Stock Markets

After the stock market’s strong run-up over the past weeks when the S&P 500 Index came close to reprising its longest winning streak in nearly two decades, equities lost steam and ended mixed for the week. According to the Wall Street Journal Markets tracker, the Dow Jones Industrial Average (DJIA) eked out a 0.65% gain for the week, and its Total Stock Market Index a 0.91% return as well. The S&P 500 Index ascended by 1.31% while the technology-heavy Nasdaq Stock Market Composite climbed by 2.37%. However, the NYSE Composite declined by 0.56%. The risk perception metric CBOE Volatility Index (Vix) receded by 4.96%.

On Wednesday, the S&P 500 achieved its eighth consecutive gain and the Nasdaq Composite registered its ninth straight gain. The gains were extremely narrow, however. The equally weighted version of the S&P 500 trailed its market-weighted version by 190 basis points, or 1.90%. It was not surprising that the market ran out of momentum as this was one of the final weeks of major third-quarter corporate earnings releases. Some support to the growth counters was provided by upside surprises among some of the technology-oriented firms. Cloud monitoring and security firm Datadog surged 20% on Tuesday after it reported stronger-than-expected earnings and guidance, thus providing a general boost to high-valuation software stocks. However, the initial catalyst that ended the winning streak of major indexes appeared to be the $24 billion auction of 30-year U.S. Treasury bonds last Thursday, which was met with the weakest demand in two years.

U.S. Economy

Investors have been keeping close watch lately as to whether demand will be able to keep up with the government’s elevated borrowing needs, especially after the temporary lifting of the federal debt ceiling. Very few economic data were released this week, most of which were close to expectations. The lone exception was the release on Friday of the University of Michigan’s preliminary measure of consumer sentiment which, contrary to expectations, fell to its lowest level in six months. The survey’s chief researcher attributed this to the wars in Gaza and Ukraine exacerbating worries about the likelihood of higher interest rates. Also reaching higher than previous records was the expectation that long-run inflation rates would4.9 hit 3.2%, the highest level in the survey since 2011.

The economy has remained surprisingly resilient over the first three quarters of this year. The third-quarter GDP annualized growth rate of 4.9% was, in fact, the strongest since 2021 and significantly above what is considered the trend growth in the U.S. of 1.5% to 2.0%. The strong economic growth has so far been driven by personal consumption which so far this year has surprised on the upside. Historically, the U.S. economy has been driven by consumers, as attested to by consumer spending comprising approximately 70% of U.S. GDP. The question remains as to whether this trend may be slowing in the weeks to come. Since the end of the pandemic period when households were flushed with stimulus cash, the household savings rate has declined to near post-pandemic lows as recent spending has eased pent-up demand. Consumers are spending less than usual due to rising costs and stimulus-era savings depletion. Credit card debt has risen fsto more than $1 trillion in the third quarter of 2023, its highest on record. Bank lending standards have remained tight and consumers continue to face higher interest rates. As a result, businesses and consumers will face greater difficulty in securing loans.

Metals and Mining

During Thursday’s meeting conducted by Federal Reserve chair Jerome Powell, he warned markets that while inflation has come down from last y ear’s 40-year highs, the central bank is not confident that it has inflation well under control sufficiently to shift from its present tightening stance. He added that the Federal Reserve would not hesitate to raise interest rates further if inflation pressures continue to intensify. This sent negative signals to investors who hitherto were hoping that the Fed was ready to adopt a more dovish bias enough to reverse interest rates and bring them down. Gold investors did not like the message and dropped gold prices below their $1,950 per ounce support.

Over the past week, the spot prices of precious metals were significantly down. Gold, which held at $1,992.65 last week, well above the $1,950 support, ended this week below it at $1,940.20 per troy ounce for a drop of 2.63%. Silver lost 4.05% of its value, dropping from $23.21 the week before to $22.27 per troy ounce this week. Platinum came from $934.75 on its previous week’s close to $845.83 per troy ounce this week, falling by 9.51%. Palladium took a 14.26% hit as it fell from the previous week’s closing price of $1,121.78 to this week’s closing price of $961.77 per troy ounce. The three-month LME prices of industrial metals ended mixed for the week. Copper ended the week at $8,035.50 per metric ton, lower by 1.32% from its price last week of $8,143.00. Zinc ended higher at $2,562.00 per metric ton, 3.39% up from its ending price the week before of $2,478.00. Aluminum closed this week at $2,215.00 per metric ton, slightly lower by 0.56% from last week’s close at $2,227.50. Tin ended the week at $24,603.00 per metric ton, 2.68% higher than the previous week’s closing price of $23,962.00.

Energy and Oil

Oil prices struggled this week to maintain their levels as they were battered by inventory build-ups, the weaker=than-expected Chinese economic data, and weakening physical demand due to rising freight costs. ICE Brent was headed towards a week-on-week drop of $5 per barrel and is poised to settle at the $80 per barrel mark. Market sentiment is shifting towards a bearish outlook as investors pay close attention to OPEC+ and the actions it will take when it meets again on November 26 in Vienna after a prolonged break. In the meantime, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman blames falling oil prices on speculators. He attributes the decline in oil prices to a “ploy” hiding the true strength of the oil markets. Speculators are allegedly abusing export figures, failing to distinguish them from production numbers.

Natural Gas

For the report week covering Wednesday, November 1, to Wednesday, November 8, 2023, the Henry Hub spot price fell by $0.98 from $3.19 per million British thermal units (MMBtu) to $2.21/MMBtu. In the futures market, the price of the December 2023 NYMEX contract decreased by $0.388, from $3.494/MMBtu at the start of the report week to $3.106 by the week’s end. The price of the 12-month strip averaging December 2023 through November 2024 futures contracts declined by $0.199 to $3.306/MMBtu.

International natural gas futures prices declined over this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.36 to a weekly average of $17.46/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.73 to a weekly average of $14.63/MMBtu. In the week last year corresponding to this report week (the week covering November 2 to November 9, 2022), the prices were $27.91/MMBtu in East Asia and $33.95/MMBtu at the TTF.

World Markets

European stocks ended lower largely on concerns that rising inflation will continue to push interest rates upward. The pan-European STOXX Europe 600 Index sank by 0.21% this week as optimism dimmed that interest rates have peaked. The major stock indexes in the region were mixed. Germany’s DAX added 0.30%, Italy’s FTSE MIB lost 0.59%, and France’s CAC 40 Index was virtually unchanged. The UK’s FTSE 100 Index slid by 0.77%. As markets struggled with concerns that the interest rates will remain “higher for longer” as policymakers hawkishly contended, European government bond yield broadly climbed. Christine Lagarde, the European Central Bank (ECB) president, pronounced that it will take longer than “the next couple of quarters” before the ECB begins to reverse rates downward. The yield on Germany’s 10-year government bond climbed higher than 2.7%. Likewise, Italian bond yields surged higher. After data showed that the UK’s economy stagnated in the third quarter, UK bond yields became volatile. The country’s gross domestic product (GDP) in the third quarter was in line with the BoE’s forecast for zero growth, after expanding by 0.2% in the previous three months. Governor Andrew Bailey of the Bank of England (BoE) affirmed that it was “really too early” to talk about cutting interest rates.

In Japan, stocks climbed over the week. The Nikkei 225 Index ended 1.9% higher than last week, and the broader TOPIX Index gained by 0.6% over the same period. The optimistic performance was buoyed by strong corporate earnings, continued currency tailwinds, and the government’s commitment to additional economic stimulus. The yen softened further past the JPY 151 level to the U.S. dollar from JPY 149 the week before. This is the yen’s lowest level in 33 years. Toward the end of the week, investors’ risk appetite was dampened by the hawkish comments from Federal Reserve Chair Jerome Powell that the Fed will not hesitate to further tighten monetary policy to contain inflation and fueling expectations that interest rates will remain higher for longer. Bank of Japan (BoJ) Governor Kazuo Ueda, on the other hand, warned of possibly serious consequences if the BoJ normalized short-term interest rates. The yield on the 10-year Japanese government bond (JGB) fell to 0.85% from 0,91% at the end of the previous week.

Chinese equities climbed as investors remained generally unaffected by data showing that consumer prices slid back into contraction, thus reviving the prospect of deflation that continues to overshadow the economy. The Shanghai Composite Index rose 0.27%, and the blue-chip CSI 300 gained by 0.07% over the week. The Hong Kong benchmark Hang Seng Index dropped by 2.61%. China’s consumer price index pulled back by 0.2% in October year-on-year after remaining unchanged in September, the result of lower pork prices weighing down food prices. In the meantime, the producer price index descended by 2.6% from a year ago. This marks the 13th consecutive month of decline. A mixed snapshot of China’s economy was shown by the country’s trade data. In October, overseas exports declined by 6.4% year-on-year, surpassing the 6.2% decline in September due to softening global demand. Imports rose by 3%, however, which reversed the 6.2% contraction in September and marked the first year-on-year growth since September 2022. The overall trade surplus declined to $56.5 billion which is below consensus and down from $77.71 billion in September. These developments suggest that China’s economy remains fragile and its growth has not yet bottomed.

The Week Ahead

Among the important economic data due for release in the coming week are the consumer price index (CPI), the producer price index (PPI), and retail sales.

Key Topics to Watch

- Fed Governor Lisa Cook speaks (Mon., Nov. 13)

- Monthly U.S. federal budget

- New York Fed President John Williams speaks (Tues., Nov. 14)

- Fed Vice Chair Philip Jefferson speaks

- NFIB optimism index for October

- Consumer price index for October

- Core CPI for October

- CPI year over year

- Core CPI year over year

- Fed Vice Chair for Supervision Michael Barr testifies to Senate panel

- Chicago Fed President Austan Goolsbee speaks (Tues., Nov. 14)

- Producer price index for October

- Core PPI for October

- PPI year over year

- Core PPI year over year

- U.S. retail sales for October

- Retail sales minus autos for October

- Empire State manufacturing survey for November

- New York Fed President John Williams speaks (Wed., Nov. 15)

- Business inventories for September

- Fed Vice Chair for Supervision Michael Barr testifies to House panel

- Richmond Fed President Tom Barkin speaks

- Fed Vice Chair for Supervision Michael Barr speaks (Thurs., Nov. 16, 7:10 am)

- Initial jobless claims for November 11

- Import price index for October

- Import price index minus fuel for October

- Philadelphia Fed manufacturing survey for November

- Cleveland Fed President Loretta Mester speaks

- Industrial production for October

- Capacity utilization for October

- New York Fed President John Williams speaks (Thurs., Nov. 16)

- Home builder confidence index for November

- Fed Governor Christopher Waller speaks

- Fed Chair for Supervision Michael Barr speaks (Thurs., Nov. 16, 10:35 am)

- Fed Governor Lisa Cook speaks (Thurs., Nov. 16)

- Housing starts for October

- Building permits for October

- Boston Fed President Susan Collins speaks

- Fed Vice Chair for Supervision Michael Barr speaks (Fri., Nov. 17)

- Chicago Fed President Goolsbee speaks (Fri., Nov. 17)

- San Francisco Fed President Daly speaks

- Boston Fed President Susan Collins TV appearance

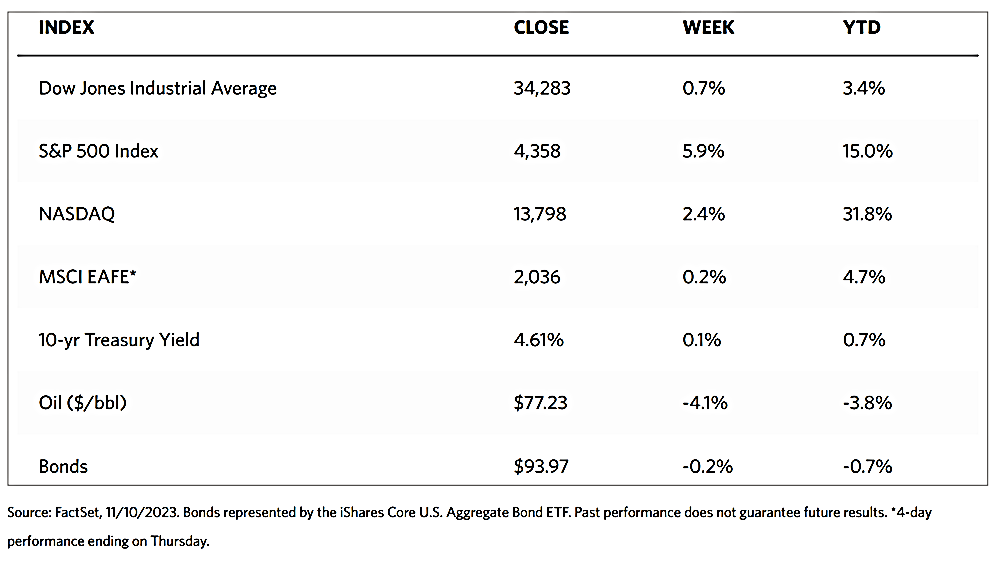

Markets Index Wrap-Up