A pheon is a visual depiction of a javelin or arrowhead, a logo of sorts tethered to weaponry and armor from hundreds of years ago.

Now, it’s the namesake of a new biotech hoping to develop its own slate of piercing cancer drugs. Pheon Therapeutics is making its debut equipped with $68 million, touting its platform focused on antibody-drug conjugates with plans to “reach IND” within the next year and a half. The company says this series A round could help fund its “clinical proof-of-concept” and “establish a pipeline of novel ADCs.”

At the helm of this venture is Bertrand Damour, former CEO of NBE Therapeutics, which under his tenure sold an anti-ROR1 ADC asset to Boehringer Ingelheim for $1.4 billion. Before that, Damour held CEO posts at a handful of other biotechs, including Merck & Co.-acquired OncoEthix. Another company led by Damour, Mind NRG, was bought up by Minerva Neurosciences.

At his hip will be Chief Scientific Officer Leigh Zawel, Ph.D., who most recently held the same post at Cullinan Oncology. There, Zawel oversaw the development of CLN-081, an EGFR inhibitor that’s attracted partnerships from both Taiho Pharmaceuticals and Zai Lab. But Zawel also comes equipped with Big Pharma experience through stints at Novartis, Merck & Co. and Pfizer.

But arguably, the most important member of the early launch team is David Thurston, Ph.D., one of the co-founders of the company and now a senior adviser. Thurston helped found Spirogen, which was bought by then-AstraZeneca subsidiary MedImmune in 2013.

Additionally, one of the Spirogen’s spinoffs, ADC Therapeutics, nabbed an FDA accelerated approval for Zynlonta in April 2021. The ADC was found to have a nearly 50% response rate among 145 patients with relapsed or refractory large B-cell lymphoma or diffuse large B-cell lymphoma. Pheon hopes that it can follow in similar footsteps as it takes its first lunges toward the clinic.

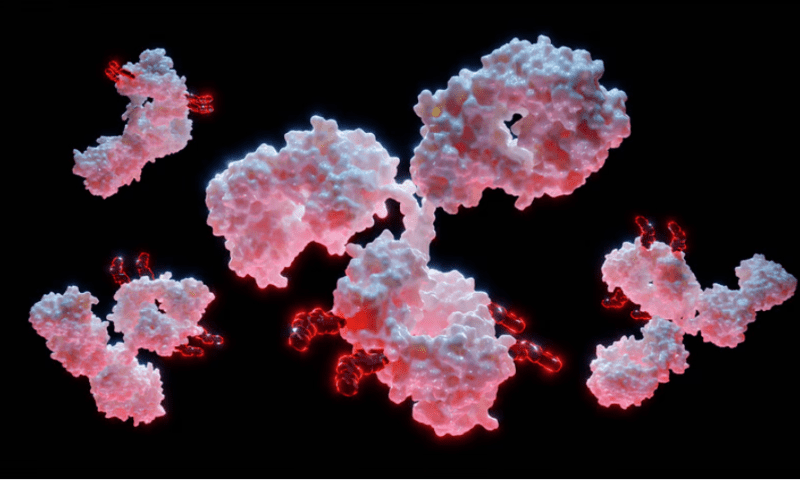

ADCs have become a budding modality to treat cancer. Instead of relying on just monoclonal antibodies, ADCs bind those to anti-cancer drugs using a linker. The belief is that by grouping the two together into one therapy, the therapeutic punch will hit even harder. Merck & Co. is one of a number of companies making big investments in the modality, with at least three ADCs in the company’s oncology pipeline.

Pheon’s fundraising round—completed months ago in March 2022—was led by Brandon Capital, Forbion and Atlas Venture, which each added a partner to Pheon’s board. They join Damour and Shaun Kirkpatrick, president of biotechnologies at seed investor Research Corporation Technologies.