A tiny surgical robot has picked up a large sum: Medical Microinstruments has secured $110 million in venture capital funding to help support the commercial rollout of its Symani system, with wristed instruments small enough to help surgeons suture the most delicate blood vessels and tissues.

MMI’s series C round was led by Fidelity Management & Research Company and joined by its previous backers—which include Deerfield Management, the headliner of the company’s 2022 series B financing that raised a total of $87 million, alongside Wellington Partners, BioStar Capital, RA Capital Management, Andera Partners, Fountain Healthcare Partners, Panakès Partners and Sambatech.

“Against a backdrop of plateauing investments in medical robotics, this support builds on our confidence in a new, less invasive solution for open surgery, a significant market that can benefit from the smallest wristed microinstruments,” MMI CEO Mark Toland said in a statement.

The company plans to put the proceeds toward collecting additional clinical evidence for Symani, as well as establishing new hospital partnerships, according to Toland.

The system previously received a CE mark approval in Europe in 2019; MMI now plans to expand its reach in the U.S. and the Asia Pacific region, where it announced two distribution deals last October spanning South Korea, Hong Kong, Australia, New Zealand and countries across Southeast Asia.

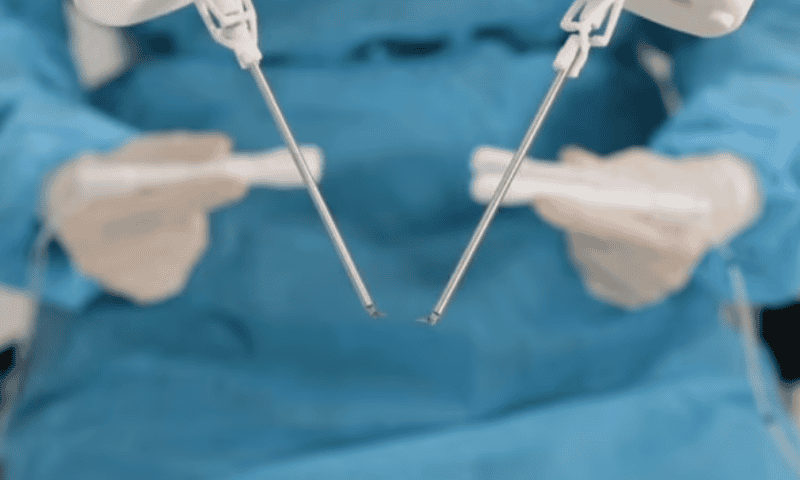

Symani, with its two robotic arms, is designed to mimic the dexterity of human hands on a much smaller scale while smoothing out otherwise uncontrollable tremors. The company said it can assist in open soft-tissue procedures such as free flap reconstructions after tumor resection, as well as in lymphatic surgery and trauma replantations.

MMI forecasts that the market of Symani’s eligible microsurgical procedures will increase from 3 million to 22 million per year by 2028, pending device development and future regulatory green lights.