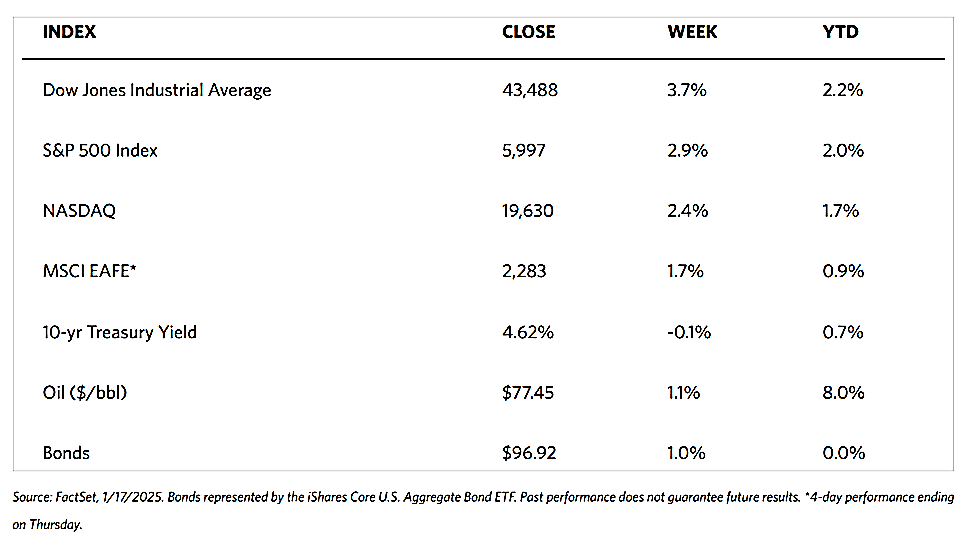

Stock Markets

All major stock indexes ended in positive territory this week, rebounding from the sharp sell-off last week and erasing the losses of the prior week. The 30-stock Dow Jones Industrial Average (DJIA) surged by 3.69%, slightly better than the Total Stock Market weekly gain of 3.12%. The broad S&P 500 climbed by 2.91% while the technology-heavy Nasdaq Stock Market Composite went up by 2.45%. The NYSE Composite gained 3.40%. The investor risk perception indicator, the CBOE Volatility Index (VIX) dropped by 18.27%.

The Russell 1000 shares indicate that value stocks outperformed growth shares by the widest weekly margin since September. This was partly driven by outperformance in the energy sector amid higher oil prices. There was also some profit-taking in large-cap technology stocks. The financial sector also posted strong weekly gains after the banking giants reported strong rises in profits during the fourth quarter.

U.S. Economy

The week’s economic high point came on Wednesday with the release of the Labor Department’s December inflation report. The headline inflation signaled an acceleration from November. However, core inflation – which excludes food and energy – rose by 0.2% in December, a tick lower than the prior month and the smallest increase since July. The year-over-year core inflation figure likewise slowed from 3.3% in November to 3.2% in December.

On Thursday, the jobless claims data for the week ending January 11 was released. New applications for unemployment rose from 203,000 in the prior week to 217,000 during the current week, exceeding consensus estimates. The four-week average of claims, however, dropped modestly. Continuing claims also dropped from 1.88 million in the previous week to 1.86 million in the current week.

Metals and Mining

The spot market for precious metals remains in breakout mode. Gold holds above the former critical resistance, now support, level of $2,700 and ended this week at $2,703.25 per troy ounce, 0.50% above last week’s close at $2,689.76. Silver settled this week at $30.37 per troy ounce, 0.13% lower than last week’s close at $30.41. Platinum corrected to end the week at $944.40 per troy ounce, 2.22% lower than last week’s closing price of $965.80. Palladium ended the week at $951.50 per troy ounce, higher by 0.03% from last week’s close at $951.17. The three-month LME prices of industrial metals were mostly up. Copper came from its previous weekly close at $9,091.50 and ended the week at $9,190.00 per metric ton for a rise of 1.08%. Aluminum, which ended last week at $2,571.50, closed this week at $2,684.50 per metric ton for a 4.39% gain. Zinc ended at $2,942.00 per metric ton this week, 2.58% higher than last week’s close at $2,868.00. Tin closed at $29,775.00 per metric ton, 0.37% lower than last week’s close at $29,886.00.

The gold market previously struggled since the November 5 election under President-elect Donald Trump’s push toward a world trade war. It appears, however, that this conjecture is likely to dissipate as the effects of the America First policies become clearer. Gold has broken out of the $2,700 resistance level and continues to remain above it, despite the solid momentum of the US dollar. The currency is trading at or near its highest level in more than two years. Analysts warned that a global trade war may keep consumer prices high and arrest global growth. Geopolitical worries also were expected to weigh on the economic environment even as the government debt levels weighed on bond markets. The anticipated challenges, however, have failed to hold back investor sentiment. Gold remains the singular global asset that has a low correlation to risk assets, no third-party or geopolitical risks, relatively low volatility, and a deep and liquid market. Gold may continue to test higher critical resistance levels.

Energy and Oil

Backwardation continues to expand in both Brent and Dubai futures despite the relentless oil price rally that pushed Brent to break the $82-per-barrel resistance level. Lower prices from next week onwards could be brought about by a potential de-escalation of hostilities between Israel and Hamas, leading to the Houthis ending their maritime warfare in the Red Sea. This week, however, remains firmly in bullish territory. In other stories, the head of Libya’s National Oil Corporation Farhat Bengdara has resigned his post after three years at the helm of the state oil firm. His stewardship was marred by repeated shutdowns, militia interference, and haggling over revenue allocation.

Natural Gas

For the week beginning Wednesday, January 8, and ending Wednesday, January 15, 2025, the Henry Hub spot price rose by $0.67 from $3.76 per million British thermal units (MMBtu) to $4.083/MMBtu. Regarding the Henry Hub futures, the price of the February 2025 NYMEX contract increased by $0.43, from $3.651/MMBtu to $4.083/MMBtu throughout the report week. The last time the front-month contract settled above $4.00/MMBtu was on January 4, 2023, when it settled at $4.172/MMBtu. The price of the 12-month strip averaging February 2025 through January 2026 futures contracts climbed by $0.29 to $3.967/MMBtu. Natural gas spot prices rose at most locations this report week. Price changes ranged from a decrease of $5.00 at Transco Zone 6 NY to an increase of $1.14 at PG&E Citygate.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.15 to a weekly average of $14.15/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.55 to a weekly average of $14.00/MMBtu. In the week last year corresponding to this report week (the week beginning January 10 and ending January 17, 2024), the prices were $10.51/MMBtu in East Asia and $9.62/MMBtu at the TTF.

World Markets

European equity trended higher this week. The pan-European STOXX Europe 600 Index settled 2.37% higher than last week as investor sentiments rose on slower-than-expected inflation on both sides of the Atlantic. Market participants’ hopes climbed that central banks could continue to cut interest rates this year. Major stock indexes jumped sharply. Italy’s FTSE MIB climbed by 3.36%, Germany’s DAX added 3.41%, and France’s CAC 40 Index gained 3.75%. The UK’s FTSE 100 Index surged by 3.11%. The European Central Bank (ECB) released the minutes of its December meeting. The ECB acknowledged that they need to lower interest rates cautiously and gradually as they reduced interest rates for the third time in a row. By the end of January, the market seems to expect another quarter-point reduction in the deposit rate to 2.75%. Various ECG officials emphasized the outlook’s exceptional uncertainty due to geopolitical tensions, potential global trade frictions, and fiscal policy concerns in the region.

Japan’s stock markets declined during the week. The Nikkei 225 Index fell by 1.9% and the broader TOPIX Index gave up 1.3%. There were heightened expectations that the Bank of Japan (BoJ) could raise interest rates at its January 23-24 monetary policy meeting, based on hawkish comments from the central bank officials. This speculation provided support to the yen, which strengthened to around JPY 155.6 against the U.S. dollar, from around JPY 157.6 at the end of the week before. The profit outlook of Japan’s export-heavy industries was weighed down by the strength of the yen. The yield on the 10-year Japanese government bond climbed near its highest level during the week to as high as 1.25%, although it eventually settled at the 1.20% level. While the BoJ stressed that rates will be raised if economic and price conditions keep improving, recent concerns emerged around U.S. economic policies regarding tariffs and fiscal policy. Some investors believe that an increase in the policy rate will be delayed until March or April.

Despite persistent deflationary pressures, Chinese equities rose as the economy improved. The Shanghai Composite Index added 2.31% while the blue-chip CSI 300 gained by 2.14%. The Hong Kong benchmark Hang Seng Index rose by 2.73%. China’s GDP expanded by a better-than-expected 5.4% year-on-year in the fourth quarter. The economy grew by a quarterly 1.6%, up from a revised 1.3% gain in the preceding quarter. The GDP for the year reached 5%, attaining Beijing’s target for the year. Other data supported China’s recovery. Industrial production rose by 6.2% exceeding forecasts, up from the 5.4% increase in November. This is attributed partly to higher auto, computer, and solar cell sales. In December, retail sales grew by 3.7% from a year earlier, up from November’s 3% increase. In the January to December period, fixed asset investment was 3.2% from a year ago, slightly down from a 3.3% rise in the month preceding. Property investment declines deepened to 10.6% year-on-year. The unemployment rate moved up to 5.1%.

The Week Ahead

The Conference Board’s leading economic index and S&P Global PMI data are among the important economic releases scheduled for the coming week.

Key Topics to Watch

- U.S. leading economic indicators for Dec.

- Initial jobless claims for Jan. 18

- Existing home sales for Dec.

- Consumer sentiment (final) for Jan.

- S&P flash U.S. services PMI for Jan.

- S&P flash U.S. manufacturing PMI for Jan.

Markets Index Wrap-Up