AUD/USD Current price: 0.7306

- Receding upward momentum in equities and lower base metals’ prices led AUD lower.

- Positive US data can revive demand for high-yielding assets.

The AUD/USD pair edged sharply lower, now pressuring the 0.7300 level, as uncertainty regarding US-China trade relationship dents demand for the commodity-linked currency, while the greenback is in recovery mode. The main drag for Aussie, however, were base metals, which seem to poised to resume their bearish trend. Gold prices lost around $15.00 per troy ounce late Tuesday, after a solid US August Consumer Confidence reading, reflecting how fragile demand for the commodity is.

The Asian session had quite a scarce macroeconomic calendar, with nothing relevant in the docket these days, until next week´s RBA monetary policy meeting. As for the US, today it will release the second estimate of Q2 GDP and PCE inflation and July Pending Home Sales. Better-than-expected figures could lift equities and therefore limit USD gains.

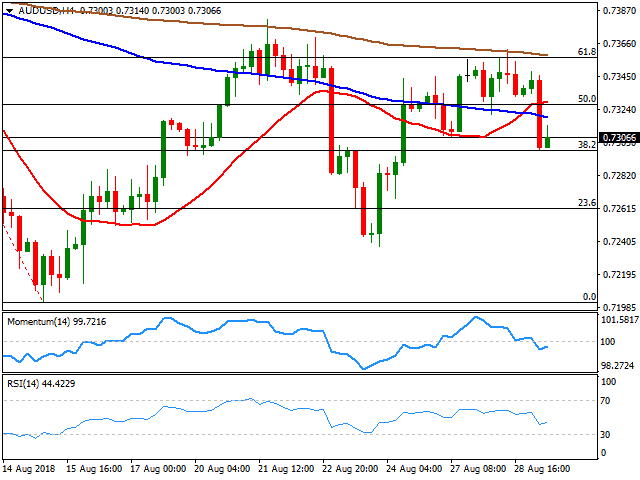

The pair stalled its slide at the 38.2% retracement of its August decline at 0.7300, after two weeks of failing to advance beyond the 61.8%retracement of the same decline at around 0.7355. The positive momentum faded further according to technical readings in the 4 hours chart, as technical indicators entered negative territory, while the price broke below all of its moving averages. The mentioned 0.7300, however, seems quite a strong intraday support and would need to clear it to turn actually bearish, with the downside potential increasing on an extension below 0.7270.

Support levels: 0.7300 0.7270 0.7230

Resistance levels: 0.7325 0.7355 0.7385