BAKX Therapeutics, a small biotech focused on cellular life and death that once boasted a partnership with Ipsen, has dissolved.

The company confirmed in an email to Fierce Biotech that BAKX “made the difficult decision to conclude operations as of July 1,” sending all rank-and-file staff out the door. Several key members of the operational team will hang on until the end of the month as the closure process is conducted. BAKX’s Watertown, Massachusetts, offices and labs will close, and all operational and scientific positions have been eliminated.

“The culmination of the company’s journey reflects several factors including the challenging funding environment,” the company said in a statement.

A licensing deal signed in 2021 by Ipsen has also been terminated, according to a spokesperson for the French pharma.

“Ipsen and BAKX have jointly decided to terminate their pre-clinical collaboration. This recent decision is the result of the program not achieving some pre-defined development milestones,” according to a statement provided by Ipsen.

BAKX was founded by Sree Kant, who previously served as head of strategic partnerships at Pfizer until 2018, according to his LinkedIn profile. He founded the biotech in June 2020. Kant confirmed the news in an email Tuesday morning.

“Its unfortunate but my key priorities now are that the academic founders are able to take what we have and advance it further and that we are able to link my team up with other opportunities in the market,” Kant said. He also posted on LinkedIn, making an appeal for others in the industry to reach out if interested in recruiting from the BAKX team.

Kant also expanded on the reasons for the dissolution of the company, citing “a decision by the board to terminate all operations based on the scientific challenges we faced, the anticipated discovery timelines, and the challenging financial environment.”

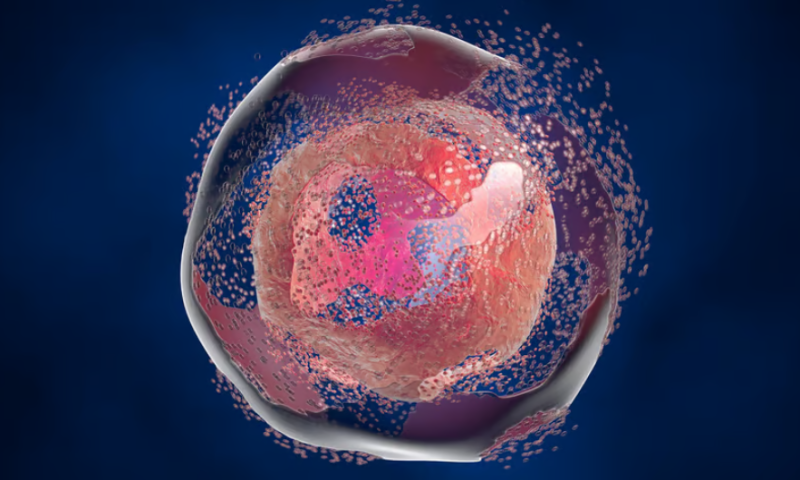

BAKX’s science focused on the mitochondrial apoptosis pathway, which is a naturally occurring process of programmed cell death. Cells that are no longer needed generally kill themselves by activating an intracellular death program. This process is a known cancer target. BKX-001 was the biotech’s lead candidate, an oral small-molecule activator of the BCL-2 associated protein-X (BAX) that was meant to trigger apoptosis in tumor cells.

In July 2021, Ipsen penned a deal with BAKX worth $14.5 million upfront to work on a preclinical program of BAX. The deal included up to $837.5 million in biobucks on the table. It’s unclear whether the biotech was able to tap into any of the funds beyond the upfront fee.

Ipsen had planned to develop BKX-001 in leukemia, lymphoma and solid tumors. The French pharma also contributed to BAKX’s $25 million series A in November 2021.

Now, BAKX intends to return the intellectual property to its academic founders to support “further development of the science,” according to the statement provided by the company.

“Today, while we haven’t quite achieved the goals, we set for ourselves, we have very tangibly advanced the science in this space – and hopefully created a platform for others to build on,” Kant said in his post.

Things seem to have unraveled quickly at BAKX, which boasted of several new hires this year including announcements in April and February.