QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) is an investment issuer listed on the Canadian Securities Exchange dedicated to acquiring equity, debt, or other securities of publicly traded or private companies. It provides financing in exchange for pre-determined royalties or distributions, or for the acquisition of all or part of one or more businesses, portfolios, or other assets.

QuestCap bills itself as a social impact investment focused company.[1] “Impact investing” is a strategy through which investors aim to make a positive societal impact in addition to financial gains.

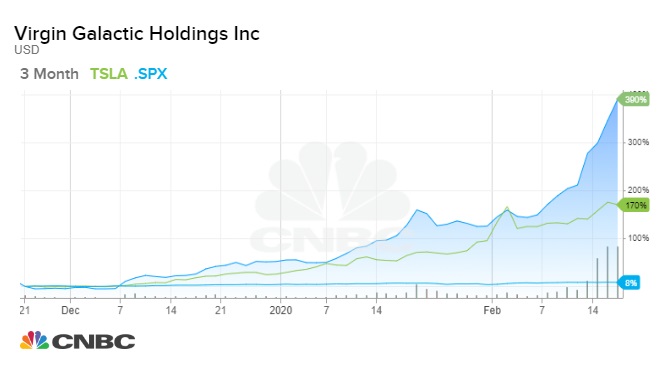

According to a report from the Global Impact Investing Network, published in April 2019, the global size of the impact investing market at that time exceeded half a trillion dollars.[2] More than half (58%) of the funds invested are from the United States and Canada.

Now, here’s where things get really interesting from an investment point of view:

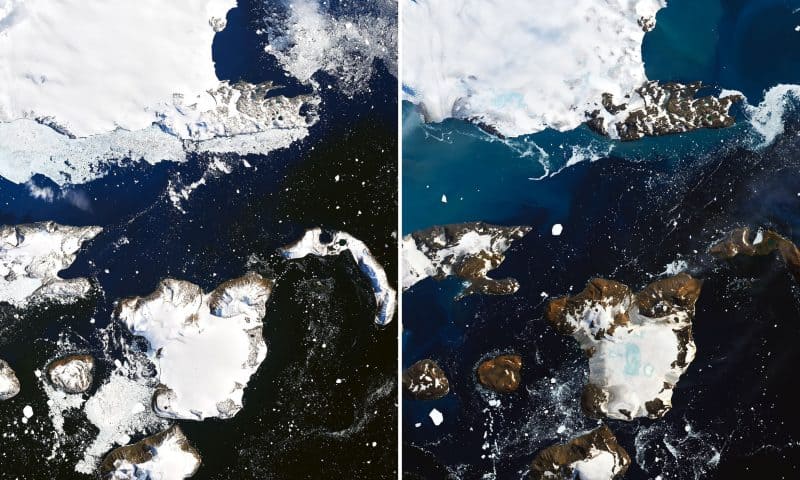

QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) is composed of three divisions: MedQuest, ClimateQuest, and TechQuest.[3] It is currently focused on developing MedQuest, which invests in near-market technology and therapies to combat the current global health crisis. Reports indicate that, as the pandemic stretches on, more funds will flow into the impact investing sector.[4] [5]

Through MedQuest, the company is targeting three aspects of the pandemic response: testing for the virus, assessing the evolution and biology of the pathogen to potentially source effective therapies, and regulating certain social institutions so as to expedite the post-crisis “restoration period.”[6]

Here are some investment highlights for QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1):

- Through a profit sharing agreement with More Than Just Rice Inc (“MTJR”), QuestCap will receive 40% of any profits earned by MTJR from IgG/IgM antibody test kit sales in North and South America.

- By acquiring 49% of Athletics and Health Solutions Inc., QuestCap will help implement the “Standard for Safe Sport” for the Division Mayor del Fútbol Colombiano. As a part of the program, QuestCap will earn profits by providing technical expertise and from the sale of MTJR’s tests.

- QuestCap will also receive royalties generated by any commercial product developed by Sinai Health Foundation related to the research done by the Lunenfeld-Tanenbaum Research Institute towards an alternate diagnostic test for SARS-CoV-2.

- In exchange for a $1 million investment, QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) will receive a 3.5% royalty on any revenues earned from the commercialization of the research done by the Sunnybrook Translational Research Group for Emerging and Respiratory Viruses (SERV).

- QuestCap has also invested $1 million in order to acquire 40% of Amino Therapeutics Inc., which is working on a “novel approach” to developing a drug candidate to address the global pandemic.

- The company’s management team includes Stan Bharti. Bharti’s most successful project was Consolidated Thompson Iron Mines which began as a $1 million dollar exploration iron ore company which later sold to Cliffs Natural Resources for $4.9 billion in cash.[7] QuestCap’s advisory board also includes medical experts and broadcasting legend Larry King.

Rapid, Point-of-Care Serological Tests

On April 7, QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) announced that it entered into a profit sharing agreement with MTJR to exclusively distribute, market, and sell IgG/IgM antibody tests in both North and South America.[8]

Through a small blood sample, these tests provide rapid, point-of-care results to identify individuals who may be infected with SARS-CoV-2, the virus behind the current pandemic. This is done by analyzing the patient’s blood for antibodies to COVID-19. All necessary components come included in the kits and the results are available in 10 to 15 minutes.

“Highly sensitive and specific tests for antibodies … will likely be a component of an essential toolkit for understanding who might have immunity and to help inform health authorities on where we stand on controlling the worldwide outbreak.”

- Dr. Lawrence Steinman, Member of the Board of Advisors for QuestCap

Though they haven’t been approved by the FDA, the regulatory body has permitted the distribution and marketing of the tests in the US based on its public health emergency policy. They are already being sold and distributed in the European Union, certain Asian countries, and South Korea where their clinical effectiveness is being assessed.

QuestCap will help finance MTJR’s purchase of the antibody test for distribution in the Americas, and will receive 40% of any profits earned from the sale of these tests.

Mike McCarthy—former Senior Policy Advisor to the Minister of Health of Ontario and another Member of the Board of Advisors for QuestCap—says that the strategic partnership to distribute these antibody tests will help “our society return to a ‘new normal’.

“Standard for Safe Sport” Protocol

Despite the research being done to address the global crisis, it is far too early to begin reliably forecasting a return to normalcy, especially for large-scale social events like concerts, conventions, and sporting events.

In fact, according to Dean Winslow, an infectious-disease doctor at Stanford, the return of large spectator sports “may even have to be delayed a little bit longer” than most other forms of gathering.[9]

This, however, brings us to another key element of QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) impact investment portfolio.

On April 17, the company executed a share purchase agreement to acquire 49% of Athletics and Health Solutions Inc. Just days earlier, Athletics and Health Solutions itself signed an LOI with DIMAYOR—the organization responsible for operating professional football leagues and tournaments in Colombia—to restart football activities in that nation.[10]

A major part of this plan is the implementation of a “Standard for Safe Sport Medical Screening, Interpretation and Reporting” protocol. Created by Glenco Medical Corp.—whose CEO, Glenn Copeland, is a Special Advisor to QuestCap—the Standard for Safe Sport involves:

- Extensive screening using antibody tests supplied by MTJR;

- Self-assessment, self-reporting, and self-regulation on the part of all those involved in the league, including players, staff, and support personnel;

- Collaboration with governing bodies;

- Enforcement of medical recommendations and measures for recovery.

Through its previously discussed deal with MTJR, QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) will receive 40% of any profits earned from the sale of the tests. The company expects this test will provide the confidence to return the players back to the field in a controlled ecosystem.

Another Potential Diagnostic Test

While QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) works to bring the IgG/IgM antibody tests to the American market, its investment is also enabling a team of researchers in Ontario to develop another potential diagnostic test.

Led by Dr. Anne-Claude Gingras, the team operates out of Lunenfeld-Tanenbaum Research Institute (LTRI), one of the world’s top biomedical research institutes. Their aim is to gain a better understanding of SARS-CoV-2 biology and evolution. This, they believe, could lead to the development of an alternative test to identify the virus.

On April 9, QuestCap—in partnership with Sinai Health Foundation—announced that it will provide $500,000 to advance the LTRI team’s efforts to develop commercial applications related to the team’s research.[11]

“We are committed to putting our capital to use where we can to aid in the fight against this global pandemic, and this investment illustrates how public and private enterprises can work together in this time of crisis.”

- QuestCap Co-Chair, Stan Bharti

In exchange, the company will receive royalties generated by any commercial product developed by Sinai Health Foundation related to their research.

QuestCap Invests $1 Million to Establish Research Group For Emerging And Respiratory Viruses

QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) made one of its biggest moves at the beginning of April when it invested $1 million to establish the Sunnybrook Translational Research Group for Emerging and Respiratory Viruses (SERV).[12]

Led by infectious diseases physician and microbiologist Dr. Samira Mubareka—who, along with clinical microbiologist Dr. Robert Kozak and a team of close collaborators, were the first to isolate SARS-CoV-2,[13] the agent behind the ongoing global outbreak—SERV’s work will focus on three crucial streams of research:

- Virus Biology – this approach provides precision genomic data, which will be essential for outbreak investigation.

- Vaccines and Therapeutics – the SERV team will share its findings within the Canadian research and diagnostic community, thereby driving further innovative solutions to the pandemic.

- Transmission Prevention – SERV will also build a simulation space for live virus experiments to help evaluate the risks posed to healthcare workers

With the $1 million investment, QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) will receive a 3.5% royalty on any revenues earned from the commercialization of the research done by SERV. The company believes that its investment can aid researchers in Canada and across the world in their efforts to develop better diagnostic testing, treatments, and vaccines.

“On behalf of Sunnybrook, I would like to extend my deepest thanks to QuestCap for stepping up with this inspiring investment. Your support will have a direct impact on the lives of countless people in our communities, across Canada and around the world.”

- Dr. Andy Smith, Sunnybrook’s President and CEO.

As Dr. Mubareka herself explains, QuestCap’s investment will help optimize this “extremely time-sensitive research.” While no timeline for commercialization can be provided, the team will no doubt be working quickly as possible.

QuestCap Acquires 40% of Life Science Company Developing Biologic Pharmaceuticals

Just a day after the Sunnybrook deal was announced, QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) announced another major impact investment— a 40% stake in Amino Therapeutics Inc.[14]

Through its parent company, Exponential Genomics Inc., Amino has exclusive rights to leverage the XenoArray platform to engineer a potential treatment for the virus behind the global pandemic.

If successfully developed, the treatment would be a small molecule drug candidate based on peptide protease inhibitors. By selectively bonding with specific proteases, these inhibitors could potentially fight the virus’s ability to reproduce.

Amino’s President and CEO, David Preiner, described this as a “novel approach” to developing a drug candidate, and described his team as being “optimistic” about potentially yielding effective treatments.

“We are working on ways to accelerate the drug development timeline for novel biologics to start regulatory processes, demonstrate patient safety, and bring patients treatments.”

- David Preiner, President and CEO of Amino Therapeutics

As with the Sunnybrook deal, QuestCap Inc. (OTC: COPRF) – (CSE:QSC) – (FRA:34C1) invested $1 million for its 40% acquisition of Amino. The closing of the deal was announced on April 13.[15]

QuestCap’s Management Team and Advisory Board

Neil Said – President and Chief Executive Officer. Said has worked as an officer and legal consultant to numerous Canadian listed companies in the technology, cannabis, mining, oil & gas, and healthcare industries. He began his career as a securities lawyer at Osler, Hoskin & Harcourt LLP, where he worked on a variety of corporate and commercial transactions. Neil is also currently the head of legal for the Forbes & Manhattan group of companies.

Deborah Battiston – Chief Financial Officer. In addition to her work at QuestCap, Battiston serves or has served as CFO at a number of other companies, including Origin Gold Corp., Trigon Metals, Inc., Jourdan Resources, Inc., Q-Gold Resources Ltd., Savanna Capital Corp., Yukoterre Resources, Inc., Sulliden Mining Capital, Inc., QMX Gold Corp., Russo-Forest Corp. and Tangelo Games Corp. She is also on the Board of Directors at Savanna Capital Corp. and Sulliden Mining Capital, Inc.

Stan Bharti – Co-Chairman. Bharti is the founder of Forbes & Manhattan, a merchant bank with a focus on resource-based sectors. In May 2011, Forbes & Manhattan took Consolidated Thompson Iron Mines—then a $1M dollar exploration iron ore company—was later able to develop and sell it to Cliffs Natural Resources Inc. for $4.9 billion in cash. Over the last ten years, Bharti has invested and raised over US$10 billion and has listed over 50 companies on different stock markets including Toronto, London, Australia, South Africa and New York.

G. Scott Moore – Co-Chairman. In addition to his position at QuestCap, Moore is also Chairman at Vilhelmina Mineral AB; President, CEO, and Director at Euro Sun Mining, Inc; and COO and Vice President at Forbes & Manhattan Inc, as well as President and CEO at its subsidiary, Potash Atlantico Corp. Together with his previous positions, Moore has served at the helm of nine companies.

Richard Dolan – Member of the Advisory Board. Dolan began his career in the wealth management industry. Following a ten-year record of raising over $3 billion in assets, he was invited to design and deliver a certificate program at Schulich School of Business’s Executive Development Centre in York University on the subject of marketing and selling wealth management services. Since 2006, he has toured with US Presidents Bill Clinton, George W. Bush, Barack Obama, and Donald J. Trump as well as Secretary of State Hillary Clinton.[16]

Jim Rogers – Member of the Advisory Board. Mr. Rogers co-founded the Quantum Fund, a global-investment partnership. Over the next 10 years, the portfolio gained 4,200%. After retiring at age 37, he continued to manage his own portfolio and serve as a professor of finance at the Columbia University Graduate School of Business.

Dr. Lawrence Steinman – Member of the Advisory Board. Steinman is Professor of Neurology, Neurological Sciences and Pediatrics at Stanford University and Chair of the Stanford Program in Immunology from 2001 to 2011. His research focuses on antigen specific tolerance in autoimmune disease and in gene therapy for degenerative neurologic diseases. He was a postdoctoral fellow in chemical immunology at the Weizmann Institute of Science and has received numerous honors. He also co-founded several biotech companies, including Neurocrine, Atreca, 180 Therapeutics, and Tolerion. He was a Director of Centocor from 1988 until its sale to Johnson and Johnson.[17]

Dr. Glenn Copeland – Member of the Advisory Board. As an expert in the treatment and diagnosis of lower extremity sports medicine injuries, Dr. Copeland has offered invaluable advice and service since 1979 in his significant role as one of the team doctors of the Toronto Blue Jays of Major League Baseball. Furthermore, Dr. Copeland has overseen the lower extremity health and wellbeing as Consultant to Major League Baseball Umpires for over 20 years. He still continues in that capacity. Dr. Copeland was entrenched as Medical Director for Ottawa Sports and Entertainment Group, the Ottawa REDBLACKS of the CFL as well as the Ottawa 67’s of the OHL in 2013. He still continues in this role. Dr. Copeland’s more recent appointment was to the Atlanta Braves of Major League Baseball as a foot and ankle Consultant in 2017, where he currently remains operating in that position.

About Mike McCarthy – Member of the Advisory Board. As a volunteer Vice-President of the Canadian Hemophilia Society, McCarthy was the national spokesperson for Canadians infected by blood tainted with Hepatitis C. Presently, Mike is a Principal at Grosso McCarthy and provides counsel to clients in both the not-for-profit and for-profit sectors. In 2003, he provided strategic support and counsel to the government of Ontario during the SARS outbreak. McCarthy has more than 14 years of experience with the Ontario Ministry of Health and Long-Term Care and 24 years in health policy and delivery. He previously spent 18 years as a psychiatric nurse.

Larry King – Member of the Advisory Board. King has conducted more than 40,000 interviews over his 60-year career and can still be seen hosting “Larry King Now” on Ora TV, Hulu and RT. Celebrities, politicians, athletes and newsmakers from around the planet have experienced Larry King’s unique disarming interview style and come to trust him as a friend and talented professional. From JFK and Vladimir Putin, to the Dalai Lama and Lady Gaga, anyone having an impact on the world has sat across the desk from Larry King.

Editorial Team

USA News Group

Sources:

[1] http://questcapinc.com/

[2] https://thegiin.org/research/publication/impinv-market-size

[3] https://www.globenewswire.com/news-release/2020/03/30/2008778/0/en/QUESTCAP-APPOINTS-NEW-CEO-OUTLINES-NEW-INVESTMENT-STRATEGY-AND-PROVIDES-CORPORATE-UPDATE.html

[4] https://www.barrons.com/articles/impact-investments-rise-amid-covid-19-pandemic-01586086243

[5] https://www.fnlondon.com/articles/covid-19-shows-the-case-for-impact-investing-20200420

[6] http://questcapinc.com/medquest/

[7] https://en.wikipedia.org/wiki/Stan_Bharti

[8] http://questcapinc.com/questcap-announces-profit-sharing-on-exclusive-distribution-contract/

[9] https://www.boston.com/sports/sports-news/2020/04/05/how-long-sports-return

[10] https://www.globenewswire.com/news-release/2020/04/17/2017801/0/en/REPEAT-QuestCap-to-Acquire-49-Percent-of-Athletics-and-Health-Solutions-Inc-With-Intent-to-Deploy-COVID-19-Standard-for-Safe-Sport-With-Colombian-Professional-Soccer-League.html

[11] https://streetsignals.com/questcap-made-investment-in-sinai-health-foundation

[12] https://www.globenewswire.com/news-release/2020/04/02/2010455/0/en/QUESTCAP-TO-INVEST-1-MILLION-WITH-SUNNYBROOK-RESEARCH-INSTITUTE-TO-ESTABLISH-THE-SUNNYBROOK-TRANSLATIONAL-RESEARCH-GROUP-FOR-EMERGING-AND-RESPIRATORY-VIRUSES.html

[13] https://sunnybrook.ca/research/media/item.asp?f=covid-19-isolated-2020&i=2069

[14] https://www.globenewswire.com/news-release/2020/04/03/2011571/0/en/QUESTCAP-SIGNS-BINDING-LOI-TO-ACQUIRE-INTEREST-IN-AMINO-THERAPEUTICS.html

[15] https://www.globenewswire.com/news-release/2020/04/13/2015184/0/en/QuestCap-Completes-Acquisition-of-Amino-Therapeutics.html

[16] https://www.globenewswire.com/news-release/2020/04/08/2013289/0/en/QuestCap-Appoints-Richard-Dolan-and-Jim-Rogers-to-Advisory-Board.html

[17] https://www.globenewswire.com/news-release/2020/04/02/2010668/0/en/REPEAT-QUESTCAP-TO-INVEST-1-MILLION-WITH-SUNNYBROOK-RESEARCH-INSTITUTE-TO-ESTABLISH-THE-SUNNYBROOK-TRANSLATIONAL-RESEARCH-GROUP-FOR-EMERGING-AND-RESPIRATORY-VIRUSES.html

Disclaimer:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for QuestCap Inc. advertising and digital media in Canada and Europe from the company directly. Please note, as we are shareholders of the company MIQ reserve the right to advertise this company Worldwide, and will advertise the company Worldwide. There may be other 3rd parties who may have shares of QuestCap Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of QuestCap Inc. which were purchased as a part of a financing offered by the QuestCap Inc. We also reserve the right to buy and sell, and will buy and sell shares of QuestCap Inc. in the open market at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of QuestCap Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.