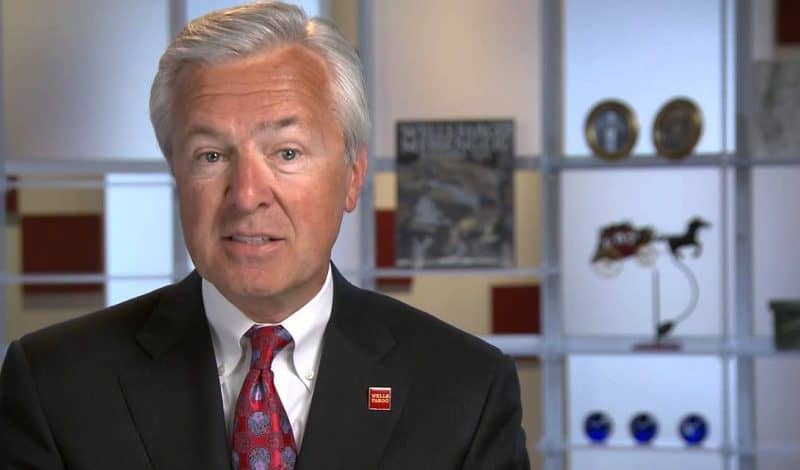

The U.S. government announced Thursday that former Wells Fargo CEO John Stumpf has been banned from ever working at a bank again and will pay $17.5 million for scandals in which millions of fake accounts were set up to meet sales quotas.

The notice from the Office of the Comptroller of the Currency said the regulator plans to target other individuals, including former executives, for their role in the scandals.

“The actions announced by the OCC today reinforce the agency’s expectations that management and employees of national banks and federal savings associations provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations,” Comptroller of the Currency Joseph Otting said.

In addition to the $17.5 million fine, Stumpf’s settlement declares he shall not participate “in any manner” at any bank regulated by the OCC or participate or attempt to participate in a bank’s corporate board votes.

The OCC also said the former head of Wells Fargo’s Community Bank unit, Carrie Tolstedt, is still fighting the allegations against her. The regulator also seeks a prohibition order and $25 million from Tolstedt.

The nation’s fourth-largest bank, Wells Fargo has remained muddled in restructuring and regulatory reforms since 2016 stemming from the scandals at its consumer-facing community bank.

The fallout has had lasting consequences for the San-Francisco-based bank, once a rapidly growing lender with eye-popping profits. In recent years, however, Wells has stalled between stagnant revenues and an urgent need to cost cuts.

In light of the announcement, current Wells Fargo CEO Charlie Scharf told the bank’s employees that “the OCC’s actions are consistent with my belief that we should hold ourselves and individuals accountable.”

“They also are consistent with our belief that significant parts of the operating model of our Community Bank were flawed,” he added. “At the time of the sales practices issues, the Company did not have in place the appropriate people, structure, processes, controls, or culture to prevent the inappropriate conduct.”

Scharf added that “Wells Fargo will not make any remaining compensation payments that may be owed to these individuals while we review the filings.”