Oxurion’s vision was just a mirage. The last program standing in what was once a three-front attack on eye diseases failed Monday, prompting the Belgian biotech to start preparing to file for bankruptcy.

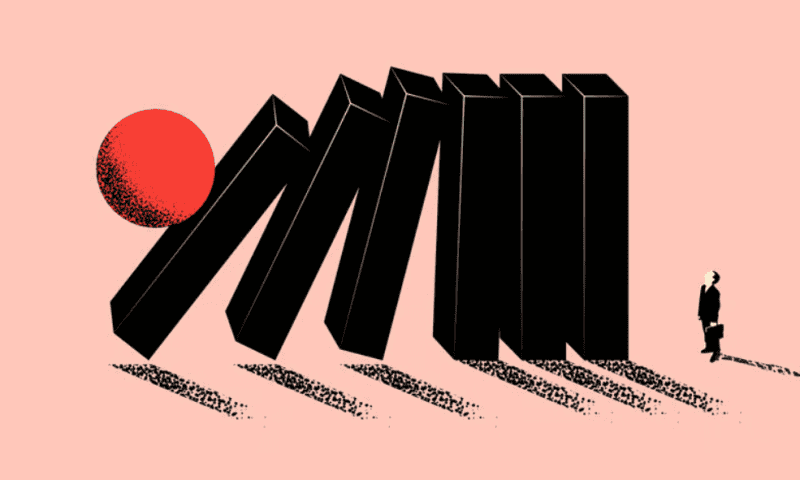

The final domino to fall is THR-149, a plasma kallikrein inhibitor that Oxurion identified as a potential treatment for patients with diabetic macular edema (DME) who respond suboptimally to anti-VEGF therapy. To put that idea to the test, Oxurion randomized 112 DME patients to receive either THR-149 or Bayer and Regeneron’s anti-VEGF drug Eylea in the phase 2 trial.

THR-149 failed to improve vision as much as Eylea after three months. On a standard eye test, the mean change from baseline in the THR-149 cohort was -0.2 letters, compared to +3.5 letters in the Eylea arm.

The failure looks set to be the last major act in the story of Oxurion. The biotech’s R&D pipeline and cash reserves have thinned in recent years, with the failure of two other DME candidates, anti-PlGF antibody THR-317 and pan RGD integrin antagonist THR-687, being accompanied by the decline of its bank balance. Oxurion ended (PDF) June with 2.2 million euros ($2.4 million) in cash and equivalents.

With its bank account almost as barren as its pipeline, Oxurion has decided to “take the necessary steps to file for bankruptcy.” The biotech has yet to disclose a timeline for winding down its business, the roots of which go back more than 30 years to the foundation of ThromboGenics.

ThromboGenics worked on treatments for cardiovascular conditions, eye diseases and cancer. Novartis picked up rights to one of its candidates in 2012. The eye disease drug came to market as Jetrea the next year but underwhelmed commercially, leading Novartis to scrap the alliance in 2017. ThromboGenics changed its name to Oxurion the following year.