Less than a month after finally going public, Disc Medicine has come a step closer to getting a third blood disorder candidate into the clinic via a licensing deal with Mabwell worth $10 million upfront.

The deal with Mabwell will give Disc the license outside of China and Southeast Asia to a portfolio of novel monoclonal antibodies to modulate iron homeostasis, including a candidate called MTWX-003 that is set to enter the clinic in the second half of the year. Alongside the upfront payment, La Jolla, California-based Mabwell will be in line for up to $412.5 million in development and commercial milestones as well as royalties.

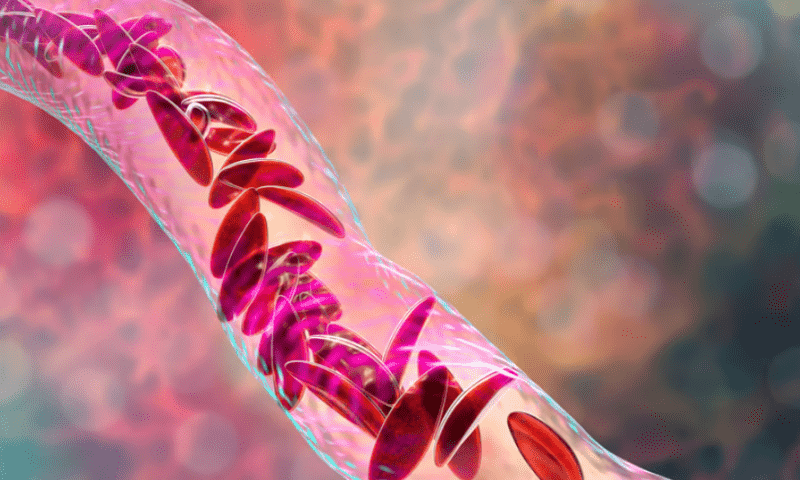

The portfolio is a good fit for Cambridge, Massachusetts-based Disc, which is focused on the hepcidin pathway as a way to develop new therapies against ineffective red blood cell production. The biotech already has two programs in the clinic: a GlyT1 inhibitor licensed from Roche that’s in phase 2 for erythropoietic porphyrias and a monoclonal antibody collaboration with AbbVie in a phase 1/2 trial for anemia caused by myelofibrosis.

The licensing deal is the first move by Disc since it finally joined the Nasdaq at the end of December following a merger with publicly listed Gemini that was first announced back in the summer. The Atlas-seeded startup has some money to burn, with an end-of-year infusion of $53.5 million from a syndicate of health investors contributing to $175 million the company held in cash and equivalents as of the end of 2022. At the time, Disc expected the funds to cover its operating costs into 2025.

Mabwell’s plans for MTWX-003 included testing it in a range of rare diseases, such as blood disorder beta thalassemia and a type of blood cancer called polycythemia vera. There are no “mature and effective macromolecular drugs” for these indications yet, the company pointed out in today’s release. Mabwell’s hope is that MTWX-003 will become a first-in-class macromolecular drug to regulate iron homeostasis in vivo.