Organs-on-Chips Centre opens in UK for advancements in medical research and drug development

A new research centre which aims to revolutionise medical research and drug development using microengineered Organs-on-Chips has opened at Queen Mary University of London.

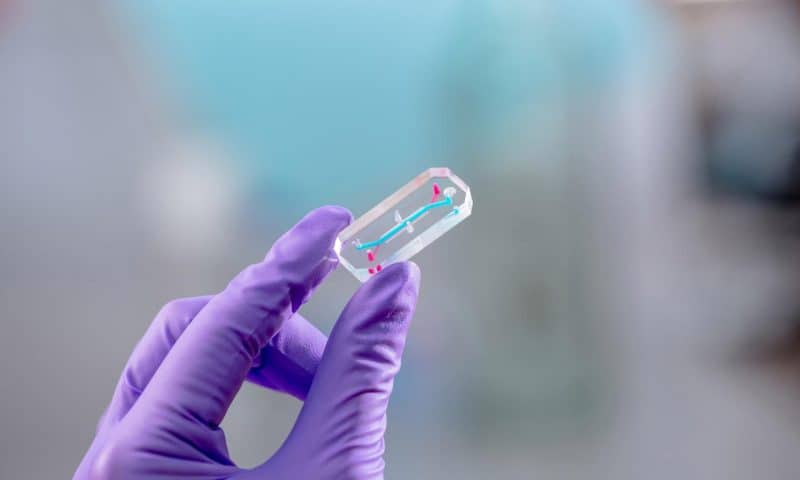

Organs-on-Chips contain tiny hollow channels lined by living human cells that recreate the microenvironment experienced by cells within the human body. As miniaturised living systems with human cells, Organs-on-Chips can predict human response with greater precision and detail than today’s cell culture or animal-based testing, and can be used in a laboratory to test drugs and understand how the body works.

Subscribe to receive our free

Market Review Weekly

The new ‘Queen Mary – Emulate Organs-on-Chips Centre’ will use Organs-on-Chips to recreate the human biology of different organs by incorporating the appropriate types of cells and tissues cultured under continuous fluid flow and mechanical forces, such as cyclic breathing and peristalsis, which create the microenvironment experience by cells in the body.

Organs-on-Chips research offers the potential to improve the testing of new drugs or therapies to predict their safety and efficacy in the human body. These living, microengineered systems also offer the potential to reduce the reliance on animal testing and enhance understanding of disease mechanisms in the development of new medicines.

Queen Mary has established the Centre in partnership with Emulate, Inc., a U.S.-based company that is on the leading-edge with a portfolio of Organs-on-Chips products and lab-ready systems for use by researchers worldwide.

The Centre will provide access to Emulate’s Organs-on-Chips technology to enable researchers to develop organ models of their design for use in a wide variety of experiments and drug development programmes. It will also provide opportunities for collaboration with Emulate and support for commercialisation and translational impact.

Professor Martin Knight, Director of the new Queen Mary – Emulate Organs-on-Chips Centre said: “The potential for this technology is outstanding, letting us recreate the behaviour of cells, tissues and organs as found in the human body in a way that has not been possible before. This will enable researchers to understand more about disease mechanisms and to test new therapies.

“An individual’s cells can also be populated into one of these Organ-Chips, which makes it possible to see how that individual’s body will respond to a certain treatment such as a specific drug combination, paving the way to a future of personalised medicine.”

The Centre is located in newly refurbished bioengineering labs within Queen Mary’s School of Engineering and Materials Science and includes dedicated Centre staff and an extensive suite of Emulate’s Organs-on-Chips testing platforms. The Centre is also part of a new Centre for Predictive in vitro Models at Queen Mary University of London.

Professor Hazel Screen, Co-Director of the Queen Mary – Emulate Organs-on-Chips Centre, added: “These bioengineered systems can also be used to examine how the body responds to other compounds such as food ingredients, pesticides, or pollutants.”

Emulate’s technology can be configured to recreate a wide range of different organ tissues and disease models. They recreate the body’s dynamic cellular microenvironment, including tissue-to-tissue interfaces, blood flow, immune cell interactions, and mechanical forces.

“Emulate is excited to partner with Queen Mary to make this new Organs-on-Chips Centre accessible to the research community in the UK. This will be the first-of-its-kind research center in the UK and we look forward to collaborating with many of the leading researchers involved in advancements in drug development and industries to accelerate new ways to improve human health,” said Geraldine A. Hamilton, PhD, President and Chief Scientific Officer of Emulate, Inc.

Organs-on-Chips technology is a rapidly expanding field with major pharmaceutical companies now investing in using these systems for drug discovery and development.

Professors Screen and Knight also run the UK’s Organ-on-a-chip Technologies Network which was officially launched in 2018. The network brings together the UK research community, industrial partners, and other stake holders to tackle the major technological questions associated with developing and building new Organs-on-Chips.

The new Queen Mary – Emulate Organs-on-Chips Centre will be used by members of the Network to drive forward innovation and rapid adoption of this new technology

Market forecasts predict that the organ-on-a-chip market can expect a compound annual growth rate of 38-57 percent over the next five years, rapidly becoming a multi-billion dollar market. This new Queen Mary – Emulate Organs-on-Chips Centre is at the forefront of this activity in the UK.