In its first full 12 months as an independent, public company, GE HealthCare posted an 8% boost in organic annual revenue—but the company said it doesn’t expect that trajectory to continue into its sophomore year.

The imaging giant has set its 2024 expectations at 4% organic sales growth. On a call with investors for the company’s fourth-quarter earnings report this week, Chief Financial Officer Jay Saccaro attributed last year’s gains to recovering supply chains and pricing advantages.

“And a lot of that came down to execution, in terms of translating backlog into sales—which was a testament to the work by many of our teams. So, as we look to 2024, we think roughly 4% is a solid number,” said Saccaro, who also described 2023’s 8% figure as the high end of the company’s previous full-year predictions and “in excess of our expectations for the fourth quarter.”

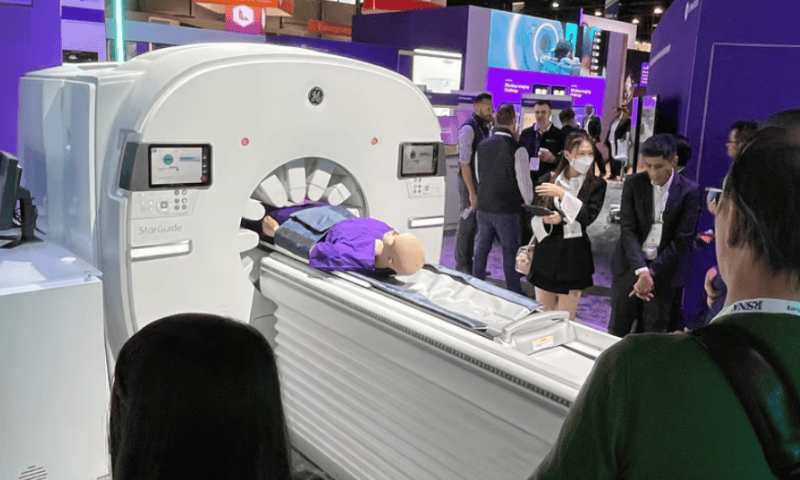

In terms of total revenue, GE HealthCare brought in $19.6 billion during 2023—including $10.6 billion from its CT and MRI imaging systems, $3.5 billion from ultrasound devices, $3.1 billion in patient care and monitoring solutions and $2.3 billion from pharmaceutical diagnostics.

That last portfolio, with its nuclear medicine and cancer-targeting imaging tracers, grew 18% year-over-year and 23% in the fourth quarter, driven by global expansions in diagnostic procedures and their need for imaging agents.

“As novel therapies become more widely available, our tracers will play an increasingly important role—putting us at the center of this transformation of care that will help enable better patient outcomes across many pathways as functional imaging expands,” President and CEO Peter Arduini said on the investor call.

“We see growth opportunities with our existing products—like Vizamyl for patients with suspected Alzheimer’s disease, as new therapies ramp up—and Cerianna for metastatic breast cancer, which are both used in conjunction with PET systems for diagnosis,” Arduini added. “And Flurpiridaz, a pipeline product for diagnosing and assessing coronary artery disease, is expected to significantly advance PET/CT imaging.”

These injectable imaging tools are also expected to help set the stage as patient care turns more toward theranostic procedures, blurring the lines between discrete tests and treatments.

“To give you some perspective, currently the overall theranostics market—which includes equipment, tracers and therapies—is about $9 billion and expected to grow to $40 billion by 2032,” Arduini said. “Today, theranostics are primarily used in thyroid, neuroendocrine and prostate tumors. However, a growing pipeline of drugs across the industry that includes breast, ovarian, pancreatic and lung cancers shows even more promise.”

“In the next three years, we plan to significantly increase our current theranostics franchise through a combination of organic and inorganic expansions,” he said, highlighting GE HealthCare’s recently proposed acquisition of the AI developer MIM Software and its plans to integrate the latter’s imaging analysis programs for radiation oncology, molecular radiotherapy, urology and theranostics in particular.

GE HealthCare’s first year also saw the company pay down $1 billion in debt while putting more than $1 billion into its R&D spend and launching more than 40 new products.

“As a result of our investments, we estimate that we have gained global market share in equipment in 2023. And, once again, we topped the FDA’s list of AI-enabled device authorizations with 58, more than any other medtech company,” Arduini said, referring to the agency’s accounting. “Our backlog remains robust, led by an improved capital equipment landscape.”

For the fourth quarter of 2023, the company posted $5.2 billion in sales for a 5% gain over the same period the year before. Net income, however, dropped to $403 million from $554 million, while the accounting for the full year fell to $1.6 billion, compared to 2022’s $1.9 billion.

All told, the price of GE HealthCare’s stock on the Nasdaq jumped more than 12% following its earnings release, to more than $81 per share. The company completed its split from the General Electric mothership in January 2023.