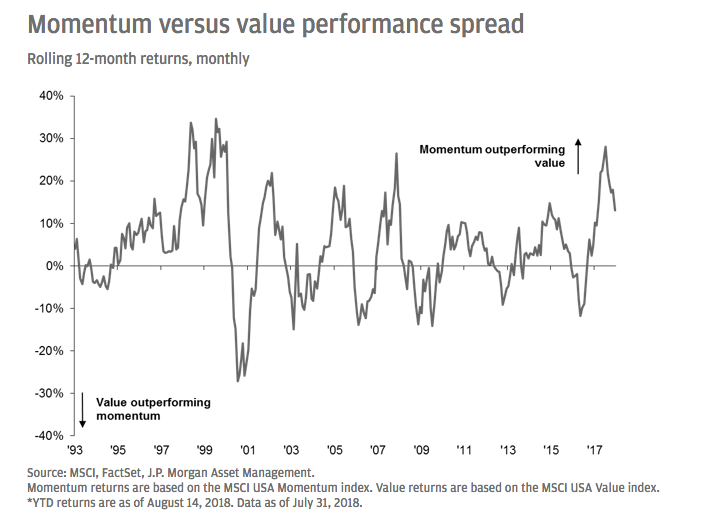

Momentum investing is a strategy which looks at relative trailing 6- and 12- month price performance when determining which stocks to overweight. 2018 has been a good year for momentum stocks, which are up an impressive 11.4%*. Stocks exhibiting value characteristics, on the other hand, have been the worst performers, up only 1.6% during this same time period. However, with momentum outperforming value, as well as the broader equity market, some investors have begun to question whether the outperformance of momentum has run its course.

As shown in the chart below, momentum stocks have generated strong excess returns over value stocks on a rolling 12-month basis over the past 18 months. While the performance spread between the two factors tends to ebb and flow, the current spread between momentum and value has begun to narrow. Moreover, value continues to look more attractive from both a valuation perspective and should benefit from a macro backdrop that has historically favored value stocks.

Changes in the composition of the benchmark can explain quite a bit of both the out and underperformance of the momentum factor over the past few years. Since the financial crisis, the momentum benchmark has evolved to look more and more like a growth benchmark, with significant exposure to sectors like information technology, consumer discretionary and industrials. While this is not always the case, the significant outperformance—and even the more recent performance challenges—can be attributable to a handful of specific stocks within those sectors.

A few weeks back, we outlined the case for value stocks given an economic backdrop of rising interest rates, a stronger dollar and a pickup in economic growth and inflation. However, given momentum is a technical strategy and not geared toward fundamentals, it is difficult to suggest the momentum trade will reverse itself anytime soon. Therefore, given the impressive outperformance of momentum and the tendency for factors to move in and out of favor over time, a prudent and balanced approach when investing suggests diversifying factor exposure.