NASA signals interest in Venus and volcanoes for next science missions

NASA scientists must not have had an easy decision this winter as they considered more than a dozen intriguing concepts for Discovery-class missions to explore the Solar System.

But decide they did, selecting four missions for additional study and refinement on Thursday. NASA said the proposals were chosen based on their potential science value and feasibility of development plans, through a competitive peer-review process.

Each of the mission teams will now receive $3 million from NASA to finalize its proposals over a nine-month period. After this, NASA will likely select two missions to proceed into development and toward launch later in the 2020s. Discovery missions have a cost cap of $450 million.

The space agency chose the following four mission concepts for further study and provided the following summaries of their capabilities.

DAVINCI+

The mission seeks to analyze Venus’ atmosphere to understand how it formed and evolved before determining whether Venus ever had an ocean. The spacecraft will plunge through Venus’ inhospitable atmosphere to precisely measure its composition down to the surface. The instruments are encapsulated within a purpose-built descent sphere to protect them from the intense environment of Venus. The “+” in DAVINCI+ refers to the imaging component of the mission, which includes cameras on the descent sphere and orbiter designed to map surface rock-type. James Garvin of NASA’s Goddard Space Flight Center in Greenbelt, Maryland, is the principal investigator. Goddard would provide project management.

Io Volcano Observer

This mission would explore Jupiter’s moon Io to learn how tidal forces shape planetary bodies. Io is heated by the constant crush of Jupiter’s gravity and is the most volcanically active body in the solar system. Little is known about Io’s specific characteristics, such as whether a magma ocean exists in its interior. Using close-in flybys, IVO would assess how magma is generated and erupted on Io. The mission’s results could revolutionize our understanding of the formation and evolution of rocky, terrestrial bodies, as well as icy ocean worlds in our solar system and extrasolar planets across the universe.

Alfred McEwen of the University of Arizona in Tucson is the principal investigator. The Johns Hopkins University Applied Physics Laboratory in Laurel, Maryland, would provide project management.

Trident

Trident would explore Triton, a unique and highly active icy moon of Neptune, to understand pathways to habitable worlds at tremendous distances from the Sun. NASA’s Voyager 2 mission showed that Triton has active resurfacing—generating the second-youngest surface in the solar system—with the potential for erupting plumes and an atmosphere. Coupled with an ionosphere that can create organic snow and the potential for an interior ocean, Triton is an exciting exploration target to understand how habitable worlds may develop in our solar system and others. Using a single fly-by, Trident would map Triton, characterize active processes, and determine whether the predicted subsurface ocean exists. Louise Prockter of the Lunar and Planetary Institute/Universities Space Research Association in Houston is the principal investigator. NASA’s Jet Propulsion Laboratory (JPL) in Pasadena, California, would provide project management.

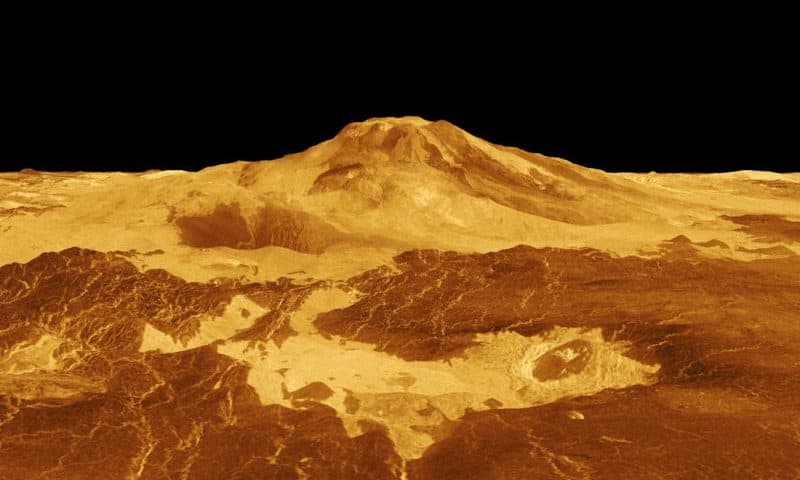

VERITAS

This mission seeks to map Venus’ surface to determine the planet’s geologic history and understand why Venus developed so differently than the Earth. Orbiting Venus with a synthetic aperture radar, VERITAS charts surface elevations over nearly the entire planet to create three-dimensional reconstructions of topography and confirm whether processes, such as plate tectonics and volcanism, are still active on Venus. VERITAS would also map infrared emissions from the surface to map Venus’ geology, which is largely unknown. Suzanne Smrekar of NASA’s Jet Propulsion Laboratory (JPL) in Pasadena, California, is the principal investigator. JPL would provide project management.

Notably, two of the four missions are targeted for Venus. NASA’s last mission to Venus was Messenger, an orbiter launched in 1989. If selected, the DAVINCI+ mission would be the first NASA-led spacecraft to enter the planet’s atmosphere since 1978. Both of these Venus missions were finalists during the last call for Discovery class missions—which were announced in January 2017—missing out in the final cut. Both of the selected missions at that time, Lucy and Psyche, were dedicated to the study of asteroids.

Perhaps Venusian enthusiasts will fare better this time.