Summary

-

- WallStars show positive broker target price upsides. 19 of 81 were tagged “safer” for dividends.

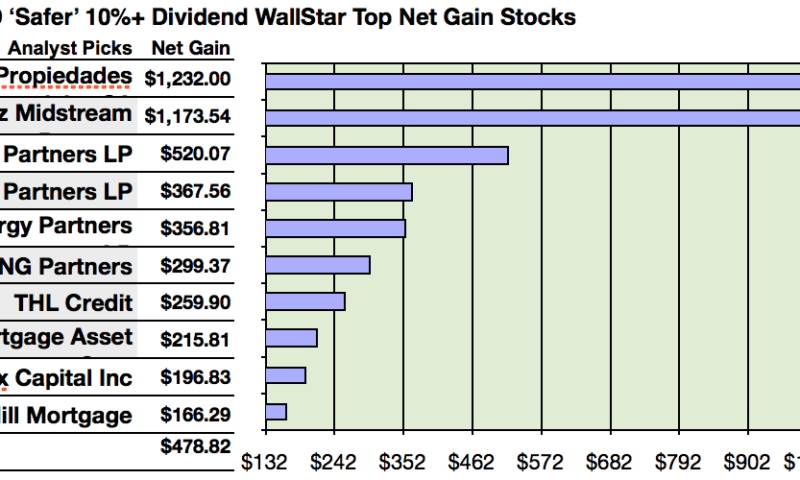

- Broker target estimated October top 10 “safer” net gains ranged from 16.63% to 123.2%.

- Top 10 10%+ “Safer” Dividend WallStar annual yields ranged from 11.65% to 24.87%. Their free cash flow yields ranged from 13.01% to 77.86%.

- Besides safety margin, 10%+ “Safer” Dividend WallStars also reported payout ratios, total annual returns, dividend growth, and P/E ratios to further manifest their dividend support.

- Analyst one-year targets determined that 10 highest yield 10%+ “Safer” Dividend WallStars could produce 31.22% more gains from $5k invested in the lowest-priced five vs. $5k in all 10.

Actionable Conclusions (1-10): Brokers Calculated Top Ten 10%+ ‘Safer’ Dividend WallStars To Net 16.6% To 123.2% By October 2019

Five of the ten top 10%+ “Safer” Dividend WallStars by yield (shaded in the chart above) were verified as being among the top ten gainers for the coming year based on analyst 1 year target prices. Thus, the yield strategy for this group, as graded by analyst estimates for this month, proved 50% accurate.

Projections based on dividends from $1000 invested in the highest yielding stocks and the aggregate one year analyst mean target prices of these stocks as reported by YCharts provided the data points. Note: one year target prices from single analysts were not applied (n/a). Data revealed ten probable profit-generating trades to October, 2019:

IRSA Propiedades Comerciales SA (IRCP) netted $1,232.00 based on dividends plus a median target price from five analysts less broker fees. The Beta number showed this estimate subject to volatility 69% under the market as a whole.

Sanchez Midstream Partners (SNMP) netted $1,173.54 based on the median of target price estimates from four analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 97% under the market as a whole.