Bristol Myers Squibb and Merck KGaA are diving deeper into the protein degradation pool, with both inking partnerships with Amphista Therapeutics that together could bring in $2.3 billion for the British biotech.

It’s a validating haul for Amphista, which announced both agreements more than a year after the company raised over $50 million in a series B from the likes of Novartis Venture Fund and Eli Lilly.

The partnership with Merck includes $44 million in upfront cash in exchange for three targets in oncology and immunology, with the potential for $1 billion in milestone payments. It follows the German pharma’s research collaboration in February with CelerisTx to use the company’s AI-enabled degrader discovery technology.

While the deal with BMS was shorter on details, it was higher in potential payoff, with a $30 million upfront payment and up to $1.25 billion in biobucks for an undisclosed number of targets. The big pharma has an existing clinical-stage pipeline of degraders that leverage two different methods: molecular glues and heterobifunctional agents.

With a combined $74 million in upfront cash, the decisions of both BMS and Merck to team up with Amphista are evidence of the considerable interest the biotech has generated since the series B closed in March 2021, CEO Nicola Thompson told Fierce Biotech.

“The majority of the interactions that we’ve had were actually incoming,” said Thompson. “We’ve had a lot of interest from a lot of groups.”

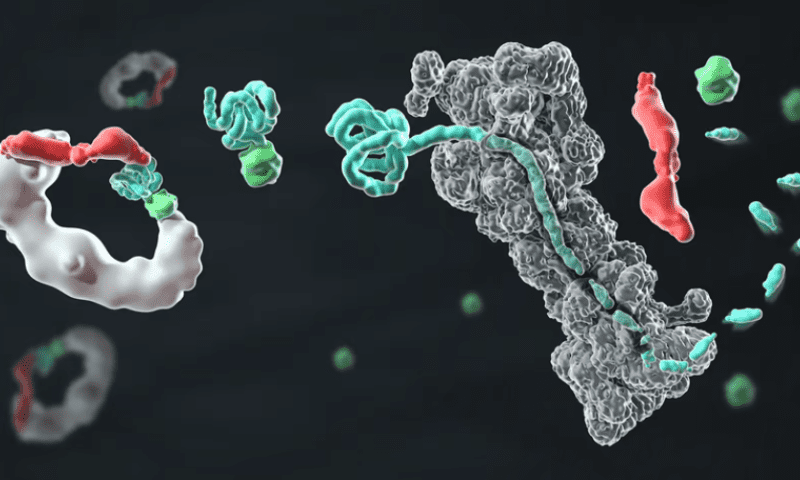

Since spinning out of the University of Dundee in Scotland and nabbing more than $7 million in a series A round in 2020, the company has focused on building its targeted protein degradation (TPD) platform called Eclipsys. At its most basic, TPD is a mechanism that targets and removes toxic and troublesome proteins instead of just inhibiting their potentially harmful functions. To do that, proteins are targeted through the ubiquitin-proteasome system, which essentially marks proteins for degradation by the proteasome.

Where Amphista hopes to make an impact is in how these proteins are marked for destruction. Much of targeted protein degradation now focuses on finding a particular ligase that can attach to proteins and bring them within proximity of the proteasome.

“We took more of a chemistry-led approach to identify molecules that could interact with what we like to think of as druggable nodes of the machinery,” Thompson said.

The CEO believes taking a broader approach will not only maximize the number of indications but improve efficacy. Amphista’s platform also has potential to target the central nervous system, Thompson added.

The company’s efforts come as the protein degradation race heats up. One of the early leaders has been Amgen, whose senior vice president of global research, Ray Deshaies, helped discover the targeted degradation field at the turn of the century. The big pharma has since tied up partnerships with companies like Arrakis and Plexium to help develop new degraders.

Amphista has yet to disclose its pipeline, with Thompson only confirming that the biotech’s first programs are in the oncology space. The focus now is on prosecuting the deals just inked, but the CEO said “nothing is off the table” when it comes to future partnerships and investors.