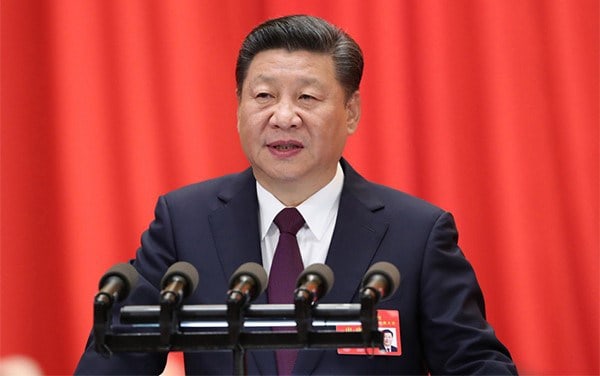

Beijing, China – Chinese President Xi Jinping has announced a $60 billion package of aid, investment and loans to Africa, against a backdrop of growing concern about rising debt distress on the continent.

The announcement was made during the Forum on China-Africa Cooperation (FOCAC) in Beijing, a triennial meeting between senior Chinese leaders and their counterparts from across Africa.

The financial package is the same amount Beijing pledged at the previous FOCAC summit in 2015, and is in line with analysts’ expectations that Xi would not vastly increase the amount of Chinese money flowing into Africa.

Over the past nearly two decades, the numbers coming out of FOCAC have generally risen with each event. The pledge in 2015 was three times the figure announced at the 2012 forum.

Jeremy Stevens, international economist for the Standard Bank Group, said many felt it would not be “politically appropriate” to pledge huge loans given concern that Africa is becoming overloaded with Chinese debt.

Stevens said Beijing’s decision not to hike loans to Africa shouldn’t be interpreted as a step back in relations.

“In reality it’s not — it’s a maturation and a natural evolution of the relationship,” he said.

China-Africa ‘Olympics’

Leaders of 53 African nations descended on the Chinese capital Monday for the start of the two-day summit, largely seeking financial support for their developing economies.

Since it was founded in 2000, FOCAC has become the “Olympics of China-Africa” relations, Steven said, and it has become customary for China to announce huge investment packages at the triennial gathering.

On Monday, Xi outlined eight major initiatives in Africa over the next three years, including plans to establish a China-Africa trade expo, provide one billion reminbi ($146 million) in food aid, extra imports to China from Africa, and a push for green development.Xi also invited African business leaders to help his country in building the Belt and Road Initiative, an ambitious collection of trade and infrastructure projects involving 68 countries.

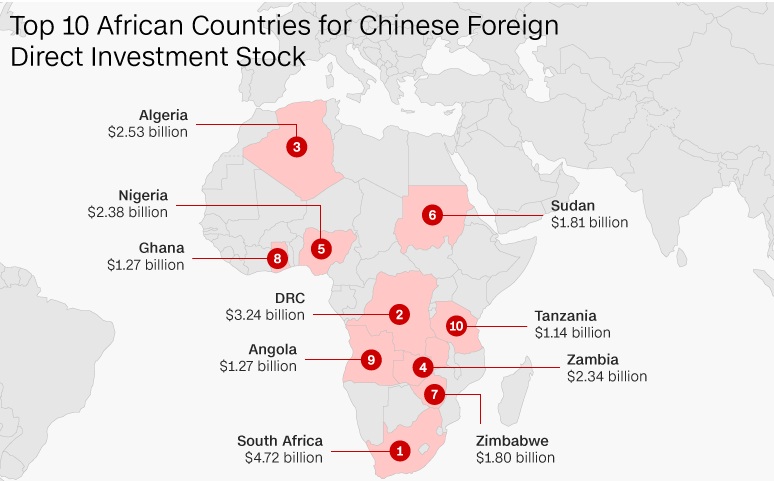

Africa has borrowed about $130 billion from China since 2000, with loans generally used to finance infrastructure projects. Earlier this year, the IMF warned that the African continent is facing a debt crisis, with 40% of low-income countries now in debt distress or at high risk of this.

Scholars from the China-Africa Research Initiative (CARI) at Johns Hopkins University found that Chinese loans were not yet a major contributor to this debt distress for most nations. Zimbabwe, for example, still owes 77% of its national debt to the Paris Club. In Djibouti, however, China holds 77% of national debt, while Zambia’s $6.4 billion in Chinese loans represents the lion share of its commitments.

Are China-Africa relations cooling?

China has now passed France, India and the United States as Africa’s largest trading partner. But total trade between China and Africa slowed from $220 billion in 2014 to $170 billion in 2017, according to the Chinese Ministry of Commerce, prompting concerns that relations might be cooling.

Janet Eom, a researcher at CARI, says this decline is mostly due to falling commodity prices. Given China’s recent trade war with the United States, Eom said that Beijing’s commercial relationships with African nations are likely to become “much more important.”

In July, Xi visited Senegal, Mauritius Rwanda, and South Africa — an itinerary that almost took him to the four corners of Sub-Saharan Africa — showing that China still prioritizes diplomatic trips to the continent.

Private business delegations have arrived “in droves” at this year’s FOCAC, said Stevens, and are pushing China to narrow their country’s trade deficits with Beijing. “Chinese exporters are finding very fertile soil in Africa,” he said. “But when increased domestic demand is met by Chinese imports rather than increased capacity at home, it’s not palatable from an African perspective.”

Chinese companies will also be expected to invest $10 billion in Africa in the next three years, according to Monday’s announcement.