2021 saw a rush of biotechs heading for the public markets, including companies seeking an initial public offering before ever producing a shred of clinical evidence.

And they paid for it.

Biotech IPOs hit a record with more than 100 listings last year, but the sector’s stock performance paints a different picture than it did during a buoyant 2020, when drug developers capitalized on their lifesaving mission as the COVID-19 pandemic raged.

So many biotechs went public last year that it was “hard for the sector to digest,” industry investor Brad Loncar wrote.

In particular, the overwhelming supply of preclinical biotechs going public should raise eyebrows, because it’s a company’s job to show proof of concept in patients. Going public beforehand is typically “too early,” Otello Stampacchia, Ph.D., founder of VC shop Omega Funds, said in an interview.

But the preclinical IPO trend is likely here to stay, Jordan Saxe, head of healthcare listings at Nasdaq, said in an interview. He sees the not-yet-in-human surge going one of two routes: Either the preclinical biotechs of 2021 produce “really interesting data” with their first readouts, or they falter in the clinic and “have to deal with that in the public markets.”

Indeed, last year proved difficult for the flurry of biotechs that raced to Wall Street before testing their investigational treatments in the clinic—and among the entire crop of 2021 IPOs, only one company has seen an increase in share price since its debut.

“Markets are a little choppy right now, and I think there’s going to be some seasonality to what happens in markets,” Saxe said. Even so, he expects another 75 or more biotech IPOs this year given the “pipeline hasn’t slowed down.”

Saxe pointed to the sheer number of private companies on the calendar of this year’s J.P. Morgan Healthcare Conference—a whopping 200—as evidence that biotechs are revving up for public offerings. “[Y]ou have to extrapolate from that that a portion are pre-IPO,” he said.

Keep in mind, the number of IPOs of the past two years is a drastic change from the six or seven annual biotech listings typical a decade ago, Saxe said.

But the number of listings can’t be viewed in isolation. The stocks’ performance and uptake in investor confidence—or lack thereof—should be considered, too. The average biotech IPO was down 22% last year, according to Jefferies.

Saxe said it’s too early to comment on who outshone the competition last year, pointing to Moderna as an example of a biotech that wouldn’t have been expected to produce one of the quickest vaccine developments in history. Put more simply, it takes time to judge the new public entrants.

Stampacchia didn’t mince words when he characterized the last 11 or so months as a bear market.

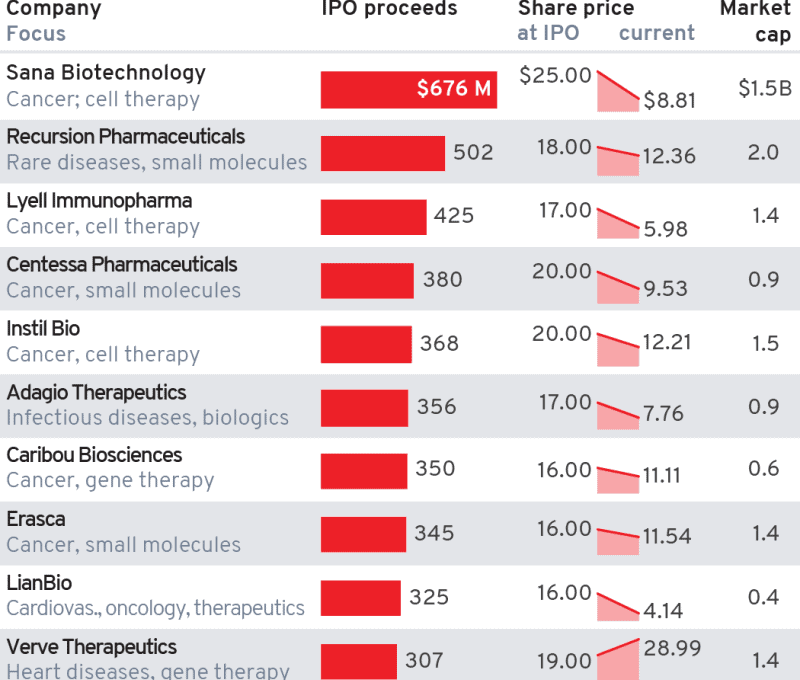

As a case in point, nine of the top 10 biotech IPOs of 2021 are now trading well below their initial offering price. The largest debut, Sana Biotechnology’s $675 million raise last February, is a shell of its former self. The cancer and cell therapy biotech priced at $25 and shares are now roughly one-third, at $8.81 apiece in early February.

Verve Therapeutics, a heart disease and gene therapy biotech, is the only company to fare better than on its first day of trading among Fierce Biotech’s top 10 list.

The stock woes haven’t deterred everyone, though, as cell therapy biotech Arcellx launched an IPO anyway earlier this month. The Takeda- and Novo-backed biotech raised about $124 million to fund a phase 2 study of its CAR-T BCMA therapy in multiple myeloma.

Biotechs should have two to three years of capital runway, and, in a stock market environment that is “not conducive,” companies should come up with a Plan B, Saxe said.

“[R]ight now, it just feels a bit silly, if not suicidal” to consider going public, Stampacchia said.