Six days after the World Health Organization officially declared COVID-19 a global pandemic on March 11, 2020, Shafique Virani, M.D., landed a brand new job.

Following a two-year stint leading a couple of subsidiaries of BridgeBio, the Roche-Genentech alum jumped to Recursion Pharmaceuticals to be the chief corporate development officer of the AI-driven drug discovery company. Roughly two weeks later, the 2020 BIO International Convention was moved completely online. The tectonic plate shifts impacting society at large created a vacuum initially filled with uncertainty and unease. But soon after came an era of hyper-productivity, says Virani.

“[T]hat was certainly a time that initially started off a lot of uncertainty, a dip and then there was obviously a takeoff,” he said.

For Recursion, the takeoff was more like a rocket ship blasting full-speed into the stratosphere. Later that year, the company raised $239 million in series D funding, more than double the capital raised in Recursion’s previous three fundraising rounds combined. In April 2021, the company closed a $436 million IPO, pushing its market value north of $5 billion. Recursion also inked two partnerships remotely with Bayer and Roche that combined could net the company billions of dollars.

Now, back at BIO in San Diego in person, Virani is looking forward to finally shaking some hands.

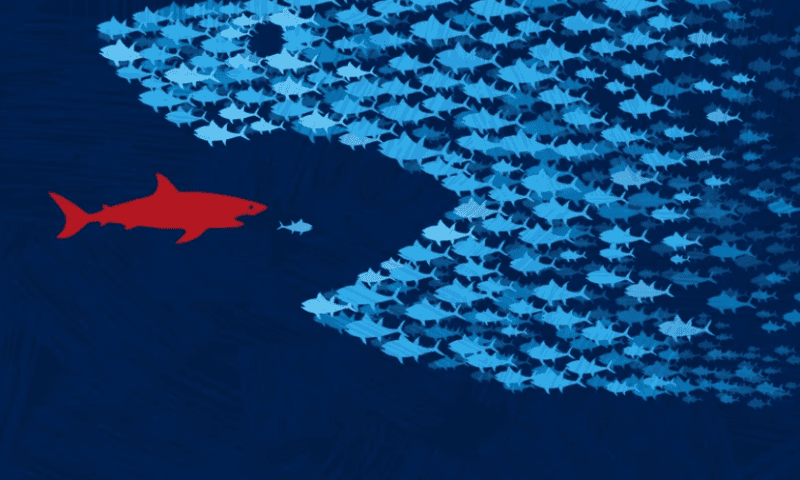

For other biotechs, the goal of this year’s conference is to find some unclenched fists. Following the industry’s liftoff, which was marked by a 140% rise in the S&P Biotech ETF from March 2020 to February 2021, the market has cratered. All of the gains over that period have been wiped away and then some, with the current value now at $63.42 a share. A recent CB Insights report found that biopharma tech deals fell 15% last quarter, the fourth consecutive quarter of declines. And it’s not just dealmaking—overall investment is down 10%, M&A is decreasing and those once-hot SPAC deals are a thing of the past; there were zero last quarter.

That’s left small-to-mid-size companies clamoring for money that appears to be drying up fast. Take OnQuality for example, a pharma developing treatments for side effects of cancer drugs. The company is slated to soon close a series B but has had to settle with raising less money as its valuation has dropped.

“It’s been a tough several months. A lot of people are really licking their wounds, re-prioritizing everything they do.” — Alex Monteith, iECURE chief business officer

“Ultimately, last year this time we were trying to figure out how to accelerate, how much growth we can create over the shortest amount of time,” said CEO Michael McCullar. “Now, may be not so aggressive with the growth plans.”

The same can be said for gene editing-focused iECURE, which is looking to raise $60 million in new funding after being spun out of the lab of Jim Wilson, M.D., Ph.D., and netting $50 million in September 2021. When asked about the progress of the latest fundraising efforts, Chief Business Officer Alex Monteith quipped: “Talk to me in a couple of weeks.”

“It’s been a tough several months,” Monteith said. “A lot of people are really licking their wounds, re-prioritizing everything they do.”

For companies like OnQuality, iECURE and many others, the fiscal belt-tightening elevates an uncomfortable question: should additional capital come from signing away some rights to potentially valuable assets?

It’s a crossroads that Eligo Bioscience is familiar with. The Paris-based company signed onto a research and option agreement with GSK in January 2021, a deal worth up to $224 million for Eligo’s lead asset to treat acne. And while CEO Xavier Duportet, Ph.D., is waiting to hear whether the Big Pharma will latch on, his biotech has continued to field “exciting” inbound interest from other pharmas. But he’s cognizant about “trying to not give all the value away because the markets are down right now.” Even the GSK deal is a bit of a quagmire, with investors relaying to Duportet that if the British pharma doesn’t elect to buy-in, then they’ll be even more interested in handing over cash.

But there are middle ground opportunities, namely signing away commercial rights to specific regions. That’s where a company like LianBio comes in, a licensing firm that works with other pharmas to develop and commercialize assets in China and other countries in the region. President and Chief Strategy Officer Debra Yu, M.D., believes the current market conditions are opening up more interest in these partnerships.

“I do think that there are more people thinking about regional deals than would have before,” she said. “Most people feel it doesn’t impact your downstream right to do a global deal.”

As for the larger pharmas on the buy-side of the equation, the market depression has brought valuations and expected upfront payments to a more “realistic range,” says Barbara Lueckel, global head of research technologies at Roche Pharma Partnering. She added that Roche was not waiting for market changes to impact “when we talk to and why we talk to certain companies.”

Jannie Oosthuizen, president of Merck &Co.’s human health division, said the U.S. pharma isn’t “bargain-hunting.”

While coy, Sebastian Guth, president of pharmaceuticals for Bayer in the Americas region, said the company had more deals in the works, for which announcements would come “as the time is ripe.”

“We did 40 deals between 2020 and today,” he said. “We’re not going to stop today.”