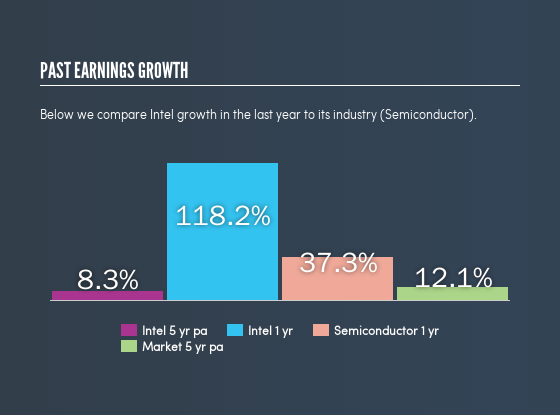

Looking at the company’s fundamental situation, Intel’s (INTC[NGS] – $58.49 0.07 (0.12%) Trade ) return on total capital is 23.43% and its return on invested capital has reached 20.60%. Its return on equity is 29.33%, and its return on assets is 16.76%. Intel’s year-on-year earnings growth rate has been positive over the past 5 years, and its 1-year earnings growth exceeds its 5-year average (118.2% vs 8.3%).

All the above metrics suggest that Intel is adept in using its earned income to generate more returns which is reflected in its stock performance as it remains an investor favorite.

Based on Elliott Wave Theory, INTC has been rallying in an impulsive waves structure since its 2008 low, and the cycle is extending higher within the strongest 3rd wave. As presented on the monthly chart, the stock is looking for the target area at $61.24 – $67.05 to end wave III, followed by a pullback in wave IV, after which the stock is projected to resume the move higher.

INTC Elliott Wave Monthly Chart

Consequently, the mid-term focus will be on the current cycle from the October 2018 and December 2018 lows. INTC is already showing 5 waves up from its $43.35 low, reaching the minimum target area $59 – $63. Short term buyers need to be careful at this stage as a 3 waves pullback can be seen.

A correction in wave (4) is expected to find buyers in 3, 7 or 11 swings as long as the pivot at the December 2018 low remains intact for the stock to continue the rally higher as a 5 waves structure from the October 2018 low.

INTC Elliott Wave 4H Chart

In conclusion, Intel’s technical and fundamental picture is strong on both sides and the stock is aiming for further gains in the future. Therefore Investors are advised to watch INTC closely for a buying opportunity during the next pullback.