A phase 3 failure puts another nail in the coffin for Tricida to get its kidney disease drug to market, two years after the FDA denied approval.

Having already taken a battering with previous regulatory woes, Tricida’s stock plummeted 94% in the first hour of trading this morning to 61 cents apiece.

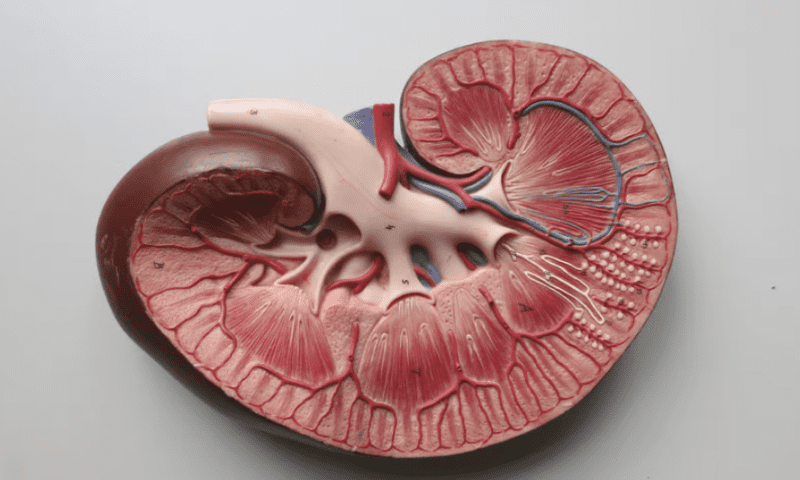

Veverimer, the company’s sole asset, is designed to attach to hydrochloric acid in the gastrointestinal tract and keep it bound until it is excreted. The theory is that this will cut acid levels in the body and increase serum bicarbonate. Tricida designed veverimer as a way to reverse the acid accumulation that causes complications in some advanced chronic kidney disease (CKD) patients.

In August 2020, the FDA already turned down Tricida’s application to get veverimer approved for metabolic acidosis in CKD patients. The agency cited “the need for additional data on the magnitude and durability of the treatment effect of veverimer on the surrogate marker of serum bicarbonate and the applicability of the treatment effect to the U.S. population,” the biotech explained at the time.

Now, two years later, Tricida has produced data from a fresh phase 3—but, unfortunately, it’s not the readout the company had been hoping for. In the VALOR-CKD trial, veverimer did not meet the primary endpoint, which measured how much time it took for a patient to experience either renal death, end-stage renal disease (ESRD) or at least a 40% reduction in estimated glomerular filtration rate (eGFR).

Over the 26.7 months of median treatment duration, 20.2% of the 739 patients taking veverimer experienced one of these endpoints, compared to 20.1% of the 737 patients given placebo, Tricida said in a release Monday.

To compound the unwanted results, Tricida noted higher-than-expected levels of serum bicarbonate in the placebo group. This meant investigators were unable to compare an untreated population with low serum bicarbonate levels to a veverimer-treated population and as a result were unable to assess the therapy’s ability to slow CKD progression.

“Given our past clinical experience with veverimer and the VALOR-CKD trial design, we were surprised that there was not a greater separation in serum bicarbonate levels between the two groups,” CEO Gerrit Klaerner, Ph.D., said in the release. “In light of the disappointing results from the trial, and our cash runway, we are evaluating next steps.”

The San Francisco-based company had $98.7 million in cash and equivalents as of June 30, which it expected at the time to last into the second quarter of 2023.