In its first year-end financial report since going public on the London Stock Exchange in September, Oxford Nanopore Technologies had quite a big year to sum up.

Overall, even as its earnings from COVID-19 testing severely dwindled, the U.K.-based company raked in 133.7 million pounds sterling, or around $177 million, across the entire company for the year. That’s about a 17% jump above 2020’s revenue, which weighed in at 113.9 million pounds.

The breakdown of those earnings differed widely between the two years. While 2020’s revenue represented about a 60-40 split between Oxford Nanopore’s life science research tools business and its coronavirus-related offerings, respectively, COVID testing made up just 5% of total revenue in 2021.

Amid that drop-off, the company’s annual net loss plunged even further into the red, from 61.2 million pounds below the line in 2020 to a total loss of 167.6 million pounds, or about $222.3 million, last year, which it attributed largely to share-based payment charges and IPO costs.

Still, even as its COVID revenues shrank from 48.3 million pounds in 2020 to less than 7 million pounds last year, that sharp decrease was offset by growth of almost 100% in the life science research tools segment. In that category—the company’s core business—earnings surged to 127 million pounds ($168.4 million).

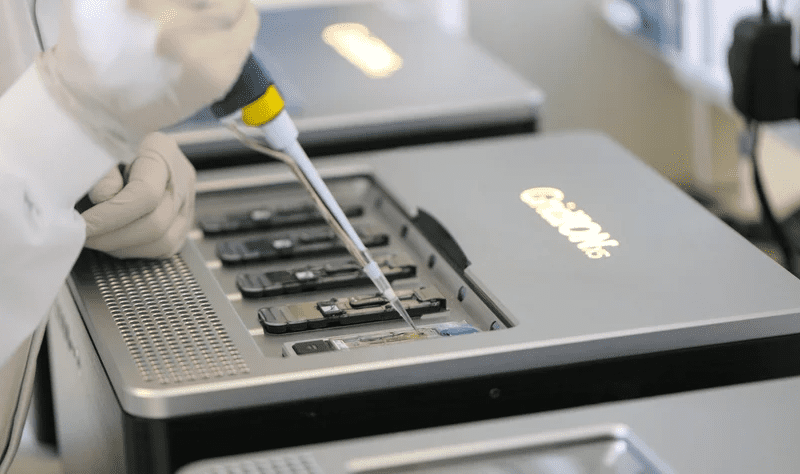

The segment encompasses devices and other tools for researchers like Oxford Nanopore’s flagship nanopore sequencers and their accompanying flow cells and sample preparation kits. The technology is designed to perform rapid, real-time analysis of any length of DNA or RNA fragment, giving researchers earlier access to more comprehensive genetic sequencing reports.

That part of the business got a major boost throughout 2021, as the company rolled out a handful of new accessories and features for its sequencing platform—including the addition of new machine learning algorithms to improve analyses—and also racked up another 1,400 life science research clients, bringing its total roster to more than 6,300 users.

Buoyed by its success in the segment, Oxford Nanopore bumped up its life science research tools business’ revenue predictions for the next two years.

It’s now expecting to take in 145 million pounds to 160 million pounds from its core business in 2022 and between 190 million pounds and 220 million pounds the following year, compared to previous forecasts that originally topped out at the lower ends of each of those ranges.

“We see extraordinary opportunities ahead, reflected both in the progress we have made in the current research market and in the preparations that we are making to address many potential uses for our technology in applied markets, from infectious disease to agricultural optimization,” CEO Gordon Sanghera said in a statement. “The progress we have made over the last year, combined with the new capital raised in our IPO, puts us in a strong position to achieve this goal.”