Stock Markets

After a streak of three consecutive weekly losses, stocks rebounded this week, a sign that investors are gaining confidence that the market may have temporarily bottomed out after retracing half of its summer gains. Inflation concerns appear to have been moderated with the expectation that the Fed’s future hawkish measures may be tempered. Energy shares underperformed the other sectors due to a midweek decline in oil prices, which briefly descended to their lowest level since the Russia-Ukraine war broke out; nevertheless, the sector still registered a modest gain for the week. The consumer discretionary sector outperformed the market due to a rally in heavily-weighted Tesla.

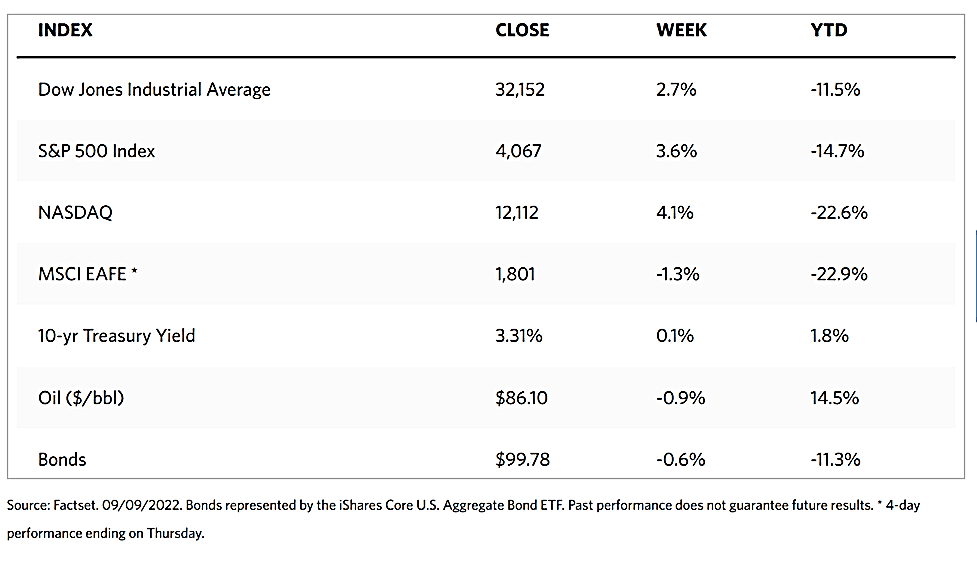

The markets were closed on Monday in observance of Labor Day. During the four-day trading week, the Dow Jones Industrial Average (DJIA) saw a 2.66% climb, while the total stock market did better, gaining 3.23%. The Nasdaq Stock Market Composite, which tracks technology stocks, surged by 4.14%. The broad S&P 500 Index rose by 3.65%, while the NYSE Composite gained 3.41%. The market began to turn on Wednesday in a relief rally on light trading volumes, suggesting the unlikelihood of a reversal. The rally was partly a reaction to the more dovish comments made by Federal Reserve Vice Chair Lael Brainard and Cleveland Fed President Loretta Mester. Brainard further remarked that she believed, despite the Fed continuing to raise rates, a recession could still be avoided. It appears that inflation may be cooking faster than the Fed originally expected when it released some hawkish projections in the past weeks.

U.S. Economy

The pandemic shutdown has wrought notable imbalances and distortions in the economy. The more significant impact was the impairments to global supply chains, increased consumer spending on goods relative to services, and record-high household savings. Moving towards the end of the year and on to 2023, economic growth is expected to continue. Growth drivers will shift from the pandemic stimuli to normalization in the underlying GDP trends, among which are the improvements in clearing supply bottlenecks, consumer spending supported by a drawdown in excess savings, and a shift to more services spending as pent-up demand due to the shutdown is released.

The healthy labor market appears to have tightened amid a return this year to full employment and strong hiring demand. The unemployment rate may likely fall back to below 4% from 2021’s average of 5.4%, with wage growth remaining steady for the rest of the year. While payrolls in the leisure and hospitality sector still lag behind the other sectors, total employment has returned to pre-pandemic levels. We may expect to see some cracks in the otherwise solid labor-market situation as demand slows and hiring freezes and layoffs may take place in certain industries. These are starting to emerge in pockets of the technology sector. The pace of monthly job growth as well as the pace of monthly job openings will begin to slow. The high trend in job quits has descended from its record highs in recent months. Workers’ confidence that opportunities will remain plentiful as they were in the past year appears to be moderating. Nevertheless, overall employment conditions will remain reasonably favorable, fueling support for consumer spending and moving the economy further forward.

Metals and Mining

Analysts observe that gold and precious metals appear to gain solid footing, although it is still premature to speculate that gold is close to a breakout. The precious metal has registered some strength from the fact that it did not break down to new lows this week. Another development this week was the major breakout of the U.S. dollar against a basket of foreign currencies, including the Japanese yen and the Chinese yuan. The pound also fell to a 35-year low against the greenback, and the euro continues to trade below parity with the dollar. Against this backdrop, gold has managed to hold steady to its support at $1,700. The precious metal has also remained steady despite rising bond yields, as the U.S. 10-year yields surged to 3.5% this week, the highest it has been in two months. The trend in yields will continue to prevail as the market sees a 90% likelihood that the Federal Reserve will raise interest rates by 75 basis points. This will further test the price of gold, which tends to weaken vis-à-vis assets that have yields.

Gold closed the week at $1,716.83 per troy ounce, higher by 0.27%, from the earlier week’s close at $1,712.19. Silver, which closed the previous week at $18.04, ended this week at $18.86 per troy ounce, higher by 4.55%. Platinum rose by 5,38% from its prior close at $839.05 to its closing price this week at $884.19 per troy ounce. Palladium began the week at $2,024.00 and closed at $2,178.58 per troy ounce for a gain of 7.64%. The three-month LME prices of base metals were mixed at trading this week. Copper gained 2.93% from its previous close at $7,633.00 to this week’s close at $7,856.50 per metric tonne. Zinc saw a slight gain of 1.02% from the previous week’s close at $3,135.50 to this week’s close at $3,167.50 per metric tonne. Aluminum dipped by 0.41% from the earlier close at $2,295.50 to end at $2,286.00 per metric tonne. Tin, which ended one week earlier at $21,155.00, closed this week at $21,165.00 per metric tonne for a gain of 0.05%.

Energy and Oil

The oil markets continue to be impacted by weak macroeconomic data. ICE Brent continues to trend around $90 per barrel after it bounced back from multi-month lows where it treaded mid-week. Bearish sentiment appears to prevail as news of weak Chinese trade data and ECB interest rate hikes overpowered the story of Iran’s nuclear deal getting sidetracked, a story more relevant to the supply/demand situation. Nevertheless, threats of supply cut-offs appear to have countered a very bearish inventory report by the U.S. Energy Information Administration (EIA), sending oil prices upward early on Friday morning. Russia’s President Vladimir Putin raised the stakes in Europe’s energy crisis as the EU considers a pipeline gas price cap. Putin threatened to halt energy exports to any country that will implement price gaps on the country’s oil, gas, and coal.

Natural Gas

For the report week from Wednesday, August 31 to Wednesday, September 7, the Henry Hub spot price fell by $0.82 from $8.95 per million British thermal units (MMBtu) at the start of the week to $8.13/MMBtu by the week’s end. Regarding futures prices, the price of the October 2022 NYMEX contract descended by $1.285 for the week, from $9.127/MMBtu to $7.842/MMBtu. The price of the 12-month strip averaging October 2022 through September 2023 futures contracts decreased by $0.869 to $6.526/MMBtu. In all regions this report week, natural gas spot prices decreased as prices at major pricing hubs declined. After reaching record highs last week, international natural gas futures prices declined this week. Weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia slid by $7.95 to a weekly average of $56.07/MMBtu, while natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $17.13 to a weekly average of $66.49/MMBtu.

World Markets

European bourses climbed after announcements by some member countries concerning plans to address the energy crisis and boost their economies. The pan-European STOXX Europe 600 Index concluded the week 1.06% higher. Major indexes followed the trend. Germany’s DAX Index gained 0.29%, France’s CAC 40 Index rose 0.73%, and Italy’s FTSE MIB Index advanced 0.79%. The UK’s FTSE 100 Index increased by 0.96%. The British pound lost ground against the U.S. dollar before it bounced back to approximately USD 1.16, close to its lows in 1985. Uncertainty about the economic agenda of the new UK Prime Minister Liz Truss appeared to be at the center of the pound’s weakness, at least in part. After the European Central Bank (ECB) hiked its key interest rates by a record 0.75%, the euro climbed above parity with the U.S. dollar.

Japan’s stock markets ascended for the week as the Nikkei 225 climbed 2.04% and the broader TOPIX Index rose by 1.83%. Investors showed optimism as the government announced new measures to help Japan contend with rising inflation. Meanwhile, the yen fell to its lowest level in 24 years, eliciting fresh comments from government officials that any options on foreign exchange moves will not be ruled out. The yen weakened to about JPY 142 against the U.S. dollar from about JPY 140 the week before. The 10-year Japanese government bond yield dipped to 0.23% from 0.24% at the close of the preceding week. The government declared that by October, a new counter-inflation package will be launched, including cash handouts to low-income households and measures to keep the prices of some commodities and food items at their current levels. Priority is being given to the protection of households and businesses from the repercussions of higher import prices due mainly to the Russia-Ukraine war.

China’s stock markets climbed as modest inflation data and expectations of added policy support perked buying interest. The broad, capitalization-weighted Shanghai Composite Index surged 2.4% while the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, gained 1.7%. Although inflation slowed, so did trade and domestic demand. China’s consumer and factory gate inflation in August came down from their levels in July even better than analysts’ expectations. Over the 12 months ending in August, consumer prices rose 2.5%, as did factory gate prices, down sharply from the 4.2% recorded in July. Year-over-year factory gate inflation (excluding transport or delivery charges) peaked in October 2021 at 13.5%; since then, it had consistently trended lower. Earlier this past week, official data showed that exports and imports began to slow in August as growing inflation slowed overseas demand and China’s output was disrupted by coronavirus restrictions and the prevailing heat wave.

The Week Ahead

Inflation and economic activity information comprise some of the important economic data scheduled for release in the coming week.

Key Topics to Watch

- NY Fed 3-year inflation expectations

- NFIB small-business index

- Consumer price index

- Core CPI

- CPI (year-on-year)

- Core CPI (year-on-year)

- Federal budget

- Producer price index final demand

- Initial jobless claims

- Continuing jobless claims

- Retail sales

- Retail sales excluding vehicles

- Philadelphia Fed manufacturing index

- Empire State manufacturing index

- Import price index

- Industrial production index

- Capacity utilization

- Business inventories

- UMich consumer sentiment index

- UMich 5-year consumer inflation expectations

Markets Index Wrap Up