Stock Markets

The markets were set off in a new wave of volatility after the weaker-than-expected April jobs report released the previous Friday. The Labor Department reported on Wednesday that core consumer prices (that did not include food and energy) surged by 0.9% in April, the highest in almost 40 years and approximately three times analysts’ expectations. The headline consumer price index (CPI) also exceeded the forecasted 3.6%, registering a 4.2% increase for the 12 months to April. On Thursday, the reported producer prices exceeded expectations by almost two times, rising 0.6%. The sudden increase in the inflation rate, which remained unchanged for ten years, renewed investor concerns about an overheating economy. The S&P 500 lost 4% from its record high in early May, recovering slightly before the week’s end. Observed weakness appeared to be concentrated in high-growth and technology stocks.

U.S. Economy

While economists and investors expected the increase in CPI, the size of the jump was significantly above expectations. It is possible, however, that pandemic-related factors accounted for some of the increase in prices, somewhat mitigating concerns about the eventuality of runaway inflation. Prices are moving higher partly due to shortages in supply and the sudden increase in demand as the economy reopens further. If this were the main reason, then the CPI increase is likely to be temporary and will soon return to normal.

- Presently, the imbalance between demand and supply that is pushing prices higher is partially due to market distortions caused by the pandemic response. However, as the economy gradually opens, goods and services are seen to gradually increase to satisfy pent-up demand. This is a temporary situation that, in due time, is expected to normalize, reducing the inflationary pressure.

- Reports of high inflation rate may continue to cause volatility in the stock market, but the bull market remains intact since the economy is still reopening. Cyclical sectors and value-based investments may continue to benefit from the faster economic growth, even as long-term rates are subjected to upward pressure.

- There are two main drivers of the prices of goods and services. The first is the base effect. Base figures measured in April, May, and June 2020 were obtained at the height of the pandemic lockdowns. Due to the depressed base rates, the growth rates currently read in the high levels, not because the prices are escalating quickly, but because the prices they are compared to last year are extraordinarily low. The second reason may be traced to supply shortages and bottlenecks in manufacturing systems. There are widespread materials shortages due to supply chain disruptions, resulting in limited productions that still have to reach cost-efficient levels. Four factors contribute to the supply chain disturbances: the rapid rebound in demand, the shift in consumer spending patterns towards goods, lean inventories, and compliance with temporary covid-safety protocols.

Metals and Mining

The increase in gold prices that have materialized at the beginning of May continues to the present. Gold prices remain around the $1,840 per ounce trading range. The price increase was principally due to a reduction in the value of the US dollar. Thereafter, rising inflation and the possible surge in interest rates triggered investor concerns that tempered any further rally in the price of gold. For the week, gold remained flat; viewing it from a longer-term perspective, it already has risen by 6.6% from its March 1 price of $1,724.80. When compared to prices at the beginning of the year, however, gold prices remain down. As of last Friday, gold traded at $1,839.16.

The other precious metals are also maintaining their present consolidation. Silver neared $28 per ounce at the beginning of the week, then corrected to $26.75 on Thursday, close to its support at $26. It could still consolidate further towards the $23 range before it may find sustained momentum that may bring it back to the $30 to $32 price range in the coming months. It is possible that in the long-term, silver may once more test the $50 resistance seen in 1980 and 2011. Friday saw silver at $27.37. Other precious metals are Platinum that opened at a 60-day high of $1,269 per ounce, and palladium which likewise began the trading week at an all-time high of $2,908 per ounce. By Friday, platinum settled at $1,212 and palladium at $2,790.

The base metals took the opposite direction, trading down for the week. Copper fell by $471 despite initially trading at an all-time high. It pulled back to $10,253 per tonne and settled at $10,253.50 on Friday. The drop was seen as a much-needed correction, while the underlying market sentiment remains bullish. Zinc initially lost 4.8% during the week to recover to the $2,990 per tonne range where it remained on Friday. Nickel also suffered a correction that landed it at $17,180 per tonne on Friday. Lead also opened lower on Monday at $2,228.50 and closed Friday at 2,116. Lead and zinc will continue to consolidate for the year since last year’s surplus of these metals are expected to carry over through 2021.

Energy and Oil

After a selloff in the middle of the past week, oil prices rebounded on Friday as uncertainties continue to prevail concerning whether the market will resume a bearish or bullish direction. Brent crude continues to trade in the upper $60s range. The Colonial Pipeline, whose operations were interrupted by a suspected online hacking episode, restarted its product flows by midweek. In time, the present localized shortages are expected to eventually ease. It was reported that the company paid the ransom demanded by the hackers, but on Friday the operator of the ransomware Darkside announced that they had lost control of the servers as well as a portion of the ransom payout. It should be recalled that the shutdown of the operations of the Colonial Pipeline was the cause of the supply shortage and surge of gasoline prices.

The oil price drop on Thursday was caused by concerns about the increase in inflation rates. While the rise in inflation may drive the price of crude to higher levels, investor fears of weaker economic growth tend to pull down commodities and undercut rising prices. On Friday, however, oil prices recovered as it became evident the fuel supply shortage was temporary. In the meantime, Europe faces the likelihood of uncertain gas prices. Carbon prices are bound to test the upper limit and the EU carbon emissions policy will continue to tighten. Coal will likely be on its way out but natural gas remains under increased pressure.

Natural Gas

During this report week (May 5 to May 12), natural gas spot prices were mixed. The Henry Hub spot price slid from $2.97 per million British thermal units (MMBtu) at the start of the week’s trading, to end the week at $2.90/MMBtu. The price of the June 2021 contract rose by $0.03 at the New York Mercantile Exchange (NYMEX), finishing at $2.969/MMBtu on Wednesday, May 12, from $2.938/MMBtu one week before. The price of the 12-month strip averaging June 2021 through May 2022 futures contracts rose to $3.001/MMBtu, up by $0.02/MMBtu. The composite price for the natural gas plant liquids at Mont Belvieu, Texas slid by $0.16/MMBtu, thereby averaging $7.50/MMBtu for the trading week ending May 12. This resulted from a decline in propane prices by about 7%, thus causing the average index price to descend week over week.

World Markets

Share prices in European stock exchanges corrected in tandem with global markets. The correction was in response to signs that inflation is ramping up which in turn triggered fears of impending interest rate increases. The pan-European STOXX Europe 600 Index closed the trading week lower by 0.54%. The major indices in the region were mixed. Italy’s FTSE MIB gained 0.63%, while the UK’s FTSE 100 fell 1.21%. France’s CAC 40 and Germany’s Xetra DAX remained relatively unchanged. The pullback of the UK index was partly due to the appreciation of the British pound against the U.S. dollar, resulting from the victory of the ruling Conservative Party in the local election. The negative correlation between the FTSE 100 Index and the value of the pound is driven by the presence of multinationals that generate revenue from abroad in the index listing. Core eurozone bonds are up in tandem with U.S. Treasury yields, due to the higher-than-expected U.S. inflation rate reported during the week.

In Asia, Japan’s stock markets fell dramatically for the week as volatility set in as a result of the unexpected and sharp increase in the US consumer price index. The spike in covid infection rates in the country and the possibility that a state of emergency will be announced in an additional three prefectures further tempered investor appetite. The broad TOPIX Index descended 2.57% while the Nikkei 225 slumped 4.43%. The 10-year Japanese government bond yield reacted by rising to 0.09%; commensurately, the yen softened marginally to end the week at JPY 109.41 to the U.S. dollar. The recovering economy is showing signs of life, however, as consumer demand registered a strong rebound from the deep slump brought about by the pandemic in the past year. Household spending increased in March by 6.2% year-on-year, in a robust reversal of the 6.6% drop in February.

China stocks, on the other hand, surged for the week as the benchmark Shanghai Stock Exchange Composite Index rose 2.1%, simultaneous with the 2.3% increase in the large-cap CSI 300 Index. China’s sovereign 10-year bond yield closed the week unchanged at 3.17% in response to the mixed economic reports. Net inflows of $9 billion in China’s government bonds were reported for April. This development is in line with Beijing’s interest in attracting foreign investments into its domestic “green bond” market, intended to support the country’s push towards renewable energy and other environmentally sustainable projects. The renminbi rose against the U.S. dollar by 0.3%, ending the week at 6.434 per dollar.

The Week Ahead

Over the coming week, look forward to the release of important economic data that includes the PMI index and existing home sales.

Key Topics to Watch

- Empire State manufacturing index

- NAHB home builders’ index

- Building permits

- Housing starts

- FOMC minutes

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Philadelphia Fed manufacturing index

- Index of leading economic indicators

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- Existing home sales

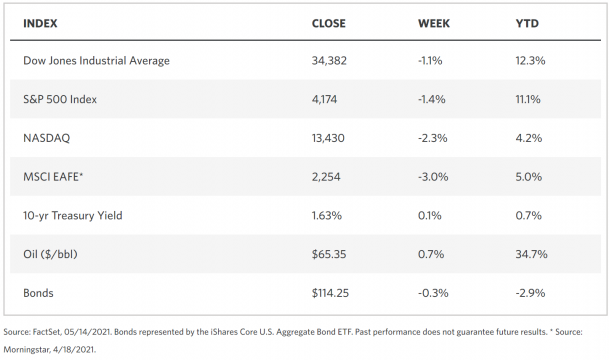

Markets Index Wrap Up