Stock price target implies a decline of more than 8%, with backlog growth on track to turn negative

Caterpillar’s stock was downgraded by Deutsche Bank analyst Chad Dillard, who also slashed his price target below current levels, citing increasing concerns that earnings will peak this year.

Dillard said the biggest risk to the bullish case for Caterpillar is if backlog growth turns negative, as that has historically preceded a downward earnings revision cycle by three months. And it was becoming “increasingly clear” that Caterpillar’s order backlog will decline within the next quarter.

Caterpillar CAT, -0.66% reported in late January that the order backlog at the end of the fourth quarter was $16.5 billion, down 4.6% from the end of the sequential third quarter. On an annual basis, order backlog growth decelerated to 4.4% in 2018 from 31% in 2017.

“Synchronized global growth has collapsed, the China land cycle is rolling over (and will continue to weaken (and will continue to weaken despite the single positive data point this week), Europe is slowing more than expected and the U.S. is oversaturated with construction equipment,” Dillard wrote in a note to clients. “Each of these factors alone are powerful drivers of [Caterpillar’s] earnings, but together this synchronized slowdown will not only usher in a negative earnings revision cycle, but also make 2019 the cyclical peak.”

It doesn’t help that more than half of Caterpillar’s revenue in 2018 was from outside the U.S. For China, Caterpillar said in January it expects demand to be “about flat” in 2019 after two years of significant growth. Read more in Caterpillar’s 10-K filing with the Securities and Exchange Commission.

Dillard downgraded Caterpillar to hold, after being at buy the past seven months, and lowered his stock price target to $128, which is 7.7% below current levels, from $152.

“While we acknowledge that management has done a tremendous job improving cross-cycle earnings power and the balance sheet optionality is impressive, we fear this positives are already priced in and the oncoming down-cycle is too powerful to overcome,” Dillard wrote.

He said during negative growth cycles, consensus analyst earnings estimates typically get cut by 45% and shares fall by 40% from the peak.

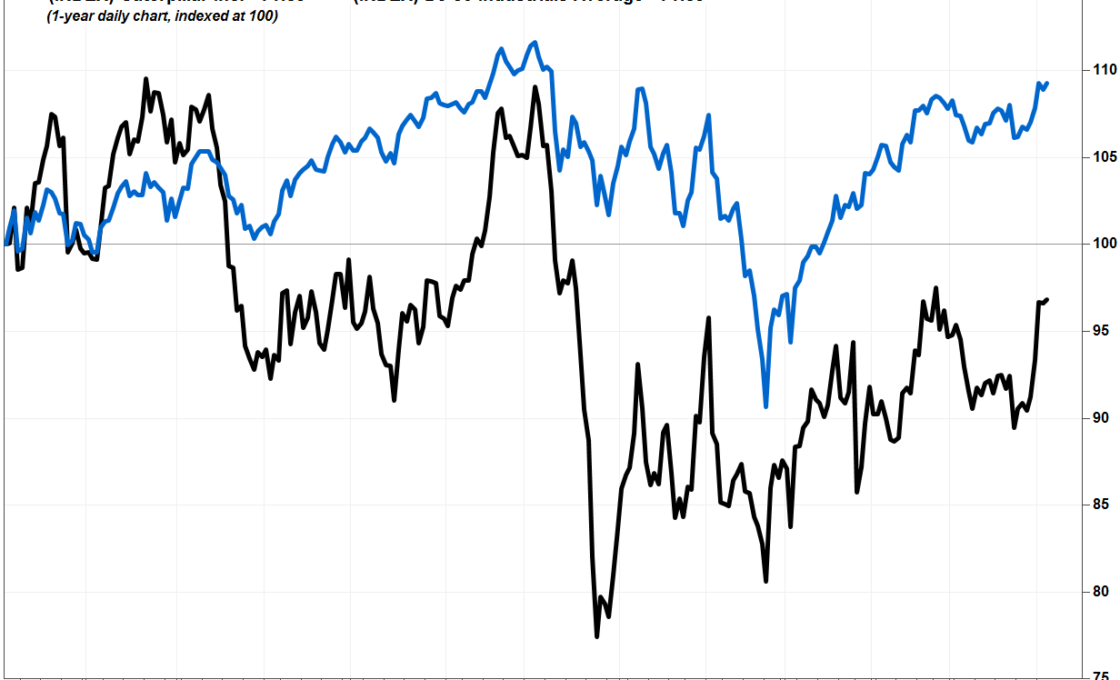

The stock slumped 1.1% in afternoon trade Wednesday. It has rallied 14% over the past three months, but has lost 4.4% over the past 12 months, and has dropped 19% from its Jan. 22, 2018 record close of $170.89. In comparison, the Dow Jones Industrial Average DJIA, +0.15% has climbed 15% the past three months and 8.8% the past year, and was just 26% below its Oct. 3, 2018 record close of 26,828.39.

Meanwhile, the FactSet consensus for Caterpillar’s 2019 earnings per share has declined 5.4% since the end of 2018 to $12.16, and the consensus for total revenue has slipped 3.2% to $56.59 billion.

Dillard’s concerns echo those of UBS analyst Steven Fisher, who chopped his rating down by two notches to sell from buy in late February, citing the belief that more than half of Caterpillar’s businesses will peak this year and “roll over” next year.