Investors sold shares of Analog Devices, Inc. (NASDAQ:ADI) on strength during trading on Wednesday. $54.08 million flowed into the stock on the tick-up and $91.62 million flowed out of the stock on the tick-down, for a money net flow of $37.54 million out of the stock. Of all equities tracked, Analog Devices had the 26th highest net out-flow for the day. Analog Devices traded up $1.73 for the day and closed at $109.84

A number of equities research analysts have recently commented on the stock. Robert W. Baird reiterated a “buy” rating and issued a $100.00 target price on shares of Analog Devices in a research report on Wednesday, February 20th. Sanford C. Bernstein cut shares of Analog Devices from an “outperform” rating to a “market perform” rating and set a $106.00 target price for the company. in a research report on Monday, March 25th. Piper Jaffray Companies reiterated a “buy” rating and issued a $118.00 target price on shares of Analog Devices in a research report on Wednesday, February 20th. SunTrust Banks increased their target price on shares of Analog Devices to $126.00 and gave the company an “average” rating in a research report on Thursday, February 21st. Finally, Oppenheimer increased their target price on shares of Analog Devices to $117.00 and gave the company an “outperform” rating in a research report on Thursday, February 21st. One equities research analyst has rated the stock with a sell rating, eleven have issued a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the stock. The stock presently has a consensus rating of “Buy” and a consensus price target of $102.86.

The company has a debt-to-equity ratio of 0.54, a quick ratio of 1.64 and a current ratio of 2.34. The company has a market cap of $39.82 billion, a P/E ratio of 18.49, a P/E/G ratio of 1.60 and a beta of 1.25.

Analog Devices (NASDAQ:ADI) last posted its quarterly earnings data on Wednesday, February 20th. The semiconductor company reported $1.33 EPS for the quarter, beating the Thomson Reuters’ consensus estimate of $1.28 by $0.05. Analog Devices had a net margin of 25.42% and a return on equity of 19.99%. The business had revenue of $1.54 billion during the quarter, compared to analyst estimates of $1.51 billion. During the same quarter last year, the firm posted $1.42 earnings per share. The business’s revenue for the quarter was down 1.6% compared to the same quarter last year. Analysts anticipate that Analog Devices, Inc. will post 5.45 earnings per share for the current fiscal year.

The company also recently announced a quarterly dividend, which was paid on Tuesday, March 12th. Investors of record on Friday, March 1st were issued a $0.54 dividend. This is a boost from Analog Devices’s previous quarterly dividend of $0.48. The ex-dividend date was Thursday, February 28th. This represents a $2.16 annualized dividend and a yield of 1.97%. Analog Devices’s dividend payout ratio (DPR) is 36.36%.

In other Analog Devices news, SVP Margaret K. Seif sold 2,700 shares of the firm’s stock in a transaction that occurred on Friday, January 11th. The shares were sold at an average price of $90.00, for a total transaction of $243,000.00. Following the sale, the senior vice president now owns 24,517 shares of the company’s stock, valued at $2,206,530. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CAO Eileen Wynne sold 2,736 shares of the firm’s stock in a transaction that occurred on Thursday, February 21st. The stock was sold at an average price of $105.28, for a total transaction of $288,046.08. Following the sale, the chief accounting officer now directly owns 4,888 shares in the company, valued at approximately $514,608.64. The disclosure for this sale can be found here. In the last ninety days, insiders sold 102,590 shares of company stock worth $10,900,552. 0.50% of the stock is owned by corporate insiders.

Hedge funds have recently added to or reduced their stakes in the business. Legacy Financial Advisors Inc. increased its holdings in shares of Analog Devices by 9,766.7% in the 4th quarter. Legacy Financial Advisors Inc. now owns 296 shares of the semiconductor company’s stock valued at $25,000 after acquiring an additional 293 shares during the period. PRW Wealth Management LLC acquired a new position in shares of Analog Devices in the 4th quarter valued at $27,000. Bruderman Asset Management LLC acquired a new position in shares of Analog Devices in the 4th quarter valued at $31,000. Liberty Wealth Management LLC acquired a new position in shares of Analog Devices in the 4th quarter valued at $33,000. Finally, Massmutual Trust Co. FSB ADV acquired a new position in shares of Analog Devices in the 4th quarter valued at $34,000. 91.31% of the stock is currently owned by institutional investors.

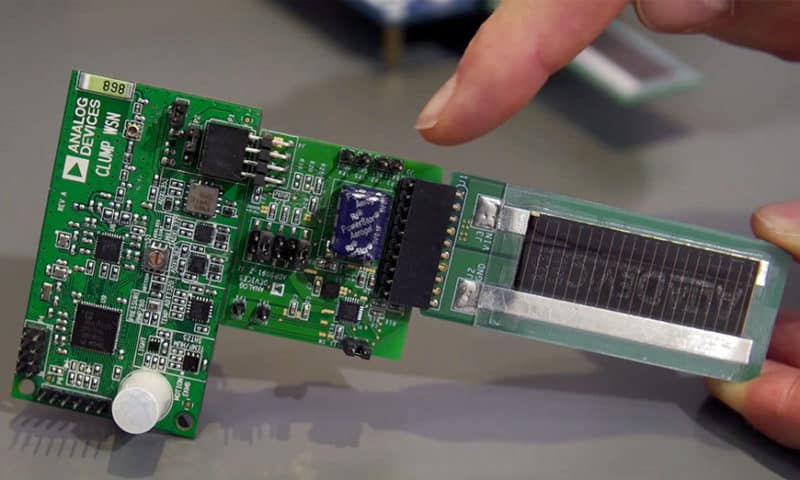

Analog Devices Company Profile (NASDAQ:ADI)

Analog Devices, Inc engages in the design, development, manufacture, and marketing of integrated circuits (ICs). Its products include industrial process control systems, medical imaging equipment, factory process automation systems, patient vital signs monitoring devices, instrumentation and measurement systems, wireless infrastructure equipment, energy management systems, networking equipment, aerospace and defense electronics, optical systems, automobiles, and portable consumer devices.