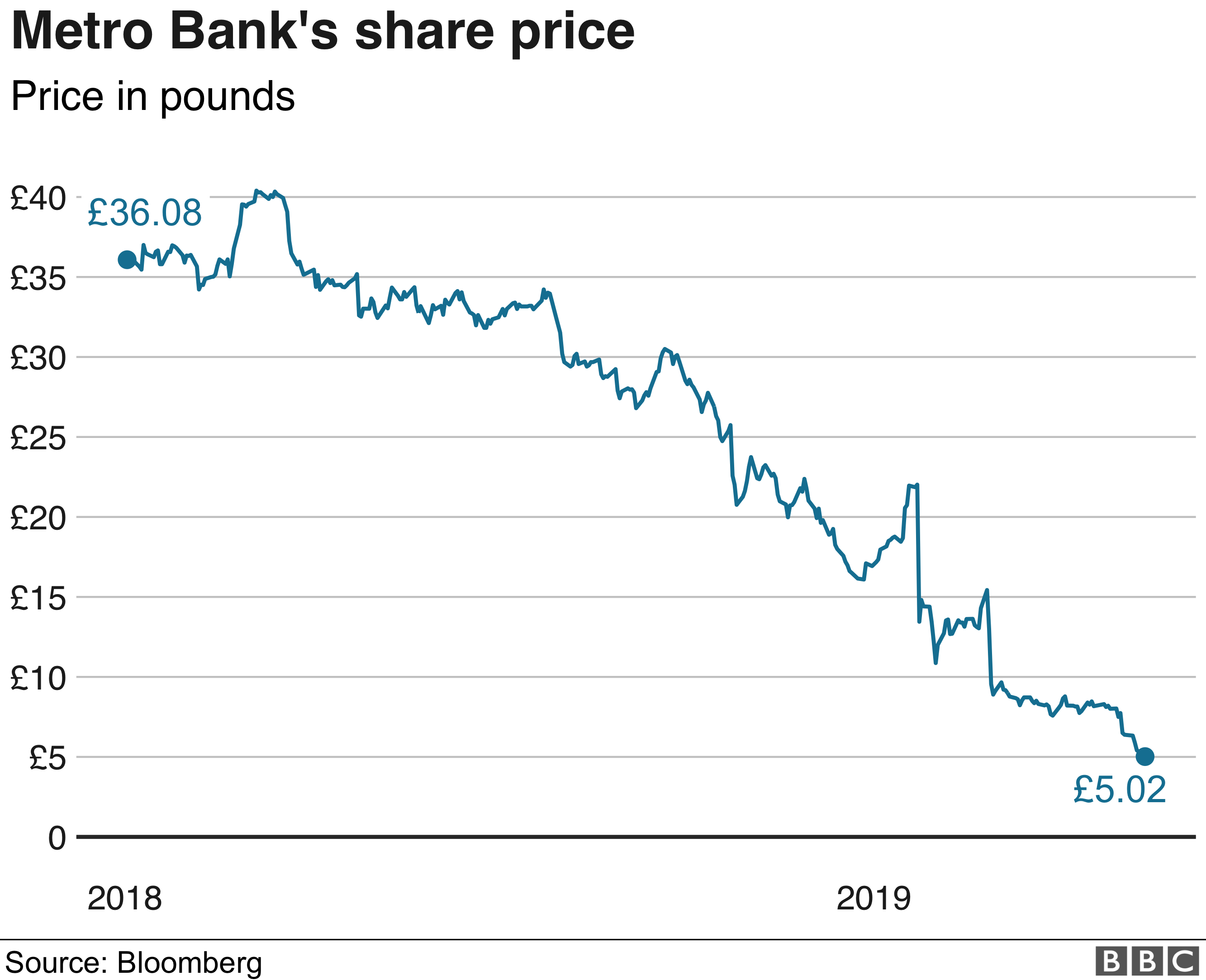

Metro Bank’s share price has fallen another 4% in early trading as concerns persist over its financial health.

The bank’s shares have lost three-quarters of their value since January, when it announced it needed money to boost their capital after an accounting error.

It said it was in “final discussions” with shareholders and new investors over its plans to raise £350m.

“Feedback continues to be positive,” it added.

The bank said it expected to raise the money by the end of June.Metro Bank shares continue to slide

It said it would raise the money via a share placing, with additional shares created and offered to new and existing investors.

How important is Metro Bank?

If you live outside London and the South East of England, it might be entirely unfamiliar to you.

It has no branches north of Peterborough and none west of Bristol and Bath.

However, inside that restricted area, it now has 67 branches and is arguably the best-known of the “challenger” banks that sprang up in the wake of the financial crisis, taking on the established names such as Lloyds, Barclays, HSBC, RBS and Santander.

When it opened its first branch in London’s Holborn in 2010, it was the first High Street Bank to set up in the UK in more than 100 years.

It now has 1.7 million customer accounts.

Its founder and chairman is billionaire American Vernon Hill. Mr Hill shook up the US banking scene in 1973, when at the age of 26 he founded the US chain Commerce Bank with just one branch.

By the time he sold it in 2007 for $8.5bn (£6.5bn), he had built it into a major player across the US with 440 stores.

So what went wrong at Metro Bank?

“They misclassified a whole host of commercial property loans and buy-to-let loans, giving them the incorrect risk rating,” said Michael Hewson, chief market analyst at CMC Markets.

“Commercial property generally is a slightly more risky form of loan than a buy-to-let.”

Mr Hewson told the BBC’s Today programme that incorrectly categorising those commercial property loans as buy-to-let loans meant that “they weren’t holding enough capital on their balance sheet as a result”.

The bank’s new share placing is aimed at making up for the shortfall on its books.

What were the knock-on effects?

Last week, the bank said pre-tax profits in the three months ending 31 March 2019 had halved – from £8.6m to £4.3m – compared with the same time last year.

The bank also said it had lost key clients in the wake of the mistake.

“Adverse sentiment following January’s update impacted deposit growth in the quarter, with a small number of large commercial and partnership customers making withdrawals,” said Metro Bank’s chief executive, Craig Donaldson.

Mr Donaldson has said there are “absolutely no question marks” over the bank’s future.

He said he had offered to resign when the accounting error was first discovered, but he had the confidence of the board to carry on. However, he was foregoing his bonus as a result.

What does this mean for customers?

Over the weekend, queues formed at some bank branches in the west London area, after a WhatsApp message advised customers to check their safety deposit boxes.

“We’re aware there were increased queries in some stores about safe deposit boxes following false rumours about Metro Bank on social media and messaging apps,” a spokesperson said.

“There is no truth to these rumours and we want to reassure our customers that there is no reason to be concerned.”

Customers with up to £85,000 in their account are covered by the Financial Services Compensation Scheme, which guarantees that if a bank runs into trouble, depositors will get their money back up to that level.

What is distinctive about the bank’s branches?

On its website, Metro Bank bills itself as a “different kind of High Street bank”, with branches open seven days a week, from 08:00 to 20:00 on weekdays, where no appointment is necessary and you can open an account and get a debit card straight away.

The branches are open-plan, with no glass barriers between the customers and staff.

There are also giant “Dogs rule” posters featuring Mr Hill’s Yorkshire terrier, Sir Duffield – officially the bank’s chief canine officer – advertising its policy of welcoming dog owners.

Each branch is stocked with bowls of dog biscuits and water and there are even canine-sized, logo-emblazoned neckerchiefs.

The branches are also customer-friendly in other ways, with lollipops for children and free pens prominently displaying the Metro brand.