Flagship-founded Cellarity has hauled in $121 million in new series C funds as the biotech continues to push its cell behavior therapies toward the clinic.

The latest financing round, announced Tuesday, brings the company’s total raised to $274 million since Cellarity launched at the end of 2019. Whereas much of drug development centers on diving deeper and deeper into specific molecules, Cellarity is betting on a larger answer: The company has focused on mechanisms of whole cells and their impact on disease progression. Using machine learning, Cellarity says it’s able to make digital predictions on potential targets at a faster pace than the usual screening process.

Joining Cellarity’s group of financiers is the VC wing of Korean energy company Hanwha Impact and Japanese pharma Kyowa Kirin as well as an additional two investors that were not named. Cellarity says the money will be used to continue hiring, build out its platform and advance pipeline assets toward the clinic.

While the company’s pipeline has not yet been unveiled, CEO Fabrice Chouraqui said in the release that its identified compounds have already been validated in lab and animal testing. On its website, Cellarity says it’s advancing a number of programs spanning hematology, immuno-oncology and metabolism disease areas.

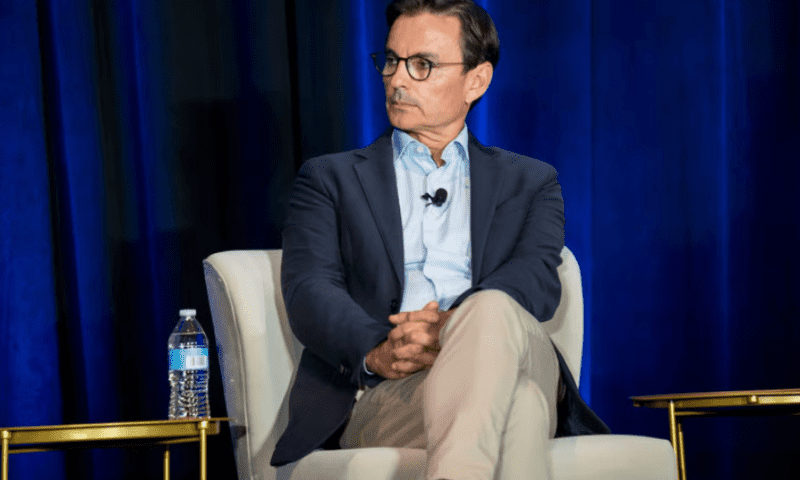

“Our business is not about extending runway, that’s for sure,” Chouraqui told attendees at last month’s inaugural Fierce Biotech Summit in Boston. “It’s about producing great science that can generate a great return.”

The CEO also lent some insight into growing within the Flagship Pioneering ecosystem, an incubator of sorts created by the VC company for some of the hottest biotechs once they emerge from stealth. Most notably, the firm launched Moderna in 2010, which has since become a global behemoth following billions of dollars in sales of its mRNA COVID-19 vaccine.

“In this ecosystem, you are able to really leverage amazing talents,” said Chouraqui, who also holds a role as CEO-partner at the VC firm. “Talents that you would not be able to connect with at that stage of the life of a small company.” Such access allows biotechs to speed up their development process by not running into the same early pitfalls that ding other companies. But more than that, Chouraqui says the larger motto at Flagship is to keep the faith.

“Actually, [Flagship CEO Noubar Afeyan] keeps saying it’s all about leaps of faith,” he said. “It’s about belief without evidence, sometimes.”