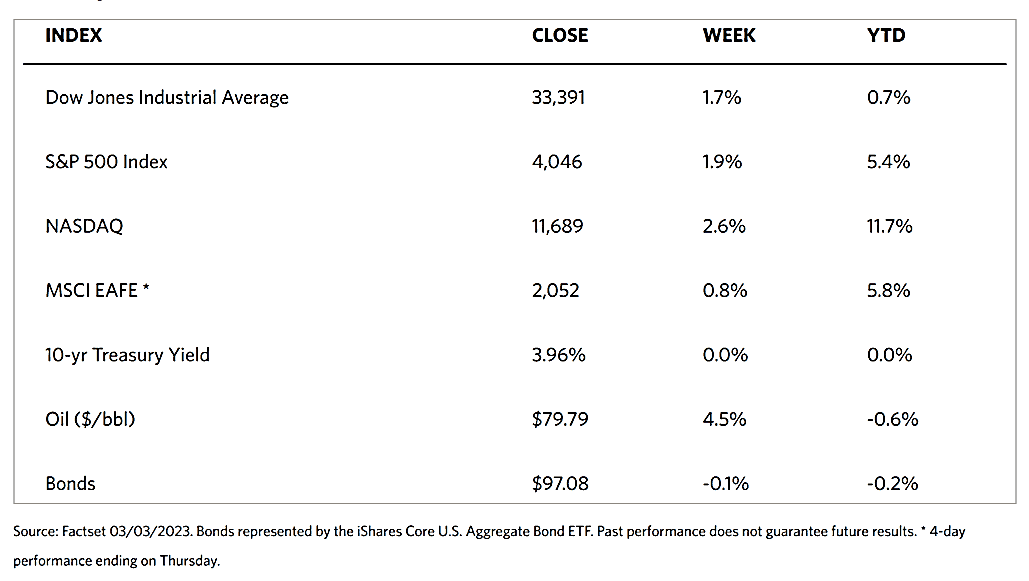

Stock markets rebounded this week from last week’s plunge. The Dow Jones Industrial Average climbed by 1.75% while the total stock market index rose by 1.97%. The S&P 500 Index ascended by 1.90% while the technology-heavy Nasdaq Stock Market Composite gained by 2.58%. The NYSE Composite went up by 1.66%. Correspondingly, the risk perception tracker CBOE Volatility index fell by 14.67%. The early strong performance of the stock markets this year gave way to last week’s plunge when equities experienced the worst weekly decline since the year began. Energy and materials shares were especially strong. Communication shares were propped by the outperformance of Facebook parent Meta Platforms. On the other hand, the Utilities sector underperformed. Low market volumes marked trading through the week, largely on the back of the lack of catalysts for speculation. Investor sentiment also appears to have gained support from the S&P 500 Index treading above its 200-day moving average, a technical support relied upon by traders. A contradictory development, however, is that overall durable goods posted their steepest decline since the height of the pandemic-related shutdowns in April 2020. Furthermore, for the first time since July 2020, wholesale inventories declined but retail inventories (excluding autos) modestly increased.

U.S. Economy

During the week, several important economic reports were released which, however, failed to lift the trading volumes due to their mixed nature eliciting a subdued reaction from investors. Nevertheless, there have been some noteworthy data points revealed in these reports. The Commerce Department revealed that orders for non-defense capital goods excluding aircraft rose by 0.8% in January. This metric is often used as an indicator of business investment, and the January figure compensated for the 0.7% increase in producer prices over the same month.

Aside from these latter developments, other evidence suggested the manufacturing sector was contracting at a slower rate while still weakening. In February, the manufacturing Purchasing Managers’ Index (PMI) of the Institute for Supply Management ticked higher for the first time since May. It nevertheless remained in contraction territory at 47.7, since levels below 50 are indicative of slowing activity. The Institute’s services PMI dipped slightly, although it was by less than consensus expectations and remained indicative of moderate expansion at 55.1.

The yield on the benchmark 10-year U.S. Treasury note pulled back from a new three-month intraday high of 4.09% on Thursday and ended the week only slightly higher. This may be attributed to the comments by Atlanta Federal Reserve President Raphael Bostic that he still supported only a quarter-point rate increase at the Federal Reserve’s upcoming policy meeting despite the hot inflation data released the previous week. Bostic further stated that the Fed may be in a position to pause further rate hikes by mid to late summer. These developments appear to check at least one of the three boxes required to support a sustainable market recovery: (1) that inflation should start to descend, (2) that the Federal Reserve pause its rate-hiking cycle, and (3) that earnings revisions start to bottom.

Metals and Mining

February was a month full of disappointments for the precious metals markets, but gold appears to be making a comeback at the start of the new month as prices have held solidly above its $1,800 per ounce price support level. It has now ended the week above $1,850 per ounce. The yellow metal ends its five-week losing streak and regained some impressive technical momentum with more than a 2% weekly gain. As a result, prices are above their 21-day moving average, a technical support level. The bullish momentum is enhanced by the fact that the gains have been made despite a significant rise in U.S. bond yields, pointing at intrinsic strength.

In the week just ended, gold came from $1,811.04 just one week ago to $1,856.48 per troy ounce this week, an increase of $2.51%. Silver rose by 2.41% from the previous week’s close at $20.76 to this week’s close at $21.26 per troy ounce. Platinum gained by 7.63% from its week-ago price of $913.03 to this week’s ending price of $982.66 per troy ounce. Palladium, which ended one week ago at $1,415.62, closed this week at $1,458.45 per troy ounce for a weekly gain of 3.03%. The three-month LME price of base metals ended mixed for the week. Copper came from the previous week’s close at $8,716.50 to this week’s close at $8,958.50 per metric tonne for a gain of 2.78%. Zinc closed one week ago at $2,964.00 and this week at $3,048.00 per metric tonne, climbing 2.83% for the week. Aluminum closed last week at $2,335.50 and this week at $2,399.50 per metric tonne, a rise of 2.74%. Tin previously ended at $25,651.00 and this week at $24,570.00 per metric tonne, bucking the trend and tumbling by 4.21%.

Energy and Oil

Oil prices this week were bullish, and the main factor pushing this trend was China’s economic rebound. In February, the country’s PMI index surged to its highest reading since April 2012 at 52.6, a sign of the resurgence of industrial activity. The China bulls have rallied oil markets to such a degree that their optimism has eclipsed the rising inflation concerns in the European Union and increasing U.S. inventories. On Friday morning, however, the Wall Street Journal reported that the UAE debated leaving OPEC and boosting production, sending oil prices plummeting, resulting in a roller-coaster ride for oil for the week. In the meantime, the U.S. Department of Energy is mulling to start purchasing oil to partially refill the Strategic Petroleum Reserves that have been depleted by rounds of releases across 2022 to 2023. Depending on market conditions, top officials appear intent on buying 40 to 60 million barrels within the next year.

Natural Gas

For the report week beginning Wednesday, February 22, and ending Wednesday, March 1, 2023, the Henry Hub spot price rose $0.51 from $2.08 per million British thermal units (MMBtu) on February 22 to $2.59/MMBtu on March 1. The March 2023 NYMEX contract expired Friday at $2.451/MMBtu, up by $0.28 from February 22. The April 2023 NYMEX contract price increased to $2.811/MMBtu, up by $0.51 from February 22 to March 1. The price of the 12-month strip averaging April 2023 through March 2024 futures contracts climbed by $0.42 to $3.527/MMBtu.

International natural gas futures prices continued to decrease this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.58 to a weekly average of $14.76/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.54 to a weekly average of $15.10/MMBtu, the lowest level since August 2021. In the week last year that corresponded to this week (the week ending March 2, 2022), the price in East Asia was $32.50/MMBtu while that at TTF was at $40.28/MMBtu.

World Markets

European equities rose as investors overcame their concerns about a possible return to restrictive monetary policies, focusing their attention instead on the improving economic outlook. The pan-European STOXX Europe 600 Index gained by 1.43%. Major indexes in the regions likewise advanced, with France’s CAC 40 Index rising by 2.24%, Germany’s DAX Index gaining by 2.42%, AND Italy’s FTSE MIG Index surging by 3.11%. The UK’s FTSE 100 inched higher by 0.87%. The European bond yields rose during the week as elevated inflation data sparked worries of renewed aggressive monetary policy tightening by the European Central Bank (ECB). The yield on Germany’s 10-year sovereign bonds climbed above 2.7%, while the Italian government bonds of the same maturity soared to new highs for 2023. In the Eurozone, the annual inflation rate eased to 8.5% in February, down from 8.6% in January. This may be attributed to a decline in energy costs, according to official data. Core inflation, which excludes energy and food costs because of their volatility, and which therefore gives a clearer indication of the underlying pricing pressures, ticked up from 5.3% to 5.6%. This implies that inflationary concerns are still far from over in the European region. The eurozone unemployment rate in January held steady at 6.7%, close to their record lows. The ECB President Christine Lagarde announced that there is likely to be a further half-point interest rate increase that will be forthcoming at the March 16 meeting.

Japan’s stock markets also gained during the week. The Nikkei 225 Index rose by 1.73% while the broader TOPIX Index climbed by 1.57%. The Bank of Japan (BoJ) governor nominee Kazuo Ueda emphasized monetary policy continuity which investors welcomed, as signs confirming the Chinese economic recovery became evident after the COVID lockdowns. The easing of entry requirements by Japan for arrivals from mainland China was another positive development that lifted the markets. There remains some uncertainty, however, regarding the likely peak in U.S. interest rates and this perception curbed some of the market gains for the week. The yield on the 10-year Japanese government bond (JGB) continued to linger about the 0.50% level at which the BoJ caps JGB yields. The yield crossed the BoJ’s ceiling during the week, however, amid upward pressure from the U.S. Treasury yields. The volatility of the U.S. Treasury yields reacted to strong data that stoked concerns about further Federal Reserve rate hikes. The yen traded within a narrow range for the week, at about JPY 136 against the U.S. dollar.

For the second week in a row, Chinese equities gained ground aheadof the National People’s Congress (NPC) meeting. Strong economic data raised prospects for a better-than-expected post-lockdown recovery. The Shanghai Stock Exchange rose by 1.87% while the blue-chip CSI 300 gained by 1.71% in local currency terms. Hong Kong’s benchmark Hang Seng Index finally advanced after four straight weeks of losses and added 2.79%. The meeting of the NPC, which is China’s Parliament, begins on Sunday, March 5, and is expected to last for one week. The meeting is held every five years and is put under scrutiny for signs concerning economic policy shifts and possible changes in senior leadership. The People’s Bank of China (PBOC) Governor Yi Gang announced at a Friday press briefing that the central bank could cut the reserve requirement ratio for banks to support the economy. The yuan exchange rate will be kept relatively stable this year, according to the governor. The PBOC released its quarterly policy report the week before, wherein it affirmed its prudent policy stance to support economic growth and stability in 2023. The central bank will also seek to maintain sufficient liquidity and credit growth while upholding its commitment to financial risk management and market-oriented foreign exchange policy.

The Week Ahead

Among the important economic data scheduled for release in the coming week are the unemployment rate, job openings, and jobless claims.

Key Topics to Watch

- San Francisco Fed President Daly speaks

- Factory orders

- Fed Chairman Powell testifies to Senate

- Wholesale inventories

- Consumer credit

- ADP employment

- U.S. trade balance

- Fed Chairman Powell testifies to House

- Job openings (JOLTS)

- Beige Book

- Jobless claims

- Fed Gov Waller speaks

- Employment report

- U.S. unemployment rate

- Federal budget

Markets Index Wrap Up