Microsoft leads Dow components, while Tesla is the worst Nasdaq-100 stock, with a 33% slide

You could call this the year of the mood swing for the U.S. stock market.

Investors went from being “certain” that the Federal Reserve would continue raising interest rates, which helped cause a sharp decline in stock prices in the fourth quarter, to being surprised by a turnaround in Fed policy in March, when the Federal Open Market Committee decided to halt the rate increases and curb the central bank’s balance-sheet runoff. Last week the language of the Fed’s customary policy statement softened further, helping to push the S&P 500 Index SPX, +0.58% to record levels.

The Fed’s about-face helped push the yield on 10-year U.S. Treasury notes TMUBMUSD10Y, -0.36% down to 2.01% on June 27 from 2.69% at the end of 2018.

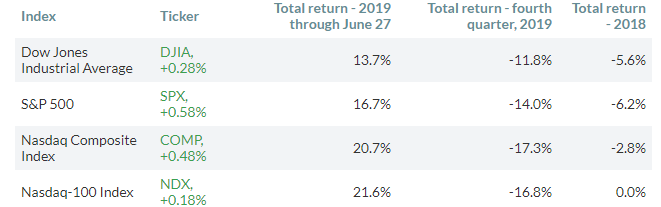

Here’s how four broad stock indexes performed during the first half of 2019 (through June 27), in the fourth quarter and all of last year:

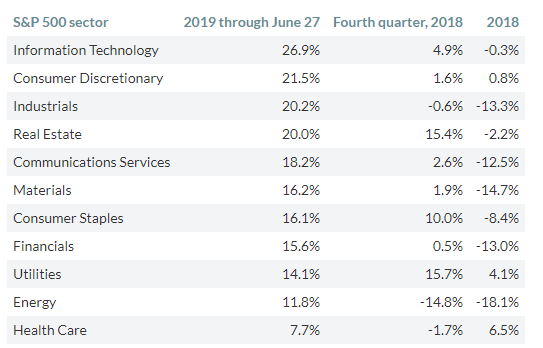

Here are total returns for the 11 sectors of the S&P 500 over the same periods:

Dow Jones Industrial Average

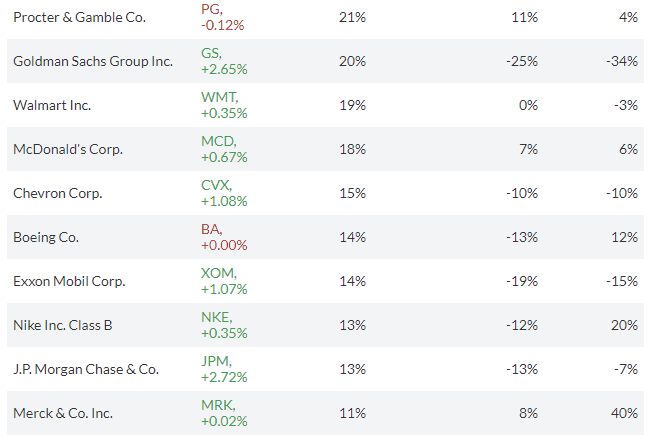

Here’s how 29 of the 30 components of the Dow Jones Industrial Average DJIA, +0.28% performed (with dividends reinvested), leaving out Dow Inc. DOW, -3.14% which began trading separately in April after it was spun-off from DowDuPont:

You can click on the tickers for more about each company, including full news coverage, profiles, charts, estimates, financials and ratings.