Sanofi seems to be in a betting mood and has been picking up card after card in licensing deals to bulk up its early-stage pipeline. Now, the French Pharma is putting even more chips down for a tie-up worth a potential $2.5 billion with bispecific antibody producer Adagene.

Adagene, which is on a quest to produce immunotherapies that don’t attack healthy cells, is partnering with Sanofi for up to four “safe” antibody candidates in oncology. Sanofi will be able to apply Adagene’s technology to two of its antibody candidates with the option to tack on two more down the road.

The French Pharma is only putting up $17 million in upfront cash plus the potential milestones if the candidates advance. But Adagene CEO Peter Luo, Ph.D., is confident the biotech can successfully get the candidates through the clinic and onto the market. Luo said explicitly that he believes his company will start hitting these milestones almost immediately, as detailed discussions have already taken place to ascertain what targets might work for the partnership.

“We’re fully ready, actually,” Luo told Fierce Biotech in an interview.

This is the fourth deal in a few months for Sanofi, which is working to fill the stockroom with early-stage candidates in a flurry of licensing deals. The Adagene agreement could ultimately be the largest of the bunch but, in the near term, falls well behind the $1 billion offered upfront to immuno-oncology player Amunix Pharmaceuticals in December 2021. It’s also the second one Sanofi has locked down for bispecific targets behind the $75 million upfront deal for rights to a Parkinson’s disease drug from South Korea’s ABL Bio signed in January.

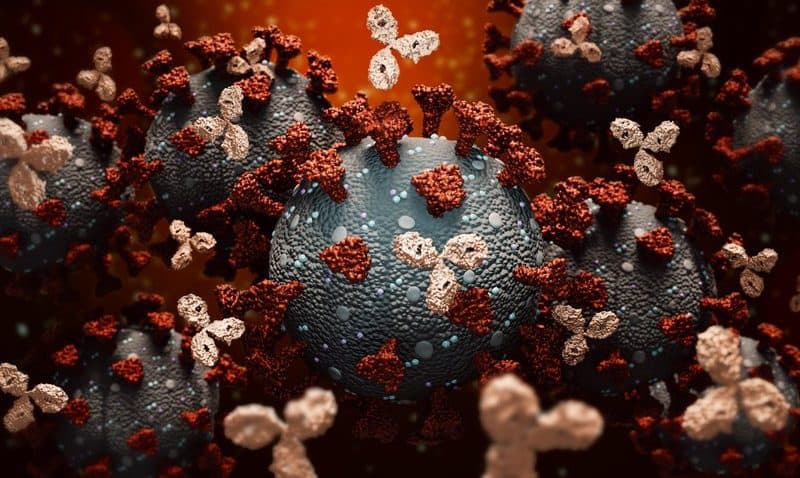

Adagene’s platform sets out to solve one of the most common side effects of modern immunotherapy: Turning your body’s immune system to fight cancer cells can simultaneously end up killing healthy cells as well. To address this, the company developed “SAFEbody” technology that only allows antibodies to bind to and activate in a tumor environment, rather than in healthy cells.

It’s part of a larger antibody discovery platform Adagene is using to immediately diversify itself. The company has already partnered with more than a dozen companies and organizations, including Bristol Myers Squibb and the National Institutes of Health. The Sanofi agreement marks the fourth specifically for the SAFEbody tech.

But the company also has a pipeline of its own, mainly focused on combination therapies as a way of maximizing the efficacy of established treatments with the safety profile of its antibodies. A phase 1b/2 trial for lead candidate ADG106 in combination with BMS’s Opdivo just launched earlier this year for patients with metastatic non-small cell lung cancer.

Adagene’s drug discovery efforts are fueled by AI, which has allowed for swift, early molecule identification. The company claims more than 50 programs in the discovery phase.

Moving forward, Luo says the company is not prioritizing the technology and its platform for cancers that have more readily available treatments in an effort to increase the value of reducing side effects. Instead, Adagene plans to provide value where there may be limited hospital resources irrespective of cancer severity.

“With this kind of technology, then you can enable community doctors to apply the drugs safely to the patients,” he said.

In February 2021, Adagene entered a similarly backloaded deal with genomic-based drug discovery company Exelixis that included $780 million in milestone payments. By December, the company had already hit a preclinical milestone that triggered $3 million.