Memory chip maker’s stock has rallied 50% since last earnings report

Micron Technology Inc.’s big stock run during the past quarter faces a crucial test of how much the memory chip market has actually improved when the chip maker reports earnings this week.

Micron MU, +0.90% is scheduled to wrap up its fiscal year with a fiscal fourth-quarter earnings report after the markets close Thursday.

The memory chip industry is in a completely different space compared with a year ago, when prices were still climbing, inventory issues had yet to rattle the sector, and Micron Chief Executive Sanjay Mehrotra had said the memory chip market had become structurally different in a post-PC only world. Over the course of 2019, chip makers have struggled with a drop off in sales as semiconductors hit peak prices and revenue toward the end of 2018, but in the past earnings season a few indicators have shown that a second-half rebound could play out.

Memory chips were hit particularly hard as customers loaded up on DRAM and NAND chips in 2018 amid rising prices, which then plummeted. DRAM, or dynamic random access memory, is the type of memory commonly used in PCs and servers, while NAND chips are the flash memory chips used in USB drives and smaller devices such as digital cameras.

What to expect

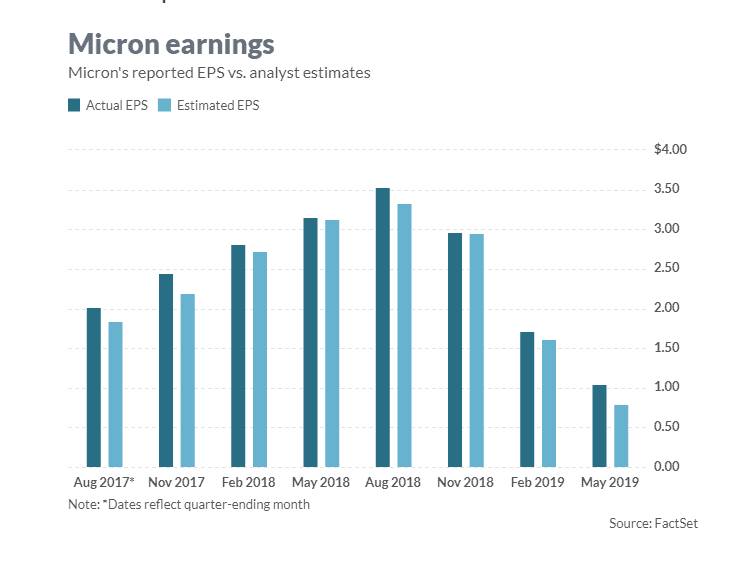

Earnings: Of the 27 analysts surveyed by FactSet, Micron on average is expected to post adjusted earnings of 51 cents a share, down from the 80 cents a share expected at the beginning of the quarter, and the $3.53 a share reported in the year-ago period. Estimize, a software platform that uses crowdsourcing from hedge-fund executives, brokerages, buy-side analysts and others, calls for earnings of 60 cents a share.

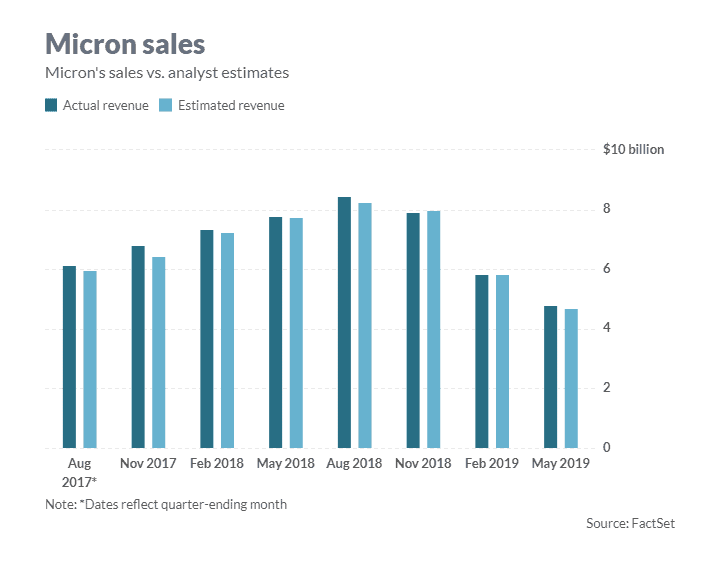

Revenue: Wall Street expects revenue of $4.59 billion from Micron, according to 27 analysts polled by FactSet. That’s down from the $4.91 billion forecast at the beginning of the quarter, and the $8.44 billion reported in the year-ago quarter. Estimize expects revenue of $4.61 billion.

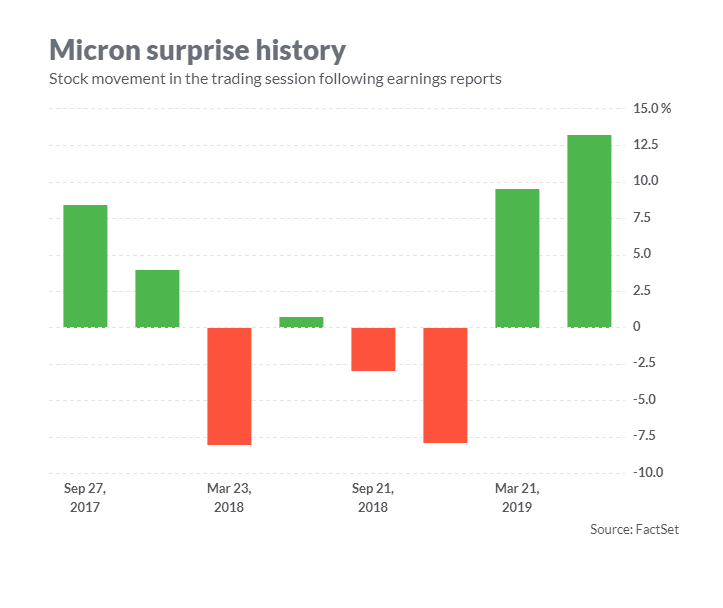

Stock movement: Micron shares have surged 52% since the company’s last earnings report, when CEO Mehrotra said he expected “strong sequential growth” in the fourth quarter as inventory problems improve. In comparison, the S&P 500 index SPX, -0.01% has gained 2.6% over that time, while the Nasdaq Composite Index COMP, -0.06% has gained 2.9% and the PHLX Semiconductor Index SOX, +0.96% gained 13%.

What analysts are saying

Eric Ross, chief investment strategist of Cascend Securities, who has a buy rating and recently raised his price target to $65 from $55, said Micron is a “good value play” for the long term and that the industry seeing a stronger second half with a season recovery in smartphone and data center sales.

“Our DRAM indicator suggests further we’ve seen the bottom of this cycle,” Ross said.

Mizuho analyst Vijay Rakesh, who has a buy rating and a $50 price target on the stock, said while checks indicate that memory trends for both DRAM and NAND are improving, but Micron is not catching the best of it.

“August DRAM contract pricing is flat and declining much more slowly, down 5% versus prior expectations of down 5-10% q/q and flattish in Jun-July given the initial Japan-South Korea concerns,” Rakesh said.

For Micron, however, Rakesh said that while near-term DRAM trends were better, those trends were weak in the second half as inventories have remained high.

Of the 33 analysts who cover Micron, 20 have buy or overweight ratings, 10 have hold ratings and three have sell or underweight ratings, with an average price target of $50.09, or 1% higher than Monday’s close.