Stock Markets

The stellar performance of equities over the past week was the result of healthy economic data, a robust end to the earnings season, and a comparatively modest outcome of the Federal Reserve policy meeting, all of which boosted investor sentiment. The major indexes, including the Dow Jones Industrial Average, the broad S&P 500 Index, and the Nasdaq Composite, rose to record highs. Growth shares outperformed value stocks, and the technology and small-caps sectors chalked up a strong performance. After the Biden administration officials broached the likelihood of releasing some supply from the strategic petroleum reserve, oil prices dropped from their recent highs, causing a slump in the energy sector. Profit margins remained resilient despite the rise in commodity prices and ongoing supply chain disruptions across several industries, due to the strong results among the remaining companies reporting their earnings for the third quarter. It seemed that equity investors tended to be more bearish towards companies that lagged consensus expectations, and more bullish towards those that did better than expected.

U.S. Economy

The Fed announced the start of its tapering, or winding down, of monthly bond purchases. Currently at $120 billion, tapering will commence at $15 billion per month, at which rate the Fed will entirely phase out purchases by June 2022. This gradual withdrawal of the emergency support extended during the 2020 pandemic recession was generally expected, since this intention was signaled in advance by policymakers. Some volatility is expected as the market seeks to price in the result of this policy shift. The general concern was that the Fed might be compelled to raise interest rates sooner than expected in response to the fast-rising inflation rate and other central banks leaning towards monetary tightening. The market calmed and resumed its surge only when the Fed announced that inflation pressures are expected to be temporary, implying that the monetary authority will be dovish on rate hikes.

Currently, there is increasing uncertainty in the outcome of the Fed’s two clashing mandates, that of full employment and stable prices. Employment figures continued to remain below pre-pandemic levels by more than four million despite the solid gains of last month, suggesting that the Fed maintain an accommodative policy. This appears to clash with the Fed’s inflation measure that hit a 30-year high in September and remained above 3% over the past six months, which appears to justify a tightening monetary policy. In reconciling the two mandates, policymakers acquiesce that the inflationary pressures may extend beyond current expectations, but the factors behind the increase in prices are merely transitory. These factors include the strong demand for goods, supply-chain disruptions, and transportation bottlenecks. The supply-demand imbalance is evidently a continuing post-pandemic malaise, but as the economy opens up and the imbalance resolves itself, inflation rates will return to moderate levels. In the meantime, tapering will not be a major market concern as the Fed will continue to provide stimulus at a slower pace as their bond purchasing is tapered.

Metals and Mining

Gold investors remain vigilant as the metal continued to fall short of sustaining a rally over the past two months, but there may be a shift in momentum as inflation rates continue to remain high and may likely rise, making gold an undervalued hedge. The spot price of gold ended above the $1,800 per troy ounce, close to its eight-week high. This is the first time that the company has ended above a strong resistance level since it first breached $1,800 in September. The rally comes in response to a report released by the U.S. Labor Department that 531,000 jobs were created in October, well above expectations, despite analysts’ observations that the market seems to be focusing on wage inflation. Wages have risen by 4.9% over the last 12 months. This trend is likely to continue as companies are compelled to increase wages to attract new workers. As the Federal Reserve and the Bank of England have announced that they are not expecting to raise interest rates anytime soon, rising inflation pressures may force real rates to fall, adding further to gold’s positive outlook.

The spot price of gold increased from $1,783.38 to $1,818.36 per troy ounce over the past week, for a weekly gain of 1.96%. Silver closed the previous week at $23.90 and ascended over the week to $24.16 per troy ounce for a gain of 1.09%. Platinum began the week at $1,022.22 and ended at $1,036.24 per troy ounce, an increase of 1.37%. Palladium, previously at $2,004.06, rose to $2,040.09 per troy ounce, for a weekly gain of 1.80%. Compared to precious metals, base metals ended mixed for the week. 3Mo copper which closed at $9,666.50 in the previous week ended lower the past week at $9,439.00 per metric tonne, for a loss of 2.35%. Zinc ended this past week at $3,240.50 per metric ton, higher by 17.99% than the prior week’s close of $2,746.50. Aluminun lost 24.24% for the week, beginning at $3,372.00 per metric tonne and ending at $2,554.50. Tin, on the other hand, rose from $35,858.00 to $36,452.00 by the week’s end for a gain of 1.66%.

Energy and Oil

International oil majors are speculating that there may be tangible increases in U.S. shale output over the next year as several investors may be diverting their windfall profits over to investing in shale. It is less likely that producers will hedge next year’s annual production, opening the possibility that next year’s U.S. crude production may be accelerated sooner than first anticipated. It is alleged that the U.S. is ready to tap into crude SPRs to impose control over runaway gasoline prices, a possibility that offset the decision by the OPEC+ to maintain the current trend in supply discipline. For this month’s meeting by the OPEC+, no new shift in policy has been announced for the oil markets. The oil group has agreed to continue with the 400,000 barrels per day monthly increments for December 2021, consistent with the past months’ performance, despite the increased demand by oil importers for higher supply in the market.

Natural Gas

An estimated 4 billion or more cubic feet per day (Bcf/d) of new capacity has been brought online for the third quarter of 2021, supplying mainly the demand markets in the Gulf Coast and Northeast region. Aside from a fairly balanced gas market for the report week October 27 to November 3, relatively mild weather also prevailed for this duration, tempering demand for air conditioning during the warm season. The Henry Hub spot price dipped by $0.27 from the week’s high of $5,86/MMBtu at the start of the week to $5.59/MMBtu by the week’s end, after touching a low at $5.17/MMBtu midweek.

The demand along the Gulf Coast ascended on average for the week, on the back of higher feed gas deliveries to LNG export terminals in Southern Louisiana. The non-export demand in the region was unchanged for the week. In the Midwest, prices decreased by $0.28 from $5.28/MMBtu to $5.54/MMBtu for the report week, closely tracking the Henry Hub price. In Northern California, the price at PG&E Citygate fell $1.17/MMBtu, from $7.43/MMBtu to $6.26/MMBtu for the week, In Southern California, the price at SoCal Citygate descended by $1.11 from $6.90/MMBtu at the start of the report week to $5.79/MMBtu by the week’s end.

U.S. supply of natural gas is up slightly for this report week due to natural gas production increasing for the second consecutive week. U.S. natural gas consumption significantly increased over the week due to increased consumption in the residential/commercial sector. In the international arena, Asian liquid natural gas (LNG) prices continue their three-week descent due to improving balance in Europe and the end of the maintenance effort at Chevron’s Wheatstone LNG project in Australia. With the improvement of supply, LNG is trading back at below $30 per million British thermal units (MMBtu).

World Markets

In Europe, equities ascended due to strong corporate earnings reports and indications from the European Central Bank (ECB) that they are keen on maintaining interest rates at a low level for the time being. The pan-European STOXX Europe 600 Index gained 1.67%. All on the upside are Germany’s Xetra DAX which rose 2.33%, France’s CAC 40 Index which gained 3.08%, and Italy’s FTSE MIB Index which surged 3.42% higher. The UK’s FTSE Index climbed 1.25%, even as the UK pound lost value against the U.S. dollar. The Bank of England kept interest rates unchanged, contrary to expectations. When the pound falls against the dollar, U.S. stocks tend to gain since many companies listed as components of the index are multinationals whose revenues are generated overseas. The core eurozone bond yields dipped from their earlier highs also in response to the ECB pushing back against increasing interest rates next year. The bank expects that inflation will continue to be subdued in the medium term. Core yields further dropped after the BOE signaled its policy is to remain unchanged on rates. UK gilt yields and peripheral eurozone bond yields also descended in tandem with the core eurozone bond yield trend.

In Japan, the solid election victory of the ruling Liberal Democratic Party led by Prime Minister Fumio Kishida infused renewed investor confidence in the equities market. The Nikkei 225 rose 2.49% in last week’s trading, while the broader TOPIX Index climbed 2.01% higher. The prospects of a stable government and policy continuity encouraged investors to take more aggressive positions in the market. The yield on the 10-year Japanese government bond slid to 0.07%, down from 0.09% from the week earlier, while the Japanese currency closed the week at approximately JPY 113.8 versus the USD, close to the three-year lows. The Bank of Japan assured investors that monetary policies will remain at their current levels.

Chinese equities went the opposite direction from that of Japan, recording a weekly loss. The CSI 300 Index dipped 1.4% and the Shanghai Composite Index fell 1.6% as news concerning the embattled property sector and the fresh COVID-19 outbreak nationwide threw cold water on investors’ sentiment. There were new restrictions in most places, triggering concerns regarding supply chain constraints. Furthermore, as infection rates neared a three-month high, worries regarding the country’s continued economic growth were more pronounced. Consistent with a flight to safety of investment funds, the yield on the 10-year Chinese government bond fell 8 basis points to 2.908% from 2.989% the week before. The yuan rose 0.16% to rest at 6.3995 versus the U.S. dollar.

The Week Ahead

Among the major economic data expected to be released in the coming week are hourly earnings, inflation data, and the Federal budget.

Key Topics to Watch

- NFIB small business index

- Producer price index final demand

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Consumer price index

- Core CPI

- Wholesale inventories (revision)

- Federal budget

- Job openings

- UMich consumer sentiment index (preliminary)

- Five-year inflation expectations (preliminary)

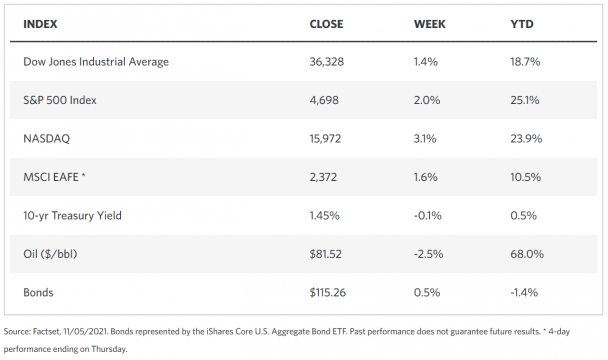

Markets Index Wrap Up