“This is the most transformational product that I’ve seen in my career with the company.”

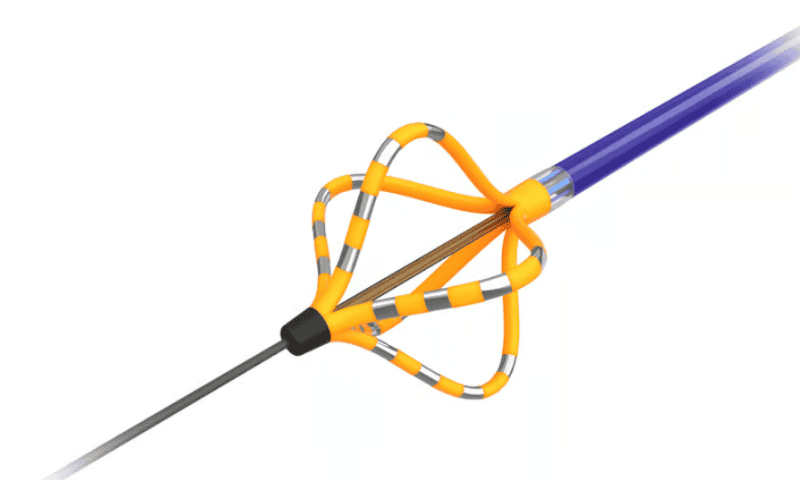

CEO Mike Mahoney didn’t waste words when describing the debut of Boston Scientific’s Farapulse pulsed-field ablation system on the company’s first-quarter earnings call this week.

The medtech company posted about 70% global sales growth in its electrophysiology division, for $300 million—including 85% gains in the U.S. alone—following the mid-quarter launch of the emerging technology that aims to help correct an irregular heartbeat while minimizing the damage to nearby healthy tissues.

Though Mahoney and the company refused to confirm exact sales numbers, following Farapulse’s approval by the FDA in January, investment analysts on the call pitched early estimates of potentially $300 million to $400 million in revenue by the end of the year—a range that would cover the $295 million Boston Scientific paid to acquire the system and its eponymous developer back in 2021.

“Early feedback on Farapulse has been extremely positive, with rapid adoption from both RF and cryo users,” Mahoney said on the call. “Electrophysiologists appreciate Farapulse’s unique safety profile, ease of use, effectiveness and efficiency of the procedure. We expect our broad EP portfolio, coupled with our other [atrial fibrillation] solutions, to drive significant global growth in 2024 and beyond.”

“We’re also seeing multiple hospitals buying their second console, which also is a great sign because it shows the adoption and how they’re using it routinely every day,” he added, while saying the company’s investments in its supply chain during recent years has helped prepare it to meet today’s demand in the U.S. and Europe and further as it continues to expand in Asia.

As a whole, Boston Scientific reported a 13.8% increase in quarterly revenue, for $3.86 billion in net sales. That outpaced the company’s previous financial guidance that forecast 7% to 9% growth—and, for the remainder of 2024, Boston Scientific bumped up those predictions to 11% to 13%.

The company’s cardiovascular division—which also spans implantable defibrillators, coronary interventions and structural heart valves—grew 15.9% total, for $2.45 billion. That includes 18.5% gains and $344 million in sales of its Watchman heart plug implant, designed to lower lifetime stroke risks in patients with afib, with the latest FLX Pro model beginning to roll out in the U.S., Canada and Japan.

Meanwhile, in medical-surgical, $1.41 billion in sales amounted to a 10.3% increase over the same three months last year, encompassing the company’s endoscopy, urology and neuromodulation offerings.

Boston Scientific is still working to finalize its $3.7 billion acquisition of Axonics, the maker of sacral neurostimulation implants for urinary and fecal incontinence, after the Federal Trade Commission earlier this month asked the pair for additional information during its antitrust review process.

While the closing of the transaction had initially been expected by the end of June, Boston Scientific and Axonics said they now believe it will be made official in the latter half of this year.