Atsena Therapeutics has cut staff to funnel more money toward an inherited retinal disease program that just began dosing for a phase 1/2 trial in August.

The company confirmed the layoffs in a statement to Fierce Biotech Thursday, saying the reduction in force happened to “prioritize resources” toward ATSN-201, a gene therapy for X-linked retinoschisis. The disease is an inherited retinal condition that causes early vision loss in about 30,000 males in the U.S. and Europe. Atsena declined to say how many employees were impacted, but a LinkedIn profile lists 42 employees total.

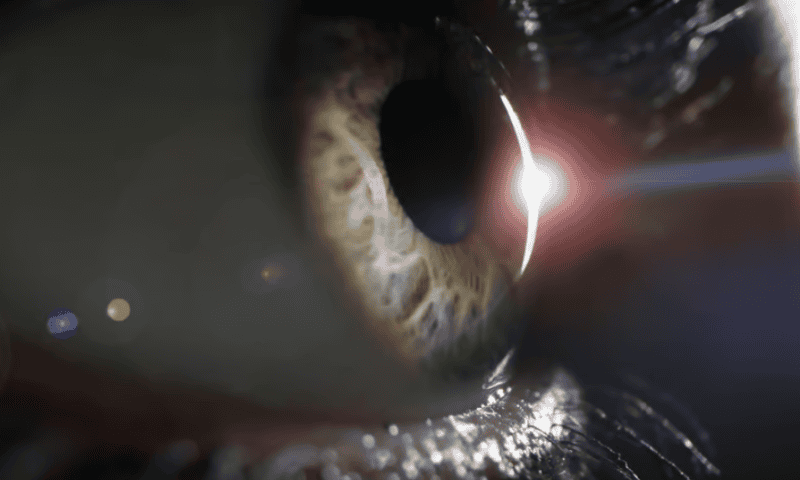

The program is the first to use Atsena’s new AAV.SPR lateral-spreading capsid, meant to reach part of the retina that couldn’t be treated with normal capsids. The biotech believes this mechanism could allow transduction in a much wider swath of the retina without foveal detachment. Atsena is also using the capsid for a third asset aimed at MYO7A-associated Usher syndrome, which is in IND-enabling studies.

Both programs are running behind Atsena’s lead asset, ATSN-101, in development for Leber congenital amaurosis (LCA). Data announced in April showed that nine patients given the highest dose level had “significantly greater” change in retinal sensitivity compared to untreated patients 28 days after treatment and at subsequent follow-ups, measured by an eye test that gauges sensitivity to light flashes after being adjusted to the dark. The company said no patients treated in the high-dose group had a reduction in a line reading test assessing best-corrected visual acuity. Twelve-month data from the trial are expected by the end of the year.

What’s unclear is how much money Atsena has to take these programs forward. The company closed a $55 million financing in December 2020, when the LCA trial was already underway. The biotech disclosed in a Securities and Exchange Commission filing earlier this month that it raised an additional $24.5 million, though $7.5 million of the private offering remains to be sold.

The lead LCA asset follows in the footsteps of Luxturna, developed by Spark Therapeutics and now owned by Roche. The Swiss pharma reported that (PDF) 2022 revenue for the drug was 12 million Swiss francs, or roughly $13.1 million. That’s just a fraction of the $760 million in revenue the ophthalmology unit brought in last year.