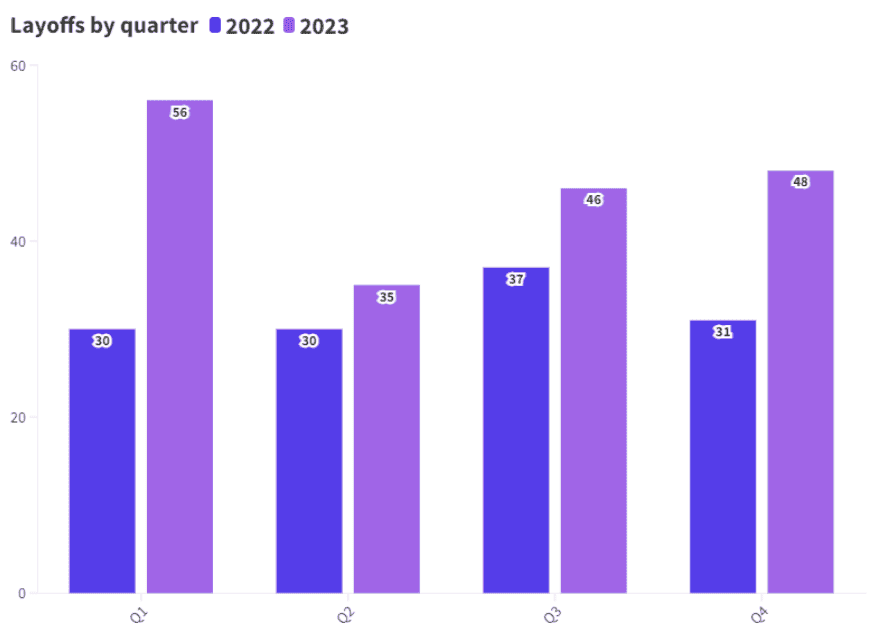

Biopharma layoffs rose 57% last year compared to 2022, with 187 industry workforce reductions in 2023 compared to 119, according to an analysis of Fierce Biotech data.

A similar data crunch in August showed that the number of layoffs had already hit 2022’s grand total of 119, foreshadowing a staggering toll to come by the end of the year.

Those numbers don’t surprise Leslie Loveless, CEO and managing partner of Slone Partners, an executive search firm that mainly serves the life sciences sector, with a focus on early-stage companies. The money-flush pandemic high of 2021, on the other hand, did surprise her.

“There may be a little bit of things reconciling themselves here because 2021 was really off the charts,” Loveless explained. “The industry is cyclical and you’re going to experience these things from time to time. This is not the worst that I have seen in 17 years for sure.”

But it’s pretty bad by all measures. The entire industry struggled, with capital hard to access except for a few standout beats: GLP-1 receptor agonists, radiopharmaceuticals and differentiated autoimmune assets, according to equity research firm William Blair. Few IPOs happened outside of those areas. Many companies were forced to shut down entirely, cut promising assets or find other ways to survive—including, of course, layoffs.

The sector is still in “cash-preservation mode,” meaning companies are resorting to creative financing options such as reverse mergers, licensing, debt financings and royalty deals.

It was, according to Mizuho, “a year of ambiguity and pain in biotech.”

While it’s difficult to truly understand the human impact of the layoffs, we know at least 9,150 employees were laid off from the 60 companies that reported numbers of staffers impacted in 2023. The remaining companies included in the Fierce Biotech Layoff Tracker either reported layoffs as a percentage of total workforce or didn’t share how many staff members would be laid off.

Of the 114 times companies did provide a percentage of staff eliminated, 39% was the mean reduction size. Many companies conducted multiple rounds throughout the year, with some repeat offenders like EQRx ultimately closing up shop entirely.

Big Pharmas also joined the ranks of companies (repeatedly) laying off staff, with names such as Pfizer, Gilead, Novartis, Amgen, Bristol Myers Squibb and Johnson & Johnson all appearing on 2023’s Layoff Tracker.

So, where do the displaced workers go?

“People that are great at what they do are going to land on their feet—just as I feel that the industry will land on its feet,” Loveless said.

Hiring is still happening and Loveless believes biopharma offers many new opportunities for great workers.

“I try to keep everything in perspective, because with every bad signal, there’s a good sign not far behind,” the CEO said.

With that being said, Loveless did say search volume this year was relatively slower compared to other years.

“That’s a factor of more layoffs in the market and also just a slower year in terms of investments compared to the last couple of years,” she explained. “Of course, the IPO market has been way down, which has a trickle-down effect to how investors invest and how people hire.”

Loveless thinks the most hard hit roles in the industry are scientist and commercial sales positions. She said the roles that are being eliminated are mostly at the manager level and below, noting that Slone Partners still had quite a busy year for C-suite and executive searches.

There are a few signs that the situation is improving, with Mizuho and William Blair flagging the Fed’s pullback on interest rate hikes that occurred around November and a flurry of late M&A deals from AbbVie, BMS and others.

Loveless said predictions can be hard to make, especially given geopolitical issues that can impact the entire industry and world.

“I think we’re as resilient as an industry can be,” Loveless said. “Talent acquisition is hard and there are a lot of people this year that have gone through challenging times. That’s sort of part of being in biotech—seeing products succeed and change lives and save lives, and seeing products fail and having to go through almost a grieving process that goes along with being in love with the science of something and then it ultimately not working. We just must not allow ourselves to be consumed by any one particular piece of bad news that happens on any given day—because it’s so much bigger than that.”