The $5.4 billion Pfizer coughed up to acquire Global Blood Therapeutics was worth it to get the Big Pharma’s hands on a pipeline of exciting sickle cell disease treatments, if analysts’ predictions are anything to go by. And those gains will come well before GBT’s preclinical pipeline, from the likes of Sanofi, enter the clinic.

Writing on Saturday—before the deal was announced—SVB Securities analysts suggested that an offer of around $5 billion “would encompass enough premium to capture the pipeline value and growth of [GBT], including un-risk adjusted value for the key pipeline asset GBT601, a potential ‘functional cure’ for sickle cell disease.”

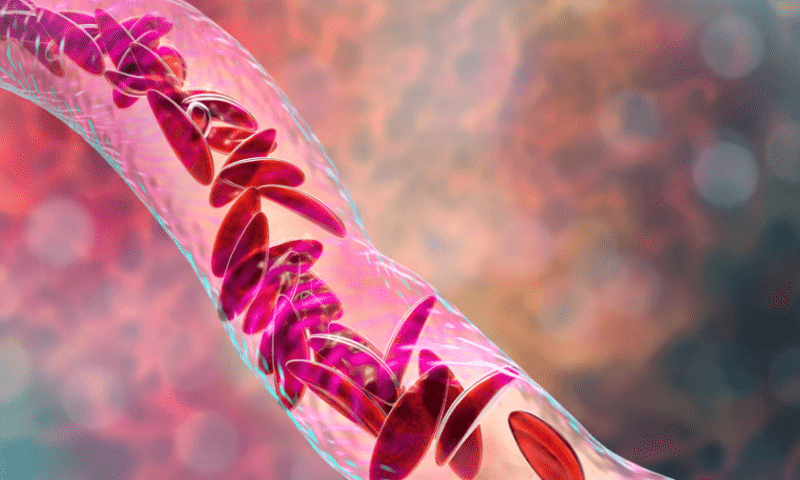

GBT601 is a next-generation sickle hemoglobin polymerization inhibitor that is currently in the mid-stage part of a phase 2/3 trial for the inherited blood disorder. The initial part of the study will look at safety and tolerability, before the second stage compares the oral drug to placebo over 48 weeks, according to ClinicalTrials.gov.

The therapy, which is taken once a day, has the potential to be a best-in-class agent to reduce the destruction of red blood cells—known as hemolysis— as well as the frequency of vaso-occlusive crisis (VOC), where sickled red blood cells deprive tissues of oxygen by blocking blood flow, Pfizer said in its announcement.

The other clinical-stage candidate Pfizer will gain from the deal is inclacumab. This monoclonal antibody targeting a protein called P-selectin is already undergoing two phase 3 trials, with hopes of becoming a quarterly treatment to reduce the frequency of VOCs and resulting hospital admissions.

Both GBT601 and inclacumab have already received orphan and rare pediatric disease tags from the FDA, Pfizer noted.

Attention for the deal is understandably on GBT601 and inclacumab, along with the approved Oxbryta tablets for sickle cell disease. But the biotech also has some interesting work in pre-clinical development.

This includes a collaboration to harness Syros Pharmaceuticals’ gene control platform to try and turn on the expression of gamma globin. The two companies aimed to induce the production of fetal hemoglobin, which they say is “known to exert protective effects on the red blood cells of patients with sickle cell disease and beta thalassemia and mitigate the clinical manifestation of these diseases.”

The remainder of GBT’s preclinical pipeline consists of potential new treatments for anti-sickling—a term for preventing the hemoglobin in red blood cells from sticking together—and reducing inflammation and oxidative stress. Both assets were acquired from Sanofi last year.