Retail tycoon Mike Ashley has offered a £150m cash injection to ailing retailer Debenhams – as long as he can become its chief executive.

Mr Ashley, who is Debenhams’ biggest shareholder, has been embroiled in a battle for control with its board.

Last week, the retailer challenged Mr Ashley to table a firm takeover offer or abandon his attempt to take control and provide funding instead.

Debenhams has refused to comment on the offer.

Days before a lender-imposed deadline is due to expire, Sports Direct has offered to underwrite £150m of new equity funding for the retailer but only if Mr Ashley becomes chief executive and £148m of debt is written off by lenders, who include banks and hedge funds.

‘Relieve pressure’

The department store chain’s financiers are considering the offer, say City sources.

Sports Direct, which owns a near 30% stake in the retailer, had previously said it was considering a £61.4m bid to take full control of Debenhams.

Sports Direct’s letter to Debenhams states: “Mr Ashley’s appointment would immediately relieve any pressure on the company’s supply chain and he would be in a position to lead the restructuring of the company’s stores and operations.

“Sports Direct remains keen to be a supportive shareholder and financier.”

Previous attempts by Sports Direct to install Mr Ashley as Debenhams chief executive have been rejected.

If Mr Ashley’s latest offer is turned down by Debenhams’ lenders, the company is likely to enter a pre-planned administration, possibly as early as next week.

Stores, staff and suppliers would not see any immediate change.

However, under the deal’s conditions, shareholders including Mr Ashley would see their stakes in the company wiped out.

Debenhams is planning a restructuring of the business to put it on a more sustainable financial footing.

That’s expected to lead to the closure of about 50 stores in the longer term.

No sites are expected to close until 2020 at the earliest.

Record loss

The retailer will also attempt to get landlords to cut the rent on the remaining sites in order to make them more profitable under a company voluntary arrangement.

The struggling department store, which has 165 stores and employs about 25,000 people, reported a record pre-tax loss of £491.5m last year.

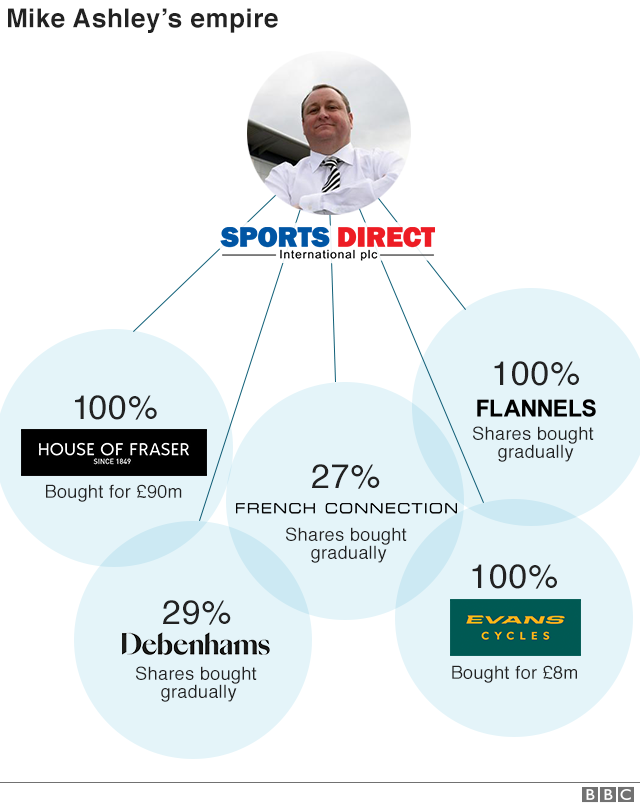

If Mr Ashley’s offer is accepted, he would control yet another High Street name.

As well as Sports Direct, Mr Ashley runs House of Fraser, Evans Cycles and Flannels.

In January Mr Ashley joined investor Landmark Group to vote the retailer’s chairman and chief executive off the board.

High Street retailers have been under increasing pressure as more people choose to shop online and visit stores less.