Shares of Intersect ENT Inc (NASDAQ:XENT) were down 6.2% during mid-day trading on Friday . The company traded as low as $23.11 and last traded at $23.30, approximately 925,115 shares traded hands during trading. An increase of 28% from the average daily volume of 720,984 shares. The stock had previously closed at $24.85.

A number of equities analysts have recently issued reports on XENT shares. ValuEngine raised shares of Intersect ENT from a “buy” rating to a “strong-buy” rating in a research report on Thursday, October 3rd. Piper Jaffray Companies set a $21.00 price objective on shares of Intersect ENT and gave the stock a “hold” rating in a research report on Friday, November 1st. JPMorgan Chase & Co. increased their price objective on shares of Intersect ENT from $25.00 to $28.00 and gave the stock an “overweight” rating in a research report on Friday, December 20th. Finally, BidaskClub cut shares of Intersect ENT from a “buy” rating to a “hold” rating in a research report on Wednesday. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating, two have given a buy rating and one has assigned a strong buy rating to the company. Intersect ENT currently has an average rating of “Hold” and a consensus target price of $27.25.

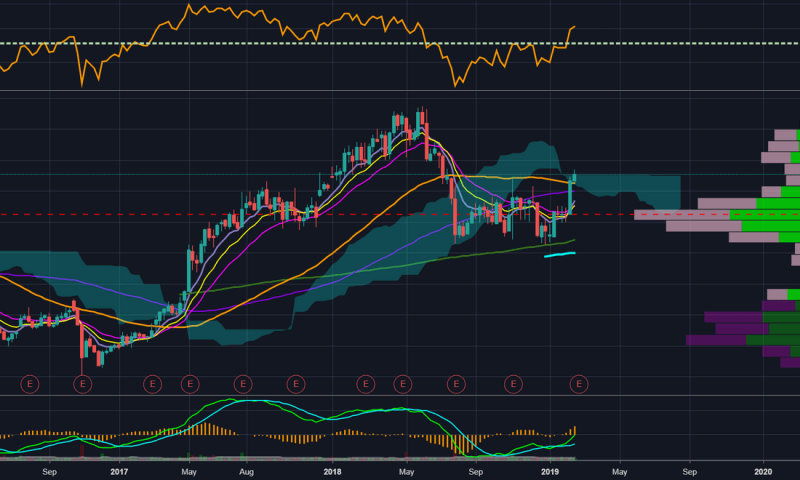

The stock’s 50-day moving average price is $22.74 and its 200-day moving average price is $19.68.

Intersect ENT (NASDAQ:XENT) last released its quarterly earnings data on Friday, November 1st. The medical equipment provider reported ($0.41) earnings per share (EPS) for the quarter, missing the Zacks’ consensus estimate of ($0.40) by ($0.01). The company had revenue of $24.06 million for the quarter, compared to the consensus estimate of $24.08 million. Intersect ENT had a negative return on equity of 34.19% and a negative net margin of 36.37%. Intersect ENT’s revenue for the quarter was down 2.5% compared to the same quarter last year. During the same period last year, the company earned ($0.25) EPS. On average, equities analysts anticipate that Intersect ENT Inc will post -1.45 earnings per share for the current year.

In related news, insider Robert H. Binney, Jr. sold 25,584 shares of the company’s stock in a transaction dated Tuesday, November 5th. The shares were sold at an average price of $21.54, for a total value of $551,079.36. The transaction was disclosed in a document filed with the SEC, which is available at this link. Corporate insiders own 5.90% of the company’s stock.

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Stifel Financial Corp raised its holdings in shares of Intersect ENT by 4.2% in the 3rd quarter. Stifel Financial Corp now owns 11,290 shares of the medical equipment provider’s stock worth $193,000 after acquiring an additional 451 shares during the last quarter. Rhumbline Advisers raised its holdings in shares of Intersect ENT by 1.7% in the 3rd quarter. Rhumbline Advisers now owns 41,192 shares of the medical equipment provider’s stock worth $701,000 after acquiring an additional 697 shares during the last quarter. California State Teachers Retirement System raised its holdings in shares of Intersect ENT by 2.5% in the 3rd quarter. California State Teachers Retirement System now owns 48,481 shares of the medical equipment provider’s stock worth $825,000 after acquiring an additional 1,193 shares during the last quarter. Quadrant Capital Group LLC acquired a new stake in shares of Intersect ENT in the 3rd quarter worth about $36,000. Finally, Bank of New York Mellon Corp raised its holdings in shares of Intersect ENT by 2.9% in the 2nd quarter. Bank of New York Mellon Corp now owns 158,552 shares of the medical equipment provider’s stock worth $3,610,000 after acquiring an additional 4,427 shares during the last quarter. Institutional investors own 97.20% of the company’s stock.

Intersect ENT Company Profile (NASDAQ:XENT)

Intersect ENT, Inc, a drug delivery company, researches and develops products for the treatment of patients with ear, nose, and throat conditions in the United States. The company offers PROPEL and PROPEL mini drug releasing implants for patients undergoing sinus surgery to treat chronic sinusitis; and PROPEL Contour, a steroid releasing implant to frontal and maxillary sinus ostia, or openings, of the dependent sinuses.