Stock Markets

Volatility dominated to cause the major indexes to close mixed. The S&P MidCap 400, the S&P 500 and the Nasdaq Composite Indexes broke out in new intraday highs on Thursday, with the small real estate sector within the S&P 500 surging but the financials underperforming the other sectoral averages, In what is widely deemed the last week of the summer vacation season, trading volumes were mostly subdued. Contributing to the end-of-week listlessness is the foreseen market closure on Monday in observance of Labor Day. Over the week, the investing sentiment was largely overshadowed by investors’ anticipation of the closely watched monthly payroll report released by the Labor Department. Although the news was expected to come way below expectations, the silver lining is that the Federal Reserve would be less likely to commence their tapering of asset purchases this year if the report is so disappointing. The negative and positive aspects contributed to the market’s mixed reaction and volatility for the week.

U.S. Economy

The release of the official August report on Friday indicated that a slowdown in unemployment gains was confirmed. Nonfarm payrolls, an indicator which was expected to gain by 750,000, grew only 235,000, disappointing for being far below consensus expectation. A bright spot in the report, however, is that the previous months’ gains were revised higher and the unemployment rate was adjusted lower to 5.2%, a new low during the pandemic era. Part of the poor payroll figures was due to the negative effect of the delta variant particularly with regard to hiring in the leisure and hospitality sectors. Analysts, however, noted that rather than lower demand, a more significant cause in the slump was due to reduced labor supply rather than lower demand. This is evident from the weekly jobless claims released on Thursday which again dipped to their lowest level since March 2020, while average hourly earnings climbed by 0.6% in August, which is approximately double the forecasted figure.

- Recent economic data appears to indicate that a slowdown in economic growth may be more likely moving forward to the end of the year. This is not entirely negative news, and may even be appropriate since the economy has been surging for much of the year. Since the recovery period after the worst of the pandemic appears to have achieved the peak in U.S. GDP growth, a slowdown in that rate of growth is likely as the delta variant continues to fuel concerns that the recovery may be waning. This may be temporary, however, and economic growth may resume its upward trend next year.

- While the slowdown projected in Friday’s August employment report was significantly against expectations, it does not signal a sustained change in the direction of the labor market or the overall economic recovery. However, it may result in a potential weakness in consumer spending for the third quarter of this year. The continued economic expansion, however, will continue to rely on a strengthening labor market. What has taken place is just a small glitch in the overall trend. As concerns for the delta variant come to an inevitable resolution, the opening up of the hospitality and leisure industries will create greater demand and the labor supply will return to the market in a big way to meet this demand, creating a solid backbone for the economic growth in the next year.

Metals and Mining

Coinciding with the miss in the U.S. labor market resulting from lower job creation in August, the gold market appears poised to move higher in the coming weeks. Some economists observe that, despite upward revisions in previous reports’ job numbers, this is not enough to offset the negative perception regarding the last report about the labor market performance. In reaction to this, the gold market responded with higher prices for precious metals overall as investors resorted to low-risk assets in a flight to safety. Gold prices gained 0.56% week-on-week, closing at $1,827.74 per ounce from last week’s $1,817.57. Gold futures went up almost 1% on Friday alone after the jobs report was made public. Silver went up 2.87%, closing at $24.72 per ounce from the earlier week’s $24.03. Platinum also climbed 1.41% to $1,026.76 from the previous $1,012.53 per ounce. Palladium bucked the trend, losing 0.11% to close at $2,420.25 per ounce on Friday compared to the previous Friday’s close of $2.423.00.

Compared to precious metals, the base metals were mixed in the past week’s trades. Copper began the week at $9,410.00 and rose to $9,431.00 per metric tonne for a gain of 0.22%. Zinc, previously at $3.002.00 per metric tonne, ended at $2,996,50, shaving 0.18% in value. Aluminum outperformed with a 2.93% price increase, closing at $2.727.00 this week from the earlier week’s close of $2.649.50 per metric tonne. Finally, tin saw a price depreciation of 1.62% this week, ending at $33,055.00 per metric tonne from the previous week’s close at $33,600.00.

Energy and Oil

This week was marked by constricting developments in the oil market, with an improving demand situation due to the post-pandemic expanding economy on the one hand, and a slowdown in the rate of recovery in the supply situation due to a natural disaster on the other. Hurricane Ida battered offshore platforms and flooded refineries as it trekked through much of Louisiana’s refining industry during the week, keeping oil prices elevated due to supply constraints. There remain 1.7 million barrels per day of offshore production still to come back on stream, and the flooding in the refineries is bound to significantly reduce U.S. crude and product stockpiles. These developments are likely to put upward pressure on oil prices. The situation is not likely to be alleviated despite the OPEC+ member states confirming their commitment to the 400,000 barrel-per-day increase until the end of 2021.

Natural Gas

In the U.S., the price of natural gas soared to its highest level since November 2018. U.S. gas prices surged to $4.73 per million British thermal units (MMBtu) when word spread that the latest reported gas storage build of the International Energy Agency (IEA) storage build came in at 20 billion cubic feet (BCf), a figure much lower than expected for the week ended August 27. This would create a likely squeeze on the supply of natural gas as the country faces strong demand for heating capacity in the coming winter months.

Due to the supply constraints, natural gas spot prices went up for most locations. During the past report week (August 25 to September 1), the Henry Hub spot price ascended from $4.01/MMBtu to $4.46/MMBtu. The September 2021 New York Mercantile Exchange (NYMEX) contract expired on Friday at $4.370/MMBtu, an increase of $0.47/MMBtu from the previous Wednesday. The October 2021 NYMEX contract price rose to $4.615/MMBtu, higher by $0.69/MMBtu from last Wednesday. The price of the 12-month strip averaging from October 2021 through September 2022 futures contract increased by $0.41/MMBtu to $4.066/MMBtu.

World Markets

European shares moved sideways for the week in listless trading as investors sought to weigh the signs of slowing economic momentum. The pan-European STOXX Europe 600 Index closed the week flat while most major indexes were mixed. France’s CAC 40 Index was relatively unchanged, Italy’s FTSE MIB Index rose by 0.22%, and Germany’s Xetra DAX Index fell by 0.45%. Higher-than-expected eurozone inflation and negative commentary from certain European Central Bank policy formulators brought the core eurozone government bond yields higher. The ECB members called for a reduction in the purchase pace of the Pandemic Emergency Purchase Program, causing the rise in government bond yields. The core markets were mostly tracked by the peripheral eurozone and UK government bond markets.

In Japan, a strong rally in the bourses was the main reaction to news of Prime Minister Yoshihide Suga’s resignation. The positive reaction was in light of the elimination of political uncertainty surrounding the tenuous situation in the country and raised expectations of increased economic stimulus. The stock market surge was also driven by the good news of Japan’s accelerating COVID-19 vaccination roll-out. The Nikkei 225 Index gained an impressive 5.38%. The broader TOPIX Index followed suit with a gain of 4.49%, during which it attained a 30-year high. The yield on the 10-year Japanese government bond rose from 0.02% at the end of the preceding week to 0.04% at the end of this week. Concerning currencies, the yen weakened marginally to JPY 109.98 from JPY 109.83 against the U.S. dollar in the week prior.

The Chinese stock market climbed on its second-straight week, with the Shanghai Composite Index rising 1.7%. The SCI outperformed the large-cap CSI 300 Index which rose by 0.3%. Listed Chinese companies registered strong earnings for the second quarter, posting a 36% annual increase in earnings per share. The strongest earnings growth was realized by companies in the upstream resources sectors, with the semiconductors and new energy vehicles sectors coming in second. Sectors that lagged included the consumer, pharmaceutical, and telecom companies. The net profits, reckoned on a two-year basis to adjust for the impacts of the pandemic, grew by 10% over the second quarter of 2019. The yield on the 10-year Chinese bond dropped by four basis points to end at 2.85%. In the currencies market, the renminbi rose in value to close at 6.451 against the U.S. dollar, or 0.5% higher.

The Week Ahead

The week ahead is shortened due to the labor day holiday, but important economic data scheduled for release during the week are consumer credit and the producer price index.

Key Topics to Watch

- Job openings in July

- Beige book

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Producer price index, August

- Wholesale inventories (revision), July

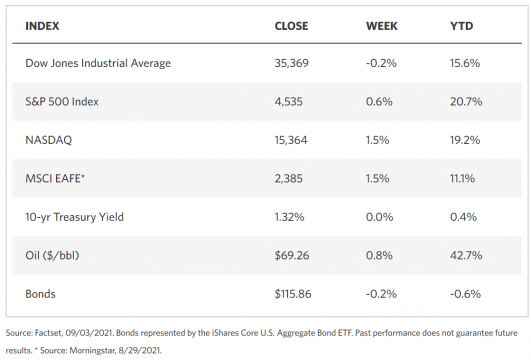

Markets Index Wrap Up