The implications of the war in Ukraine for the biotech industry have been enormous, with Checkpoint Therapeutics the latest to reconsider clinical plans.

As a result of a “substantially” longer enrollment period than expected, Checkpoint is winding down the phase 3 CONTERNO study assessing its lead asset cosibelimab in combination with chemotherapy, according to the company’s earnings report released Friday. The combination therapy was being tested as a first-line treatment for patients with metastatic non-squamous non-small cell lung cancer.

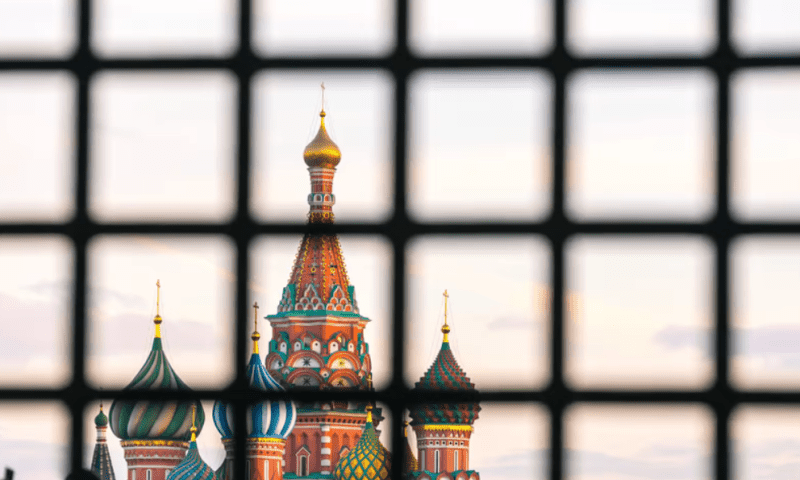

While Checkpoint attributes the delay to the “ongoing conflict in Ukraine,” the implicated trial sites are actually in Russia. According to the clinical trial record, 15 out of 22 trial sites are based in Russia. Checkpoint says the trial will wind down “over the coming months” and that all costs associated with the trial will end by the fourth quarter.

The company did not report any issues with enrollment in mid-May when it released its first-quarter earnings, even though that was almost three months after Russia invaded Ukraine.

Checkpoint’s decision to end the trial comes as the company has spent almost half of its cash reserves through the first half of the year. The company currently has $30.9 million in cash compared to $54.7 million at the start of the year. Checkpoint didn’t say how long its current reserves will last.

With the combo trial kaput, Checkpoint is pushing all of its commercial eggs toward cosibelimab as a single agent. Armed with enticing phase 3 data in patients with both locally advanced and metastatic cutaneous squamous cell carcinoma, the company is prepping an approval application for regulators. Checkpoint says it completed two “favorable” pre-application meetings with the FDA in July and determined that it will file for an approval in both the cancer stages.

The submission would mark a significant milestone for the company seven years after it licensed the asset from the Dana-Farber Cancer Institute in 2015. It could also mark a leg up in the company’s market value. Checkpoint’s shares have been trading at less than $2 since February 2022.