Stock Markets

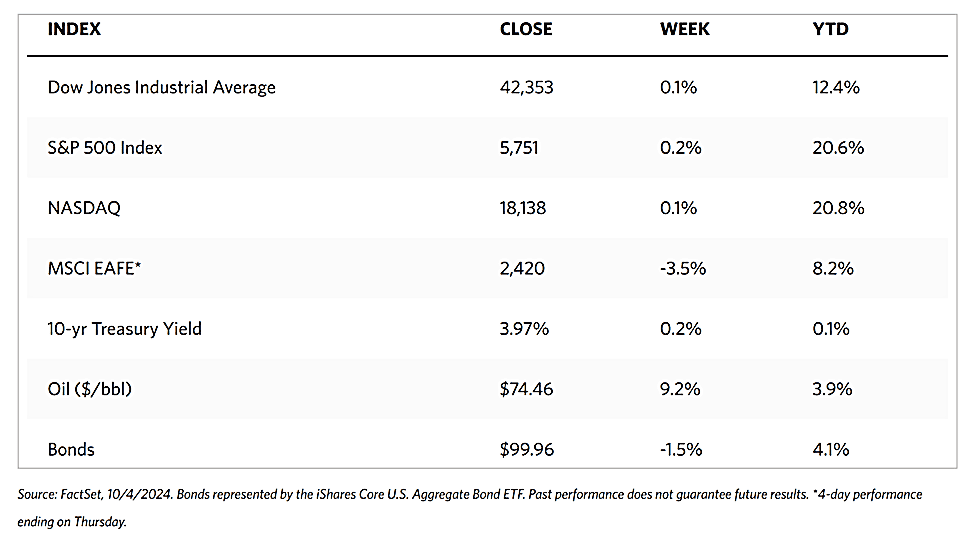

Most major stock indexes managed to rise modestly over the week. The 30-stock Dow Jones Industrial Average is slightly up by 0.09% while the Total Stock Market Index climbed by 0.19%. The broad S&P 500 inched up by 0.22% and the technology-tracking Nasdaq Stock Market composite climbed by 0.10%. The NYSE Composite advanced by 0.19%. The investor risk perception indicator, the CBOE Volatility Index (VIX) rose by 13.27%, suggesting that investors are wary that the market is facing greater volatility risk moving forward.

The stock market begins the fourth quarter on a volatile note after a strong performance during the first three quarters of the year. This is due in large part to elevated uncertainty in four major areas, namely the U.S. labor market, port strikes on the East Coast, tensions in the Middle East, and the approaching presidential elections in the U.S. Over the course of the week, however, the market found some relief in the tentative resolution of the port strike and the U.S. nonfarm jobs report that pleasantly exceeded expectations. The fundamentals of the economy remain solid despite the ongoing geopolitical uncertainties. Through 2025, the Federal Reserve is poised to lower interest rates, inflation continues to slow, and economic growth remains positive.

Moving forward, sources of volatility will continue to persist. The potential walkout by the International Longshoreman’s Association threatens to effectively close operations at every port in the East Gulf States, heightening fears of a new round of broken supply chains should the temporary agreement not be followed by a firmer resolution by mid-January. Furthermore, there are threats of a “more devastating attack” if Israel responds to the 200 missiles Iran fired directly at the central and southern parts of Israel this week, leading to an escalation in the war.

U.S. Economy

In its monthly nonfarm payrolls report, the Labor Department announced that 254,000 new jobs were added by employers in September, which is almost double the consensus estimates. The gains in August were further revised higher. The unemployment rate also inched lower to 4.1%, bringing better-than-expected news in the household survey. Investors appear wary about reacting to the data, however, the payrolls report, while generally upbeat, revealed another monthly decline in manufacturing jobs, the fifth such contraction in 2024. The Institute for Supply Management (ISM) reported on Monday that its gauge of factory activity remained unexpectedly steady at 47.2 in September (below 50 indicates contraction, and above 50 is expansion). On the contrary, it was reported on Wednesday that the ISM’s gauge of services sector activity jumped much higher than expected to 54.9, the highest level it has been in 19 months. On the negative side, the report likewise indicated that price pressures in the sector had increased, to their highest level since the start of 2024.

Metals and Mining

December gold futures ended trading on Friday at $2,665.70 per ounce, down by 0.5% for the day, and prices remained roughly unchanged for the week. According to analysts, despite the headwinds for precious metals, gold is holding up for one reason alone, and that is the risk of a weekend event in the Middle East. Investors do not want to head into the weekend without positioning in some form of insurance. Presently, gold remains the best safe-haven asset to own. A general backdrop of global uncertainty remains a major factor behind the unprecedented rally in precious metals this year, particularly gold, which, some analysts say, may push toward $3,000 per ounce before the year’s end should geopolitical tensions continue to rise.

The spot prices of precious metals ended mixed for the week. Gold closed at $2,653.60 per troy ounce for the week, slightly lower by 0.17% from last week’s close at $2,658.24. Silver ended this week at $32.20 per troy ounce, higher by 2.00% from last week’s price of $31.57. Platinum settled this week at $992.55 per troy ounce, lower by 1.12% than its close last week at $1,003.82. Palladium last traded this week at $1,013.11 per troy ounce, less by 0.30% than its close last week at $1,016.12.

The three-month LME prices of industrial metals were also mixed. Copper dipped by 1.17% from last week’s close at $9,982.50 to close this week at $9,866.00 per metric ton. Aluminum fell 0.66% from its closing price last week of $2,646.50 to close this week at $2,629.00 per metric ton. Zinc rose by 1.12% from last week’s close of $3,089.50 to end this week at $3,124.00 per metric ton. Tin ended higher by 2.42% from its closing price the previous week at $32,913.00 to close this week at $33,709.00 per metric ton.

Energy and Oil

After a protracted dispute over Libya’s Central Bank’s operations and staffing was resolved, the Benghazi government announced that it would reopen all oil fields and export terminals. Furthermore, gas production from Israel’s Leviathan and Tamar fields has restarted after a one-day shutdown caused by Iran’s large-scale missile attack which did not damage important installations. Against this backdrop, oil prices are set to post a $6 per barrel increase week-on-week as ICE Brent futures firmly settled themselves around $78 per barrel. Boosting the geopolitical risk premium are Iran’s missile barrage on Israel and the likelihood of retaliatory action from the Netanyahu government, The focus of the regional tension was such that the oil markets did not notice the lifting of Libya’s oil embargo which returned some 700,000 barrels per day (b/d) of crude oil to the market.

Natural Gas

For the report week covering Wednesday, September 25, to Wednesday, October 2, 2024, the Henry Hub spot price rose by $0.14 from $2.62 per million British thermal units (MMBtu) to $2.76/MMBtu. Concerning Henry Hub futures, the October 2024 NYMEX contract expired last Thursday at $2.585/MMBtu, down by $0.05 from the start of the report week. The November 2024 NYMEX contract price increased to $2.886/MMBtu, up by $0.07 from the start to the end of the report week. The price of the 12-month strip averaging November 2024 through October 2025 futures contracts climbed $0.05 to $3.246/MMBtu.

Regarding regional spot prices, natural gas prices rose at most locations. Price changes ranged from a decrease of $0.35 at the Algonquin Citygate in the Northeast to an increase of $1.44 at the Waha Hub.

International natural gas futures prices increased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.13 to a weekly average of $13.16/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands increased by $1.04/MMBtu to a weekly average of $12.58/MMBtu. In the same week last year corresponding to this report week, (the week from September 27 to October 4, 2023), the prices were $14.44/MMBtu in East Asia and $12.11/MMBtu at the TTF.

World Markets

The escalation of conflicts in the Middle East made European investors cautious, causing the pan-European STOXX Europe 600 Index to fall by 1.80% in local currency terms for the week. Major stock indexes also took a nosedive with Italy’s FTSE MIB plummeting by 3.26%, France’s CAC 40 Index losing by 3.21%, and Germany’s DAX declining by 1.81%. The UK’s FTSE 100 gave up 0.48%. As growth and inflation slow, the ECB’s rate cut is coming into view. The Purchasing Manager’s Indexes (PMIs) indicate a weaker eurozone growth and inflation fell below the 2% target of the European Central Bank (ECB). Both combined strengthened expectations that the central bank will cut interest rates later this month. In the eurozone, annual headline inflation slowed to 1.8% in September, which is the lowest reading since April 2021 and below forecasts for 1.9%. In August, core inflation likewise eased to 2.7% from 2.8%. For September, the eurozone composite PMI reading was revised higher to 49.6 from 48.9, thus moving closer to 50, the borderline when the PMI shifts from contraction to expansion.

Japan’s equities markets underwent a deep and sudden sell-off at the start of the week as investors came to terms with the country’s latest political developments. The Liberal Democratic Party’s (LDP’s) closely contested leadership election was won by Shigeru Ishiba (who was known to adopt a hawkish tone) on Friday, September 27. The surprise win over rival Sanae Takaichi in a runoff vote made Ishiba the new Prime Minister of Japan. The new prime minister’s known hawkish stance initially strengthened the yen and sent stock markets lower. Over the rest of the week, stock markets recovered some of their losses as Ishiba adopted a more dovish position than we have traditionally known to have. The result was a weakening of the yen to around JPY 146 against the USD from about JPY 142 at the end of the previous week. The Nikkei 225 Index and the broader TOPIX Index still registered losses of 3.0% and 1.7% respectively for the week. On the economic policy front, Ishiba committed to continue the path laid out by this predecessor, Fumio Kishida. He called for intensive efforts to overcome deflation without risking a reversal of the virtuous cycle. Ishiba admonished his cabinet to draw up a stimulus package to boost regional economies while simultaneously supporting households struggling with inflation.

In a holiday-shortened week of trading, Chinese stocks surged as optimism about Beijing’s comprehensive support measures offset the lackluster data. The Shanghai Composite Index rose by 8.06% and the blue-chip CSI 300 Index gained 8.48%. The Hong Kong benchmark Hang Seng Index ascended by 10.2%. The markets were closed on Tuesday for the National Day holiday and will reopen on Monday, October 7. Hong Kong markets were closed on Tuesday but reopened on Wednesday. For the fifth consecutive month, Chinese factory activity contracted amid weak demand. According to the country’s statistics office, the official manufacturing PMI climbed to an above-consensus 49.8 in September from 49.1 in August. It was an improvement but it remained below 50 and in contraction territory. For all but three months since April 2023, the manufacturing PMI has been in contraction. The non-manufacturing PMI, the measure of construction and services activity, dipped to a lower-than-expected 50 in September. This is its lowest level in 21 months. According to the China Real Estate Information Corporation, the value of the new home sales by China’s top 100 developers fell by 37.7% in September year-on-year, speeding up from August’s 26.8% drop.

The Week Ahead

The CPI and PPI inflation data and an analysis of consumer sentiment are among the important releases scheduled for the coming week.

Key Topics to Watch

- Fed Governor Michelle Bowman speaks (Oct. 7)

- Consumer credit for Sep.

- St. Louis Fed President Alberto Musalem speaks (Oct. 7)

- Fed Governor Adriana Kugler speaks in Europe (Oct. 8)

- NFIB optimism index for Sept.

- U.S. trade deficit for Aug.

- Atlanta Fed President Raphael Bostic speaks (Oct. 8)

- Federal Reserve Vice Chair Philip Jefferson speaks (Oct. 8)

- Atlanta Fed President Raphael Bostic gives welcoming remarks (Oct. 9)

- Dallas Fed President Lorie Logan speaks (Oct. 9)

- Wholesale inventories for Aug.

- Chicago Fed President Austan Goolsbee gives opening remarks (Oct. 9)

- Federal Reserve Vice Chair Philip Jefferson speaks (Oct. 9)

- Minutes of Fed’s September FOMC meeting (Oct. 9)

- San Francisco Fed President Mary Daly speaks (Oct. 9)

- Initial jobless claims for Oct. 5

- Consumer price index for Sept.

- Core CPI for Sept.

- CPI year over year

- Core CPI year over year

- Federal Reserve Governor Lisa Cook speaks (Oct, 10)

- Richmond Fed President Tom Barkin speaks (Oct. 10)

- New York Fed President John Williams speaks (Oct.10)

- Producer price index for Sept.

- Core PPI for Sept.

- PPI year over year

- Core PPI year over year

- Chicago Fed President Austan Goolsbee gives opening remarks (Oct. 11)

- Consumer sentiment (prelim) for Oct.

- Dallas Fed President Lorie Logan speaks (Oct. 11)

- Federal Reserve Governor Michelle Bowman speaks (Oct. 11)

Markets Index Wrap-Up