When it comes to bringing together pharma and financiers, the U.S. leads the way with industrial-scale events like J.P. Morgan in San Francisco and BIO in San Diego. But for the chairman of European life sciences VC firm Sofinnova Partners, the Jefferies London Healthcare Conference this week has offered “the same vibe” at a continental size.

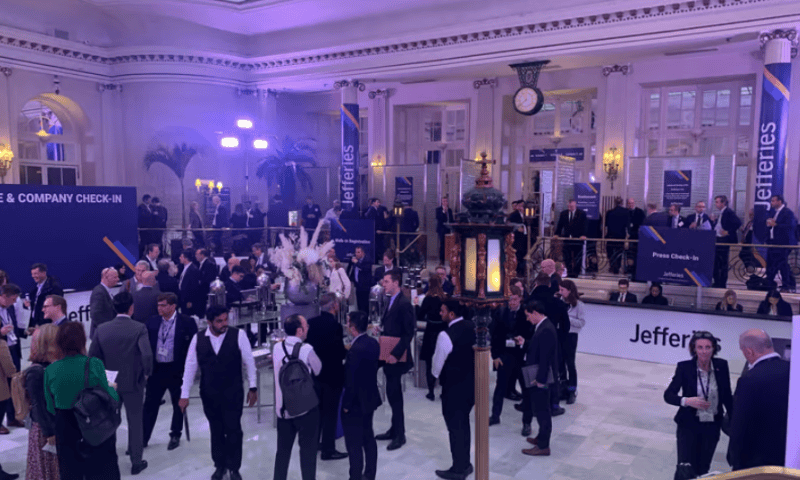

From Nov. 14-16, the elegant reception rooms of the century-old Waldorf Hilton hotel played host to presentations from a who’s who of pharma and biotech. Hosted by investment bank Jefferies, the sessions are less a chance to break news and more of an opportunity for companies to network and offer an overview of their progress under the scrutiny of financial analysts.

While the biggest pharma players tend to send their chief financial officers or other executives to present at Jefferies, there are still plenty of “big name CEOS” in attendance, says Antoine Papiernik, Sofinnova Partners chairman and managing partner.

“It’s great to have this conference in London,” he tells Fierce Biotech on the sidelines of the event. “We Europeans love it, the fact that this is actually becoming an important conference.”

There definitely seems to be more of a buzz around Jefferies this year, with packed rooms for certain speakers—a fact noted by Roche CFO Alan Hippe, Ph.D., in his own presentation. The array of European languages overheard during lunch also testifies to the conference’s standing as an increasingly important fixture in the continent’s pharma calendar.

Catching the money

So after another tough year in biotech, what is the vibe among attendees?

“There’s optimism,” Papiernik says. He points to the 740 million euro fund unveiled by Netherlands-based Gilde Healthcare this week as proof that “there’s money around.”

“It’s very difficult to get it, but if you can catch it, then you’re in business and you can grow,” he adds.

“My take is the sentiment is more positive than the geopolitical macro environment should let us believe it would be,” Papiernik continues. “Look at other fields outside of life sciences—I feel [in] the tech world people are more depressed because they have these massive valuations that are paper money.”

Sofinnova Partners—not to be confused with its U.S.-based “cousin” Sofinnova Investments—employs around 80 people spread across its Paris headquarters as well as offices in London, Milan and Luxembourg. The VC firm oversees $2.5 billion and has a portfolio of 100 companies spread across six segments including biotech, medtech and digital medicine—of which the latter closed its first $200 million fund last month.

The same month, one of Sofinnova’s European biotechs achieved that rarest of feats in 2023—a successful IPO. France’s Abivax raised over $235 million from its Nasdaq listing, which the Paris-based company will partly use to complete the phase 3 development of ulcerative colitis med obefazimod.

As a self-styled “eternal optimist,” does Papiernik see Abivax’s success as a portent that the icy IPO waters are finally thawing?

“I don’t think there’s any signs that this will happen,” he replies. “I’d love to be surprised that I’m completely wrong and this thing just goes back to the good old times, [but] I don’t think so.”

It means that an acquisition remains the most likely exit route for biotechs for the time being. “I think that’s what we need to concentrate on,” he says.

The “silver lining” is that the appetite among Big Pharmas to acquire biotechs remains strong. This was exemplified by comments at Jefferies from Roche’s CFO that there is an “urgency, but not desperation” to the company’s search for new acquisitions.

Sofinnova has seen this pharma hunger for itself in the past few weeks as Eli Lilly acquired one of its portfolio companies, French antibody-drug conjugate developer Mablink Bioscience.

In the tough financial climate, some U.S. investors have narrowed their scope to domestic biotechs, where they feel more familiar, Papiernik says. It means that a U.S. Big Pharma’s decision to go all-in on a European drug developer is always cause to celebrate.

Lilly doesn’t have a problem buying a company in Lyon if the science is good. We should find solace in this.”

— Antoine Papiernik, Sofinnova Partners

“Lilly doesn’t have a problem buying a company in Lyon if the science is good,” he says. “We should find solace in this.”

In the meantime, biotechs need to find any solution to keep the funding flowing in. “Flat is the new up,” says Papiernik, referring to a trend for financing extensions, where a biotech snags some additional cash using the same terms as a previous round.

There’s also “a lot of bridge financing going on,” he adds, as a way for companies to cover short-term costs while suitable longer-term funding is secured.

“In general, investors hate bridges, they hate uncertainty—you want a new route at ‘X’ percent,” Papiernik explains. “In the absence of that … people are doing [bridge rounds] a lot more than they used to.”

So when the sector gathers in London in a year’s time for Jefferies 2024, does Papiernik expect anything to have changed?

“My prediction is I don’t think there’s going to be a massive change on the public markets,” he responds.

“But I do think that, reading the tea leaves on the M&A side, there is going to be more transactions and that those transactions are going to liberate a lot of the pent-up demand.”