In quarterly report, Apple expected to announce investor return plans, and show signs of recovery in China after price cuts

Investors will soon receive an update on Apple Inc.’s plan for its massive pile of cash, but don’t expect anything out of the ordinary — at least, out of Apple’s ordinary.

After Apple AAPL, -0.48% announced last year that it would draw down its massive net cash position, some hoped the company would complete a transformational acquisition with that money. Instead, Apple stuck with its prior strategy of returning record amounts to shareholders.

Investors shouldn’t anticipate a change in mind set from the smartphone giant, even as it contends with slowing iPhone sales and seeks new ways to invigorate its business. But look for an update Tuesday afternoon on just how many billions more shareholders will be receiving in the near future, as Apple delivers its annual look at its capital-return plan. The company had $130 billion in net cash at the end of 2018.

Apple will have trouble matching its announcement of a year ago, when the company received board authorization to boost its share-repurchase program by a record $100 billion. The increase is likely to be more muted this year, according to Wells Fargo’s Aaron Rakers, who predicts the company could add $35 billion to the program, the same move it made in 2016 and 2017.

The company is also expected to boost its dividend in line with historical trends, but the increase may be below last year’s 15.9% bump, wrote Rakers, who rates the stock market perform. He said he expects a hike of about 10% this time around.

Apple is due to report its second-quarter results after Tuesday’s closing bell.

What to expect

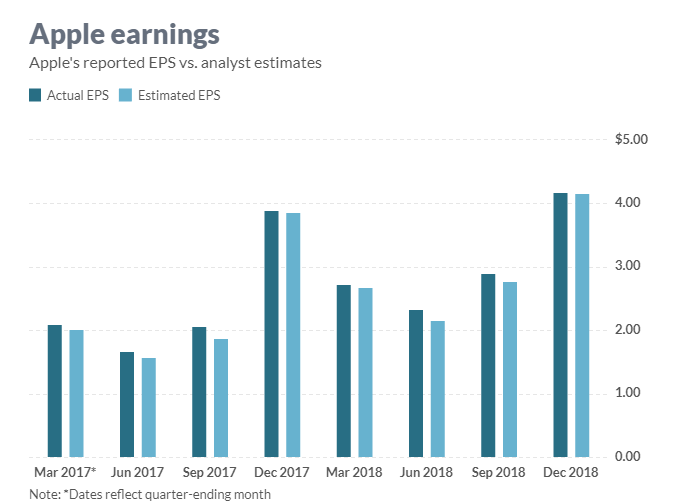

Earnings: Analysts surveyed by FactSet expect Apple to report $2.37 in earnings per share, down from $2.73 a year earlier. According to Estimize, which crowdsources projections from hedge funds, academics, and others, the average estimate calls for $2.47 a share.

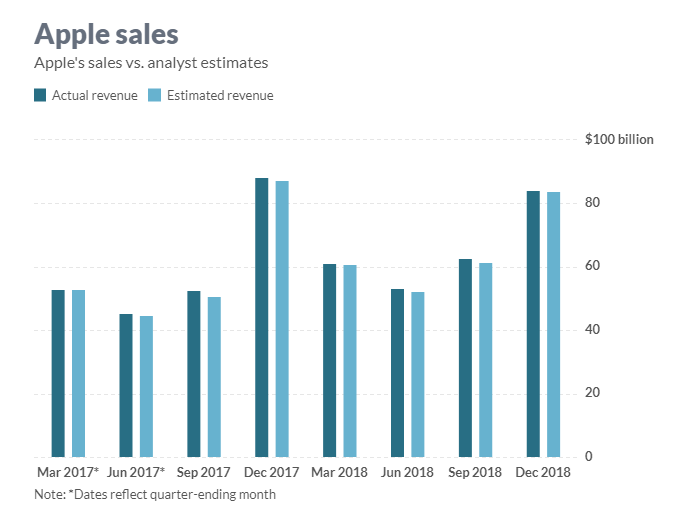

Revenue: The FactSet consensus calls for $57.6 billion in second-quarter revenue, while the Estimize consensus anticipates $58.3 billion. The company’s own forecast was for $55 billion to $59 billion. Apple reported $61.1 billion in sales a year ago.

Morgan Stanley analyst Katy Huberty expects revenue at the “high end” of management’s outlook, given her view that Apple saw improving China demand throughout the quarter.

Apple’s iPhone sales are expected to total $31.1 billion, iPad sales $4.1 billion, Mac sales $5.9 billion, while software and services revenue is projected at $11.3 billion, and “other” revenue — which includes Apple Watch and accessory sales — is expected to total $4.8 billion, according to analyst estimates compiled by FactSet.

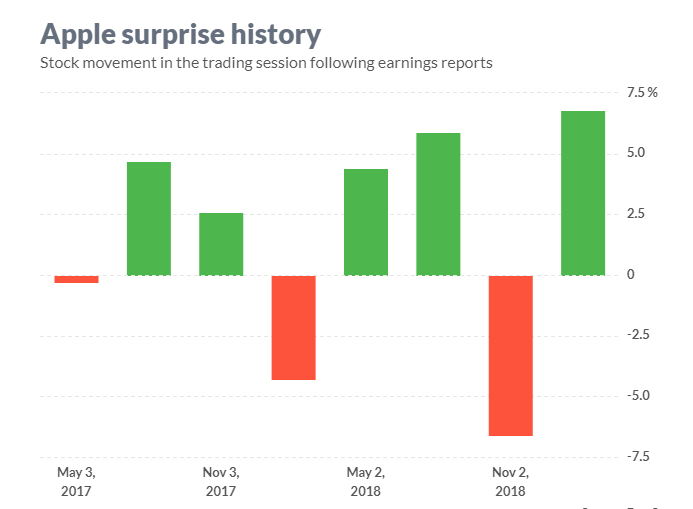

Stock movement: Apple shares have gained following five of the company’s last 10 earnings reports, though that includes the last reported quarter, in which the company faced a low bar after delivering a sizable profit warning a few weeks earlier. The stock has gained 29% so far this year, while the Dow Jones Industrial Average DJIA, +0.31% , of which Apple is a component, has gained 14%.

Of the 39 analysts tracked by FactSet who cover Apple’s stock, 19 have buy ratings, 17 have hold ratings, and three have sell ratings. The average price target on the shares is $198.64, about 3% below the stock’s current levels.Time

What else to watch for

Following Apple’s March announcement of new video, news and gaming subscription services, the company may give information about how these services are expected to affect its financials.

While revenue from those new services could, over time, be sizable, they would need to be to have any noticeable impact, given Apple’s quarter-trillion-dollar revenue base and its increasingly large services business, with its revenue of $46 billion, wrote Bernstein’s Toni Sacconaghi, who rates the stock at market perform and has a $160 share-price target on it. Apple has yet to provide pricing information for its video or gaming offerings, and it likely won’t until the fall.

China was a source of trouble for Apple in the holiday quarter, and investors will be looking for signs of improvement there and in other emerging markets. Analysts seem relatively upbeat.

“It has been Apple’s pricing hubris on iPhone XR that was the major factor in the company’s December earnings debacle in China,” wrote Wedbush’s Daniel Ives, who has an outperform rating and $225 target on Apple’s stock. “However, with some recent price cuts, demand trends are slowly turning around in this all-important region for Cupertino as we expect the Street will see when the company reports.”

Apple has a tendency to give June-quarter revenue outlooks that are below Wall Street estimates, and Huberty said she expects the company to stick to its spring conservatism again this year. That suggests the company may forecast $50 billion to $52 billion in revenue for the current quarter, which tends to be slow, since the latest crop of iPhones have been out for months and the new lineup looms on the horizon.

The FactSet consensus calls for $52.1 billion in revenue for the June period.

Huberty is more upbeat about the potential for Apple to deliver a small positive surprise with its gross-margin outlook, in part due to lower memory prices. She expects that the company will forecast 37.5% to 38.5% in gross margin, she said, while the FactSet consensus calls for 37.9%. Huberty has an overweight rating and $234 target on the shares.

The company might also provide more information on the financial implications of its recent settlement with Qualcomm Inc. QCOM, +1.85% , given that the joint release put out by the two companies contained little information.

“While CEO Cook may be grumpy about this outcome, the Qualcomm cost burden on Apple was never too severe, likely coming in below $25 per device for licensing and chips — on devices that in some cases retail for more than $1,100,” wrote Argus analyst Jim Kelleher, who rates Apple’s stock a buy with a $225 target.