Executive Summary

1. We are bullish on emerging markets, which are looking up.We wrote last week that we saw the stars aligning for 2019 to be the year that emerging markets finally wake up from their slumber. This week, we discuss the signs we see a little further. Foreign investor sentiment on emerging markets is rebounding, with flows into emerging-market ETFs growing year-to-date and in the past 12 months. The Chinese government is continuing to ease, trying to stimulate the Chinese economy in ways that will not worsen the leverage problems in its financial system; those efforts are beginning to bear fruit, both in economic data, and in sentiment among Chinese investors and small business owners. Valuations of emerging-market stocks are not stretched; presently they are just near their long-term average, and have room to expand. Most importantly, perhaps, most central banks around the world, from the U.S. Federal Reserve, the European Central Bank, and the Bank of Japan, to the People’s Bank of China and the Reserve Bank of India, are easing in response to the global growth deceleration that occurred in 2018. If the experience of the whole post-crisis period means anything, this easing will be supportive of economic growth and investor sentiment, and of asset prices generally — especially stocks.

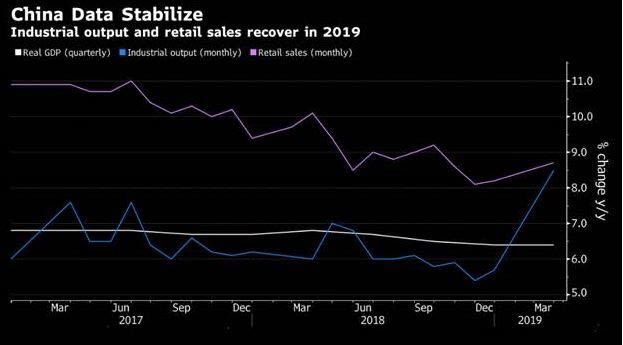

2. Market summary. We recognize that pullbacks can happen at any time, but we remain bullish on the U.S. and believe that despite its advance so far in 2019, the U.S. market can appreciate further — possibly much further. We continue to examine sectors and industries within the U.S., looking for opportunities that are created by the market’s overreaction to news flow, and uncertainty generated by political events and concerns. The economic stimulus being implemented by the Chinese government — though still modest by historical standards — seems to be bearing fruit, both in investor and small business owners sentiment, and in “green shoot” economic data such as retail sales and industrial output. Sentiment on domestic shares is good among Chinese investors, buoyed by government pronouncements talking up the significance of the stock market. Other emerging markets, especially the Asian manufacturing exporters in China’s near neighborhood, are also showing positive trends in economic data. Data are picking up in Europe as well; a Chinese reacceleration will also benefit European exporters, particularly Germany. Europe may present a tactical opportunity as a result, but investors should tread carefully — we are not long-term Europe bulls. A compliant U.S. dollar, sideways to lower, is one of the needed elements for a positive emerging-market thesis to play out. With the U.S. Federal Reserve firmly on hold, and a growing feeling that rates have seen their near-term peak, dollar strength may not be much of a concern. If this pattern plays out, gold could benefit modestly over the course of the year.

What Keeps Us Bullish: Central Banks Are In Easing Mode, Emerging Markets Still Looking Good

Last week, we wrote that we see the possibility that finally, after years of underperformance, the stars might be beginning to align for emerging markets in 2019.

Overarchingly, here’s what emerging markets need to see in order for 2019 to be their year to shine:

• Growth accelerating after the deceleration in global growth that occurred in the latter part of 2018;

• Continued stimulus from the Chinese government that bears fruit in improving Chinese economic data, since Chinese demand is a key driver for many of Asia’s developing economies in particular;

• A majority of central banks worldwide, in both developed and emerging markets, either easing financial conditions in their respective countries, or at least holding steady, and communicating their intention to help their economies and their markets;

• A sideways-to-lower U.S. dollar; and

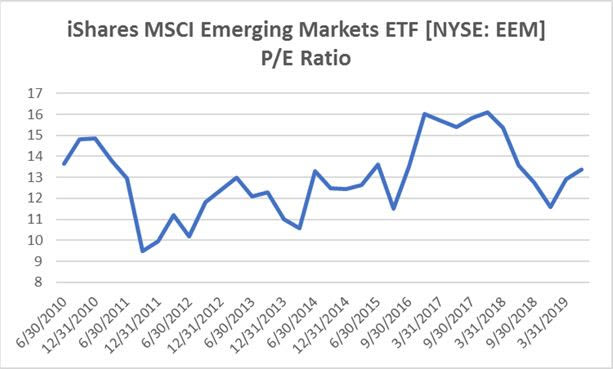

• Reasonable forward valuations in emerging markets.

As we often say, markets are discounting mechanisms. We believe that markets are in the process of pricing in the elements that emerging markets need, and that as the year progresses and the data unfold that confirm these developments, markets can rally further — not just in emerging markets, but in the United States, and to some extent, perhaps even in Europe (although we are not long-term structural bulls on Europe by any means, for reasons we have often explained and will mention again below).

Sentiment on emerging markets is gradually improving, and flows of investor funds into emerging-market equities — as indicated by purchases of ETFs — is picking up (see the chart on the following page). We often track fund flow trends as an indication of shifting investor sentiment and interest.

Year-to-date, as of this writing, total inflows to emerging-market equity ETFs are up 6.2%; in the past 12 months, they are up 8.5% over the preceding 12-month period. Hedge funds are also increasingly long emerging-market currencies, but have not reached “stretched” levels.

Bullish: Central Banks Are In Easing Mode

We’d hoped that 2017 was the year of a coordinated improvement in economic growth across the world’s major developed and developing economies. After both financial tightening and trade conflicts put that growth in question in 2018, 2019 seems to be shaping up as the year of coordinated central bank growth support.

Here’s a rundown of the easing measures being taken by some of the world’s significant central banks:

• The U.S. Federal Reserve, after raising rates consistently from 2015 through the end of 2018, made a U-turn in February of this year, putting further raises on hold; in March, they announced plans to end the drawdown of the Fed’s balance sheet (a process which drains liquidity from the global financial system). Most market participants see either zero or one further rate increase in 2019; many believe the Fed’s next move could in fact be a rate cut.

• The European Central Bank (ECB) announced its intention to maintain its negative rates to combat a slowdown in Europe’s economy, and introduced a new round of cheap loans to banks with incentives for those loans to percolate through to the real economy. (The ECB char, Mario Draghi, who staved off a crisis in 2012 with his promise to do “whatever it takes” to save the European financial system, will leave his position in November. His replacement will be determined by European governments sometime after the European Parliament elections in May.)

• The Bank of Japan (BOJ), the most vigorous of the post-crisis easers, remains in easing mode as the Japanese economy flirts with another deflationary spell and faces the impact of a sales-tax hike later this year. Many analysts believe that the BOJ’s next move will also be further easing.

• The Bank of England (BOE) remains under the cloud of Brexit drama, and is unlikely to take any action to tighten financial conditions until after that drama is resolved.

• The Swiss National Bank (SNB), at –0.75%, has the lowest rate of any major central bank, is very likely to stay put and not raise rates.

• The People’s Bank of China (PBOC) continues to act to stimulate the Chinese economy; it is likely to further reduce banks’ reserve requirements in order to create more liquidity. (This is on top of other stimulus being enacted by the Chinese government, such as tax cuts and increased bond issuance by local governments.)

• The Reserve Bank of India (RBI) is easing aggressively ahead of Indian elections (leading to some criticism that its actions are politically motivated and compromising its independence), reversing the 0.5% rate increase of 2018. Analysts expect further cuts if good monsoons and compliant oil prices help keep inflation under control.

China Data Improve

China’s economic growth is another of the important factors for emerging markets, as we noted above, because Chinese demand is so consequential for Asian emerging-market export economies such as Thailand, Korea, Vietnam, and Malaysia.

On both the sentiment front, and in the actual emerging economic data, China is showing reacceleration after its recent growth dip. This is helping broad EM trade volumes to rebound.

Investor confidence has been buoyed by the improving economic data; so has the sentiment of small business owners and sales managers. (Note that in China, as in the U.S., small business is the real engine of economic growth and vitality.) A recent survey of 500 small- and medium-sized businesses saw sentiment jump to the highest level in almost a year; business owners’ sentiment was boosted by their perception of pickups in domestic and foreign demand, sales, and production.

But more significantly, perhaps, the government has changed its tone of communication about the role that it sees the stock market has to play in the People’s Republic. From questioning and restricting in the aftermath of the popping of a stock bubble in 2015, recent government pronouncements have emphasized the importance of the stock market for China’s standing in the world. There is a pragmatic component here, as China struggles to find a way to expand the availability of capital to small businesses while ratcheting down the shadow banking that has funded small business for decades. (That shadow banking has been a prime contributor to the financial stability risks that China’s leaders are currently trying to rein in.) Such government policy pronouncements are key to the performance of the Chinese domestic stock market, which is heavily driven by local investor sentiment.

And of course, the prospect of an (at least) partial resolution to the trade conflict between the U.S. and China will bolster sentiment still further. We continue to believe that both sides are incentivized to reach a deal — even if that deal does not thoroughly deal with certain issues that will have to be dealt with in the future.

Valuations Are Reasonable

After a long period of relative underperformance, as we noted last week, emerging-market valuations in general are not stretched. The price-to-earnings ratio of the most liquid U.S.-based broad emerging-market ETF is currently sitting on its long-term average of 13.4.

Investment implications: The picture continues to look bright for emerging market stocks, as global central banks ease on concert; Chinese and emerging-market economic data turn up; and valuations look historically moderate and capable of sentiment-driven expansion. We like domestic Chinese shares, especially technology leaders, and we like Asian emerging-market exporters among China’s workshops, such as Vietnam, Thailand, Malaysia, and Korea. U.S.-based investors have many options available among ETFs to gain exposure to emerging markets. In our view, growth and aggressive investors should be over 10% in emerging markets. Even income and conservative investors can, we believe, make substantial money in non-U.S. bonds and income stocks with good yields and currency appreciation potential.

Market Summary

We’re Bullish On the U.S.

We like the U.S. and believe that despite its advance so far in 2019, the U.S. market can appreciate further. We continue to examine sectors and industries within the U.S., looking for opportunities that are created by the market’s overreaction to news flow, and uncertainty generated by political events and concerns. The recent furor over the “inversion of the yield curve” is a case in point, as we discussed last week. Yield-curve inversion is indeed a reliable indicator of a recession — usually many months or several years in advance. This is now well-discussed in mainstream financial media. What is not as well-known or discussed is that the inversion of the yield curve typically occurs well before a market top — and that there are usually significant stock-market gains to be made before that top occurs. Therefore we remain firmly in a “buy the dips” mode regarding U.S. stocks.

We’re Bullish on China and Emerging Markets

As noted above, the economic stimulus being implemented by the Chinese government — though still modest by historical standards — seems to be bearing fruit, both in investor and small business owners sentiment, and in “green shoot” economic data such as retail sales and industrial output. Sentiment on domestic shares is good among Chinese investors, buoyed by government pronouncements talking up the significance of the stock market. Other emerging markets, especially the Asian manufacturing exporters in China’s near neighborhood, are also showing positive trends in economic data. We like Chinese domestic shares and emerging-market shares in the manufacturing economies that will benefit most from a reacceleration of Chinese growth.

Europe and the U.K.

Data are picking up in Europe as well; a Chinese reacceleration will also benefit European exporters, particularly Germany. Europe may present a tactical opportunity as a result. However, besides the long-term clouds over Europe — primarily, an unhealthy banking system hobbled by the structure of a currency union without fiscal integration — there’s the nearer-term cloud of Brexit negotiations and uncertainty. Investors should tread carefully in Europe, even if they seek to take advantage of a near-term opportunity.

Commodities and the Dollar

A compliant U.S. dollar, sideways to lower, is one of the needed elements for a positive emerging-market thesis to play out. With the U.S. Federal Reserve firmly on hold, and a growing feeling that rates have seen their near-term peak, dollar strength may not be much of a concern. If this pattern plays out, gold could benefit modestly over the course of the year.