Gene therapies may be a hot area of biotech development, but that doesn’t mean companies are finding it any easier to navigate the bear market. These now include Applied Genetic Technologies Corp., which, rather than face the “challenging” funding environment ahead, has opted for a $23.5 million sale to investment fund Syncona.

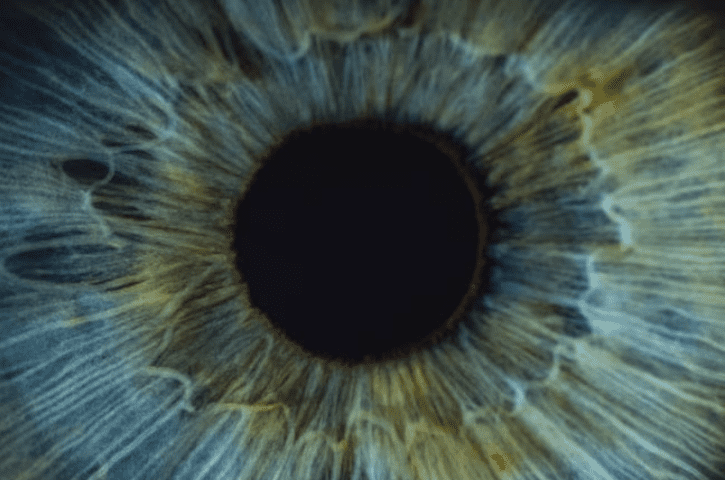

AGTC’s pipeline is focused on inherited retinal diseases, with its lead asset—a gene therapy for X-linked retinitis pigmentosa (XLRP) called AGTC-501—currently in a phase 2 expansion study. The rest of its clinical pipeline consists of phase 1/2 programs for a rare eye condition called achromatopsia and an experimental process for addressing retinal degeneration called optogenetics.

The recent history of AGTC’s stock reflects a familiar story for biotech, falling over the course of 2021 from a recent peak of $5 a share in March of that year to 24 cents at market close Monday. At 34 cents per share, the upfront offer from Syncona represents a 42% increase on the biotech’s current value, AGTC pointed out in a release Sunday.

If they agree to the deal, the gene therapy company’s shareholders will have the potential to scoop up a combined additional sum of $50 million in contingent value rights based on the clinical success of the XLRP candidate and other pipeline assets. Investors certainly appeared keen this morning, sending AGTC’s shares rocketing 70% in premarket trading to around 41 cents apiece.

In a statement accompanying the release, Scott Koenig, chairman of AGTC’s board of directors, was blunt about the reasons the board was encouraging shareholders to accept the deal, which is expected to close this year.

“Our board and leadership team evaluated all alternative options to progress AGTC-501,” Koenig said. “Given the state of equity and other funding markets, we see significant challenges in funding ongoing operations beyond 2022.”

The biotech’s shareholders may take comfort from the fact that this isn’t the first rodeo for U.K.-listed Syncona. The investment fund has a track record with retinal companies, having overseen the sale of Nightstar to Biogen for $877 million in 2019 and Gyroscope to Novartis last year for $800 million upfront. Syncona currently has three gene therapy companies in its portfolio of entities where it’s the majority shareholder: liver-focused Freeline, kidney-focused Purespring and neurological-focused Swan Bio.