After keeping investors waiting for months, ContraFect has revealed its phase 3 clinical trial has failed an interim futility analysis. The inability of the direct lytic agent to beat placebo triggered the stoppage of the study and the cratering of the biotech’s share price.

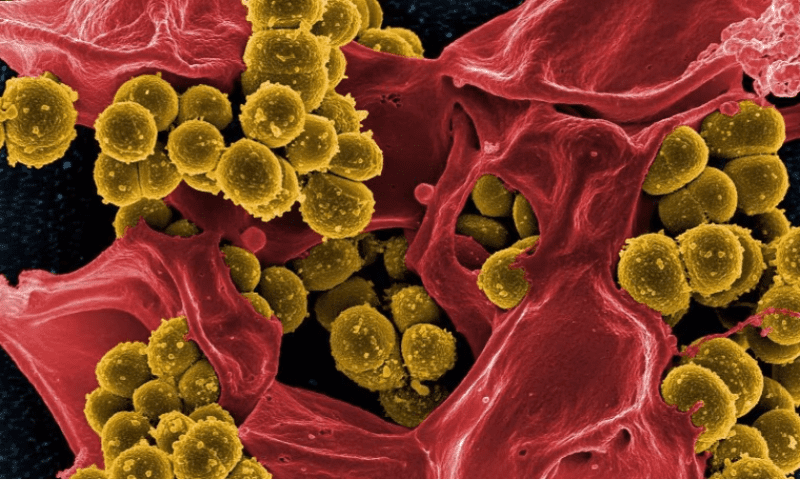

ContraFect set out to enroll around 350 patients with Staphylococcus aureus bloodstream infections in the placebo-controlled DISRUPT clinical trial, scheduling an interim analysis for when it had data on 60% of the planned enrollees with methicillin-resistant infections, known as MRSA. The interim analysis represented a key test of ContraFect’s belief that it can tackle antibiotic-resistant infections by rupturing bacteria.

In the 84 individuals with MRSA included in the interim analysis, the direct lytic agent exebacase performed no better than placebo on the primary endpoint. The primary endpoint looked at the clinical responder rate at Day 14 to determine whether a single infusion of exebacase added to the effect of standard of care antibiotics. With the data safety monitoring board finding the study was on course to fail, ContraFect is stopping the clinical trial.

“This disappointing news reflects the long history of difficulties in treating life-threatening infections like MRSA bacteremia in patients with heterogeneous co-morbidities, and who are in need of immediate life-saving treatments,” ContraFect CEO Roger Pomerantz, M.D., said in a statement.

ContraFect is holding off on discussing the implications for the development of exebacase until it has completed its analysis of the data, but investors have already made up their minds. Shares in the biotech fell around 80% in the markets’ opening hours Thursday, crushing the value of the stock to around 50 cents.

If exebacase lands on the scrapheap, it will wipe out ContraFect’s most advanced candidate. The biotech has supplied exebacase for use in other indications through compassionate use and expanded access programs, but it has no other active clinical trials. After exebacase, ContraFect’s next most advanced candidates are the preclinical lysins CF-296 and CF-370, the latter of which is an engineered prospect that is on track to be the subject of an application this year for a clinical trial.

The update on exebacase ends the long wait for the interim analysis. ContraFect began the study before the pandemic and, after suffering some delays as COVID-19 spread around the world, forecast that the analysis would take place in the second half of 2021. The company made that forecast as recently as May 2021.

In March, ContraFect revised its forecast to the first half of 2022, a target it abandoned two months later when it told investors it expected to learn of the data safety monitoring board’s recommendation in the first week of July. In the end, ContraFect shared the board’s recommendation on July 13. The biotech ended March with $42.3 million.