Anew Medical has found a way to fund development of its neurodegenerative disease gene therapies. By merging with a blank check company, the biotech plans to land a Nasdaq listing and $54 million in cash, provided investors don’t pull their money before the deal closes.

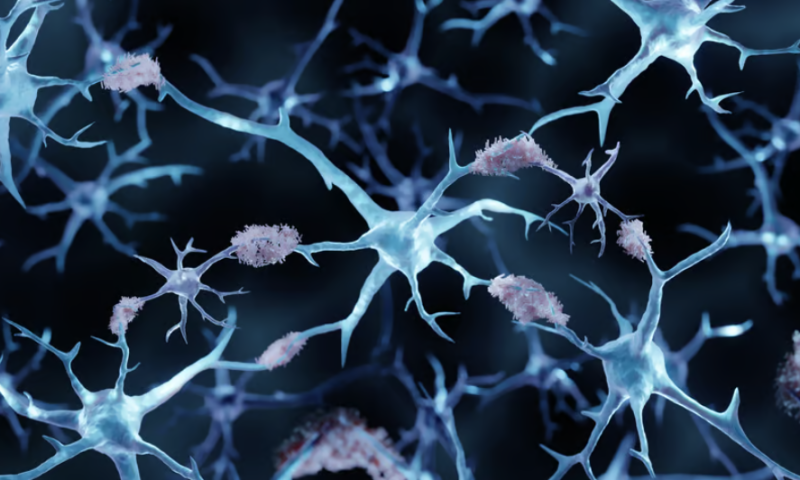

The biotech licensed gene therapy intellectual property from a research institution in Barcelona with a view to creating products that stop the progression of neurodegenerative conditions such as Alzheimer’s disease and amyotrophic lateral sclerosis. Using different adeno-associated virus vectors, Anew aims to increase expression of secreted klotho—an antagonist of the Wnt signaling pathway—in the brain and muscles to treat disease.

Anew’s plans build on work including a 2017 paper by a team at Universitat Autònoma de Barcelona that found a klotho gene therapy improved learning and memory capabilities in mice. The biotech is yet to show the idea holds up in humans, with early-phase clinical trials on the roadmap for 2024 and 2025, and plans to merge with a special purpose acquisition company (SPAC) to fund the next steps.

The merger is the result of a series of earlier deals and pivots. Strategic Asset Leasing merged with Anew Acquisition Corp in 2021, giving it control of a development pipeline split between late-phase biosimilars and early-stage gene therapies. In parallel, the SPAC Redwoods Acquisition Corp. banked $116 million last year and began looking for a merger, focusing on the carbon neutral and energy storage industries.

Redwoods failed to consummate a business combination by its original deadline, leading investors to withdraw $63 million. The remaining investors granted the SPAC an extension, resetting the deadline to July 4 with a month-by-month option to further extend the deadline through to December 4.

From the start, Redwoods told investors its search for an acquisition target wasn’t limited to a particular industry or geographic region. But the fact the company was focused on the carbon neutral and energy storage industries but ultimately struck a deal with a preclinical, high-risk biotech raises questions about how many investors will withdraw their money before the merger closes.

Redemptions, which became a bigger and bigger problem as investor enthusiasm for SPACs waned, will eat away at the money Anew receives through the merger and thereby shorten its cash runway. With the biotech in preclinical and planning to run preliminary human studies in 2024 and 2025, the gene therapy pipeline is still years away from delivering data that could validate its assets and increase its value.

Redwoods expects to close the merger in the fourth quarter.